2024-4-29 19:23 |

Best DEX in 2024: Uniswap, DTX Exchange , and WOO

Decentralized exchanges (DEXs) continue to play a crucial role in the maturing cryptocurrency market. They present a more secure and transparent substitute for centralized exchanges, giving users complete control over their assets. However, with a multitude of DEXs emerging to gain investors’ attention, choosing the “best DEX in 2024” can become overwhelming. To help you decide, we will consider three contenders: Uniswap, DTX Exchange, and WOO Network.

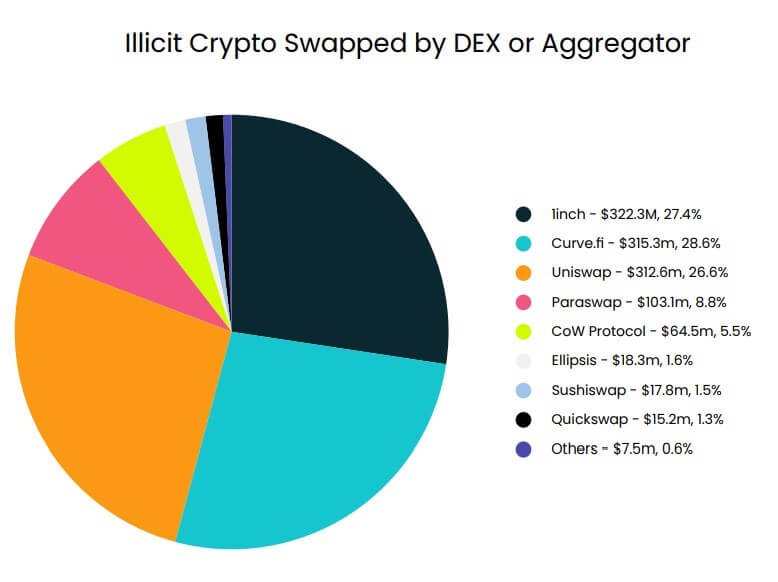

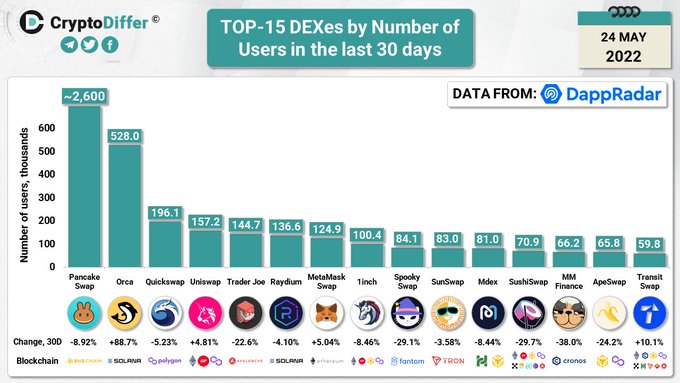

Top DEX contenders in 2024: A comparative analysis Uniswap: The OG DEXPerhaps the most well-known DEX, Uniswap, has been around since 2018. Uniswap pioneered a revolution with decentralized exchanges through its Automated Market Maker (AMM), which it invented. The AMM substitutes traditional order books with liquidity pools. A major advantage that brings is that popular assets enjoy high liquidity because tokens from these pools can be swapped directly by users.

Strengths: Deep liquidity: Uniswap boasts some of the deepest liquidity pools in the DEX space. This depth has attracted a lot of users to its platform. Simple interface: Newbie traders won’t have to break a sweat to figure the platform out. Community governance: Only UNI (Uniswap’s token) holders can manage the affairs of the platform or make decisions. Weaknesses: High Gas Fees: Congestion on the Ethereum network frequently results in high gas costs for Uniswap transactions. Restricted Order Types: Uniswap is mainly designed for basic swaps; expert traders cannot use its advanced order types. Security Concerns: Any DEX has the potential to be vulnerable to smart contract exploits. DTX Exchange: Innovation on the riseDespite being a relative newbie to Uniswap, DTX Exchange is gaining momentum quickly. It makes use of a hybrid order book/AMM paradigm, which may result in lower fees and more flexibility than pure AMMs. DTX boasts several innovative features like:

Wide asset range: Breaking the scale known to most DeFi traders, DTX offers a whopping 120,000+ financial instruments to pick from. Diversified asset class: Unlike many DEXs that support only cryptocurrency trading, DTX supports foreign exchange, stocks, commodities, and CFDs alongside cryptocurrencies. High leverage trading: With DTX, traders can access up to 1000x leverage, significantly increasing their potential earnings. Zero commission policy: Unlike other exchanges with multiple transaction fees, DTX offers a no-commission trading platform that advocates full traders’ compensation. Weakness: Reactively new: DTX Exchange is a relatively new platform with no track record to refer to. This isn’t entirely a bad thing because most projects start from here. Do your research and decide. WOO Network: Tailored for professionalsWOO Network primarily serves institutions and professional traders. It provides users with access to deep liquidity pools and maybe better pricing by aggregating liquidity from different centralized exchanges and DEXs. WOOs core functionalities are:

Wootrade: For large trades, this flagship offering provides minimum slippage and deep on-chain liquidity. WOO Token (WOO): Holding WOO tokens encourages volume and draws in professional traders by lowering trading fees on the network. Tailored Solutions: WOO Network offers features such as OTC (Over-The-Counter) trading desks to meet the demands of institutions. Strengths: Comprehensive Aggregated Liquidity: High-volume traders gain from having access to liquidity from several sources. Reduced fees: WOO token provides Incentives for trading and possible fee reductions. Attention to Big players: Institutional investors are catered to with features like OTC trading. Weaknesses: Limited Retail Appeal: WOO Network might not be as suited for casual users because of its emphasis on professionals. Opacity in Some Aspects: There may be some transparency gaps in the specifics of liquidity aggregation.Choosing the “best DEX in 2024” depends on your specific needs. Do your research. Know where you fall under, and make the right selection.

DTX Exchange is currently in its presale stage at $0.02. To learn more, visit DTX’s presale website or join DTX’s Telegram community.

Disclosure: This is a sponsored press release. Please do your research before buying any cryptocurrency or investing in any projects. Read the full disclosure here.

origin »Bitcoin price in Telegram @btc_price_every_hour

Decentralized Machine Learning (DML) на Currencies.ru

|

|