2025-11-6 23:41 |

This week, the company announced a $500 million strategic investment at a $40 billion valuation, led by heavyweight institutions including Fortress Investment Group, Citadel Securities affiliates, Pantera Capital, Galaxy Digital, Brevan Howard, and Marshall Wace.

It’s a statement round — not for cash, but for alignment. Ripple didn’t need the money. The firm had just completed a $1 billion tender offer, returning value to early shareholders and employees, and has repurchased over 25% of its float in recent years.

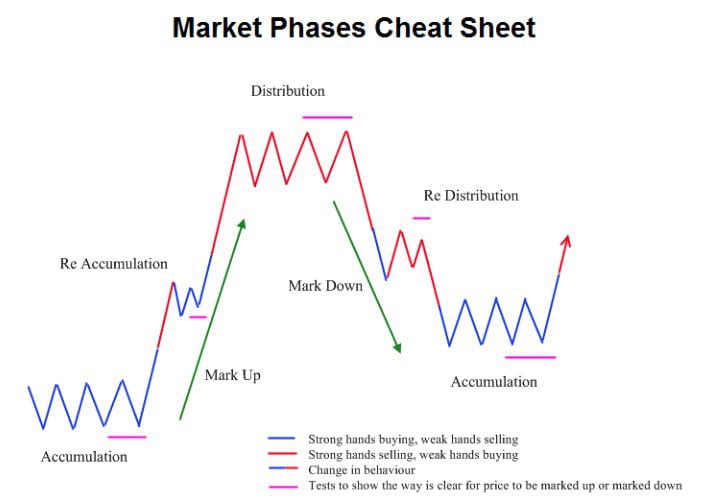

This raise is about one thing: solidifying its role as the institutional bridge between traditional finance and digital assets. Analysts suggest the news is bullish for XRP as the token jumps 9%.

XRP is up 9% overnight on the Ripple news, Source: BNC

A Controlled, Disciplined ExpansionRipple has scaled quietly but aggressively:

Six acquisitions in two years, including two worth over $1BExpansion into custody, stablecoins, prime brokerage, and corporate treasury

A licensing footprint spanning 75 global regulatory jurisdictions

More than $95B in payment volume processed

The tone from leadership reflects confidence backed by execution.

“We started with one use case — payments,” CEO Brad Garlinghouse noted. “Now we support custody, stablecoins, prime brokerage, and corporate treasury. Institutions come to Ripple to access crypto and blockchain.”

What began as a cross-border payments play has evolved into a multi-department financial infrastructure platform.

“2025 has been an incredible year for Ripple, and a record year for crypto as a whole. Although we have a couple of months left, this announcement feels like the cherry on top of a mountain of good news,” said CEO Brad Garlinghouse on X

The Stablecoin and Treasury PivotRipple’s stablecoin, RLUSD, has quietly become one of the fastest-growing in the market, crossing $1B in market cap in under a year.

Two key acquisitions accelerated Ripple’s positioning:

Rail — boosting global payments and settlement capabilitiesGTreasury — enabling Fortune 500 treasury clients to adopt stablecoin-based capital movement and liquidity management

Post-GENIUS Act regulatory changes have driven institutions toward regulated, transparent stablecoin issuers, shifting the market away from offshore opacity. Ripple saw the window and moved decisively.

Prime Brokerage & Market InfrastructureRipple’s acquisition of Hidden Road (now Ripple Prime) positions the company at the core of institutional crypto trading infrastructure.

Since the acquisition:

Client collateral doubledDaily transaction volumes climbed to 60M+

The business tripled in scale

Ripple Prime now supports collateralized lending for XRP — accelerating adoption of the asset within institutional workflows.

This is the sort of infrastructure expansion that signals long-term ambition, not short-term opportunism.

The Bigger Picture: Institutional Crypto Is HereThis investment round isn’t just capital — it’s validation of a thesis:

Digital assets are no longer an experimental add-on for financial institutionsGlobal liquidity, settlement, and collateral markets are going on-chain

The winners will be firms with regulatory clarity, infrastructure maturity, and trusted capital partners

Ripple isn’t positioning itself as a crypto rebel. It’s positioning itself as an enterprise-grade financial network tuned for an era where blockchain is infrastructure, not ideology.

With Wall Street now sitting on its cap table and its product suite spanning payments, custody, stablecoin infrastructure, and prime brokerage, Ripple is assembling a vertically integrated platform for institutional digital finance. With XRP ETFs in the pipeline the future is bright for XRP.

In a sector famous for rhetoric, Ripple’s approach is simple: build the pipes, win regulated markets, and let results speak louder than narratives.

origin »

Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|