2021-10-25 12:58 |

It’s been a busy week for bitcoin ETFs in the USA with the country seeing its first two bitcoin futures ETFs hitting the market, as part of an accelerating pace of approval being administered by the Securities and Exchange Commission (SEC). Now that the first week is over, we can make some observations on the performance of these ETFs, as well as the market overall since the first two ETFs have been approved and launched.

The first of these ETFs uses the ticker ‘BITO’. Its full name is the ‘ProShares Bitcoin Strategy ETF’ and it was launched on Oct 19 on the New York Stock Exchange by ProShares. The ‘Valkyrie Bitcoin Strategy ETF’ is the second ETF to have launched and gotten approval from the SEC. Its ticker is ‘BTF’ and it was launched on Oct 22, on the NASDAQ.

BITO, Oct 23ProShare’s BITO ETF appreciated 3.19% on its first day, but its value has dropped by -6.51% overall, opening at $41.94 and currently standing at $39.21. Over the past 24 hours alone, BITO has declined -3.23%. Valkyries ‘BTF’ opened yesterday at $25. Its value rose slightly upon opening, however it has since fallen continuously, currently valued at $24.3. This is a 24-hour difference of -2.80%.

BTF, Oct 23 ETFs are on the rise, but are they good for crypto?Despite the questionable performance of these SEC-approved, bitcoin futures ETFs so far, they have had a strong positive impact on the cryptocurrency markets and community overall. Oct 20: the day after the launch of ProShares ‘BITO’ ETF, saw the value of Bitcoin reach an astounding new all-time high (ATH) of over $66,000.

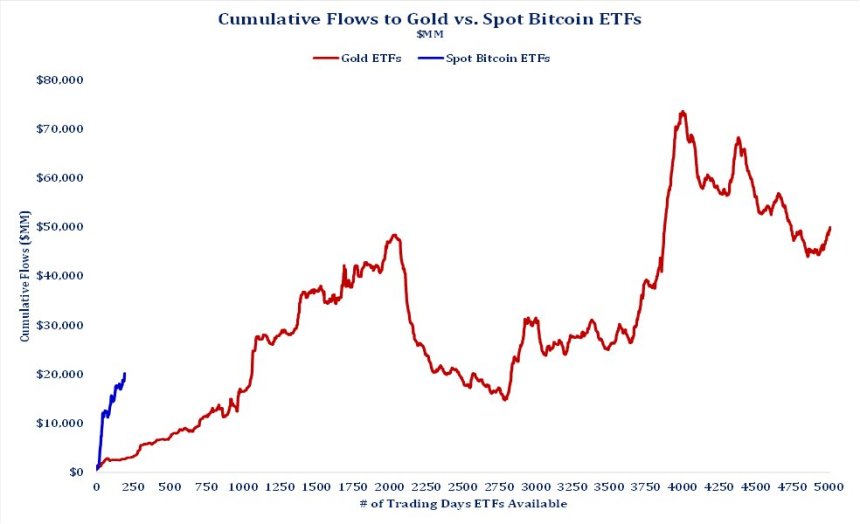

Bitcoin value in USD, Sept 24 – Oct 23These new bitcoin-futures-based ETFs are arguably a good thing for the crypto market and community because they are an investment product that helps introduce a new audience (and new capital) to crypto investment. They offer a more safe and appealing option for those who may otherwise be skeptical of investing non-SEC approved nor regulated alternatives. There are some critics, however, such as Peter Schiff, who recently said he thinks the SEC should be “abolished” for approving bitcoin ETFs.

The green lighting of these first ETFs in the USA has also coincided with a huge number of new filings for ETFs with the SEC. The next big ETF announced comes from global investment management firm VanEck, and its bitcoin futures ETF is scheduled for release next week. As more successful stories of SEC-approved ETFs come out, it becomes increasingly likely it is that we will see continued growth in ETF filings in the foreseeable future.

What do you think about this subject? Write to us and tell us!

The post Troubling First Week Performance: Valkyrie & ProShares Bitcoin Futures ETFs appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|