2021-7-8 20:00 |

Sygnum, a Swiss-based bank, has recently revealed that it will begin offering customers access to Ethereum 2.0 staking through its banking platform. This would make the bank the first bank to offer ETH 2.0 staking to its clients. Sygnum Bank has said that its clients would be able to conveniently and security stake Ethereum through its institutional-grade banking platform. Furthermore, clients can generate up to 7% yield yearly on their staking activities.

This news follows a report from two JP Morgan analysts who forecasted that staking could be a $40 billion industry by the year 2025. They predicted this would come following the total implementation of ETH 2.0 which is expected to make the Ethereum network more secure and scalable.

Related Reading | Ethereum Tests $2,300 Range As Market Adds $70 Billion

The announcement was made on Sygnum’s website on July 6, 2021.

Staking Is A Compelling Choice For Ethereum InvestorsAccording to the announcement on Sygnum’s website, the digital asset bank believes that staking will always be a prime choice for investors in Ethereum. Given the benefits of ETH 2.0, the opportunities are endless for investors.

One of the reasons for this is the exponential growth of decentralized finance (DeFi). DeFi has gained significant popularity in the market these past months and the applications for DeFi are powered by the Ethereum network.

Sygnum is the world’s first digital asset bank. Keeping in line with being first at what they do, they have made the step to add Ethereum 2.0 staking to add to their portfolio of yield generating products.

Ethereum price breaks $2,300 as number of stake coins grows | Source: ETHUSD on TradingView.comThe feature for staking ETH 2.0 is completely integrated with the bank’s platform. Customers will be able to stake the Ethereum they have in their existing wallets on the network through the bank’s infrastructure.

Sygnum provides its clients institutional-grade custody and wallets are fully segregated. This means that clients’ stakes coins will be held in the clients’ individual accounts, with the highest security that the Sygnum platform provides.

This keeps true to Sygnum’s mission of bringing innovative digital assets products to regulated spaces. Signum continues to expand its offers of attractive and yield generating products. And staking is the latest addition to that portfolio.

ETH 2.0 And The Rise Of StakingETH 2.0 consists of a series of upgrades that are currently being made to the Ethereum blockchain. The upgrades are meant to make the network safer, faster, efficient, and more scalable going forward.

The most prominent of the upgrades will be the move from proof-of-work currently being used by the network to proof-of-stake. Proof of work currently uses high computational power to confirm transactions via mining blocks. But proof-of-stake only requires validators, who are required to stake 32 ETH, to confirm transactions.

The validators for each transaction will be selected at random to confirm transactions. This completely eliminates the competition that is seen in the proof-of-work mechanisms and hence transactions will require less computational power to confirm because there is not a competition to mine blocks.

Ethereum 2.0 proof of stake mechanism is expected to use about 99% less energy than the current proof of work mechanism.

Related Reading | Ethereum Upgrades Could Jumpstart $40 Billion Staking Industry, JP Morgan

Staking has seen significant growth in the past year. It first became mainstream in the crypto space in 2020. Now, it has grown widely in popularity.

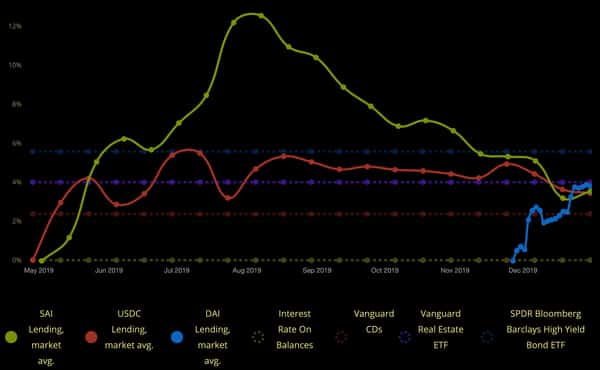

Investors are staking their coins as a way to get rewards for being validators. Staked coins could yield as high as 13% per annum for stakers. This is fast becoming a means of passive income for investors in the crypto community.

As the final date of the move to Ethereum 2.0 draws near, the number of coins staked has increased. There are currently over 6 million ETH staked today. This number accounts for 5% of the total circulating supply of Etherum.

Featured image from Genesis Block, chart from TradingView.com origin »Bitcoin price in Telegram @btc_price_every_hour

Time New Bank (TNB) на Currencies.ru

|

|