2020-11-11 06:00 |

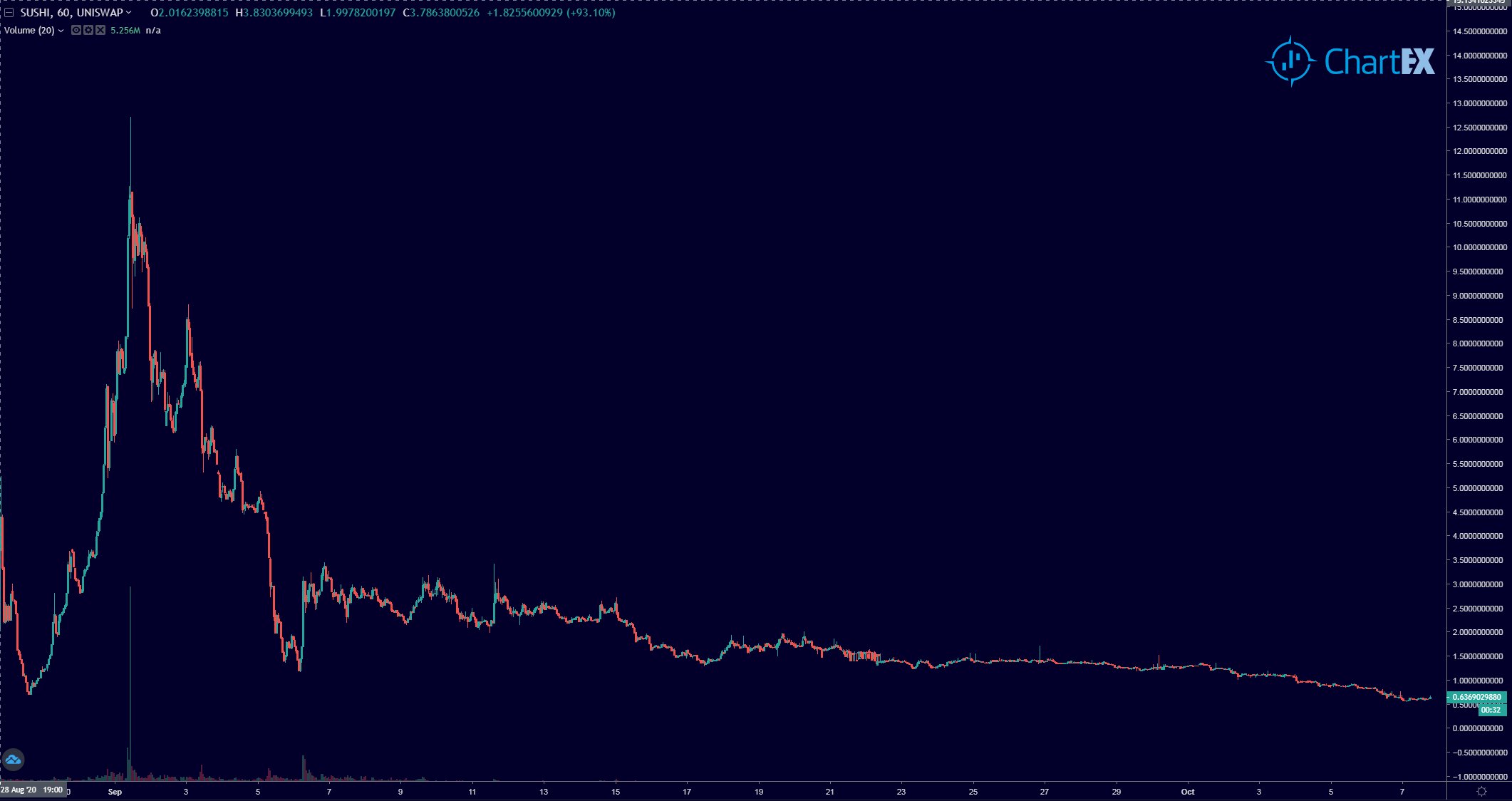

Even after the recent rally, the prices of top DeFi coins are down massively since the summer highs. Data from CoinGecko indicates that the average DeFi coin has dropped by approximately 60-70% from their summer highs, underperforming Bitcoin massively.

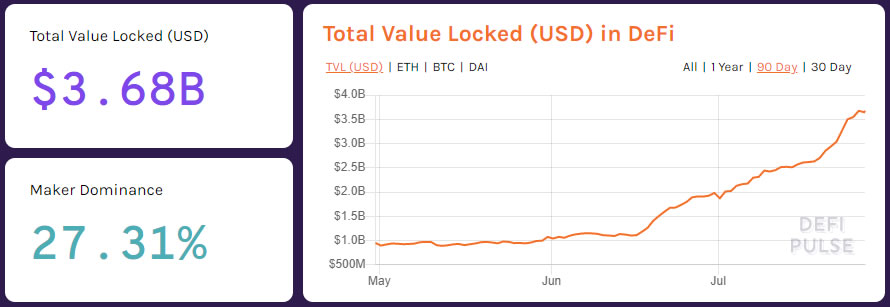

This comes in spite of the fact that the total value locked in DeFi contracts has hit a new all-time high of $12.69 billion. Analysts say that this is a testament to the long-term value of decentralized finance, especially in a world where yields offered in traditional financial services are close to 0%.

Related Reading: Here’s Why Ethereum’s DeFi Market May Be Near A Bottom Total Value Locked in DeFi Hits New All-Time HighYesterday, Ethereum data aggregator DeFi Pulse reported that the total value locked (TVL) in DeFi contracts has just set a new all-time high at $12.69 billion. This is the highest this metric has been since late-October, which was when the previous highs of $12.43 billion were established.

The latest high set by DeFi’s aggregate TVL comes after the metric had entered a period of consolidation from mid September to early November. The collapse in the value of coins pertaining to this space likely contributed to this trend, as yields were temporarily supressed.

But with coins such as Yearn.finance (YFI), Meta (MTA), Balancer (BAL), and many others breaking higher, yields have begun to trend higher once again.

As a result, investors with capital on the sidelines are more incentivized to use DeFi contracts.

For instance, if Uniswap (UNI) rallies 50%, the yields offered by the platform’s yield opportunities are expected to jump by approximately 50%.

Related Reading: Tyler Winklevoss: A “Tsunami” of Capital Is Coming For Bitcoin More Growth to ComeWhile the recent growth has been impressive, analysts think that DeFi is on the precipice of a greater market cycle that will bring it past the summer highs.

Crypto-asset analyst and Messari’s former head of product, Qiao Wang, recently stated:

“From an investment point of view, BTC pre-2013 and ETH pre-2015 were once-in-a-lifetime asymmetric bets. DeFi pre-2021 is once-in-a-decade IMO (until proven wrong). If you’ve missed the first two don’t miss the latter.”

He also recently said that he expects that Silicon Valley will take a large interest in the space in the coming years. He believes that this influx of capital and attention will drive the DeFi space parabolically higher due to the capital that many Silicon Valley investors have.

Related Reading: 3 Bitcoin On-Chain Trends Show a Macro Bull Market Is Brewing Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Pivotal Ethereum DeFi Metric Just Hit a New All-Time High origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|