2025-11-15 02:15 |

Bybit and analytics partner Block Scholes have released a new Crypto Derivatives Analytics Report that, the firms say, flagged growing defensive positioning across derivatives markets ahead of Bitcoin’s recent rout, a selloff that pushed the flagship coin more than 20% below its all-time high and to a six-month low.

The report paints a picture of a market that was quietly preparing for the downside. Perpetual funding rates across major tokens showed a mixed sentiment profile, while many altcoins leaned plainly bearish; at the same time, open interest in large-cap perpetual swaps has contracted sharply, sitting at roughly half the levels seen in early October as traders stayed away from reopening long positions.

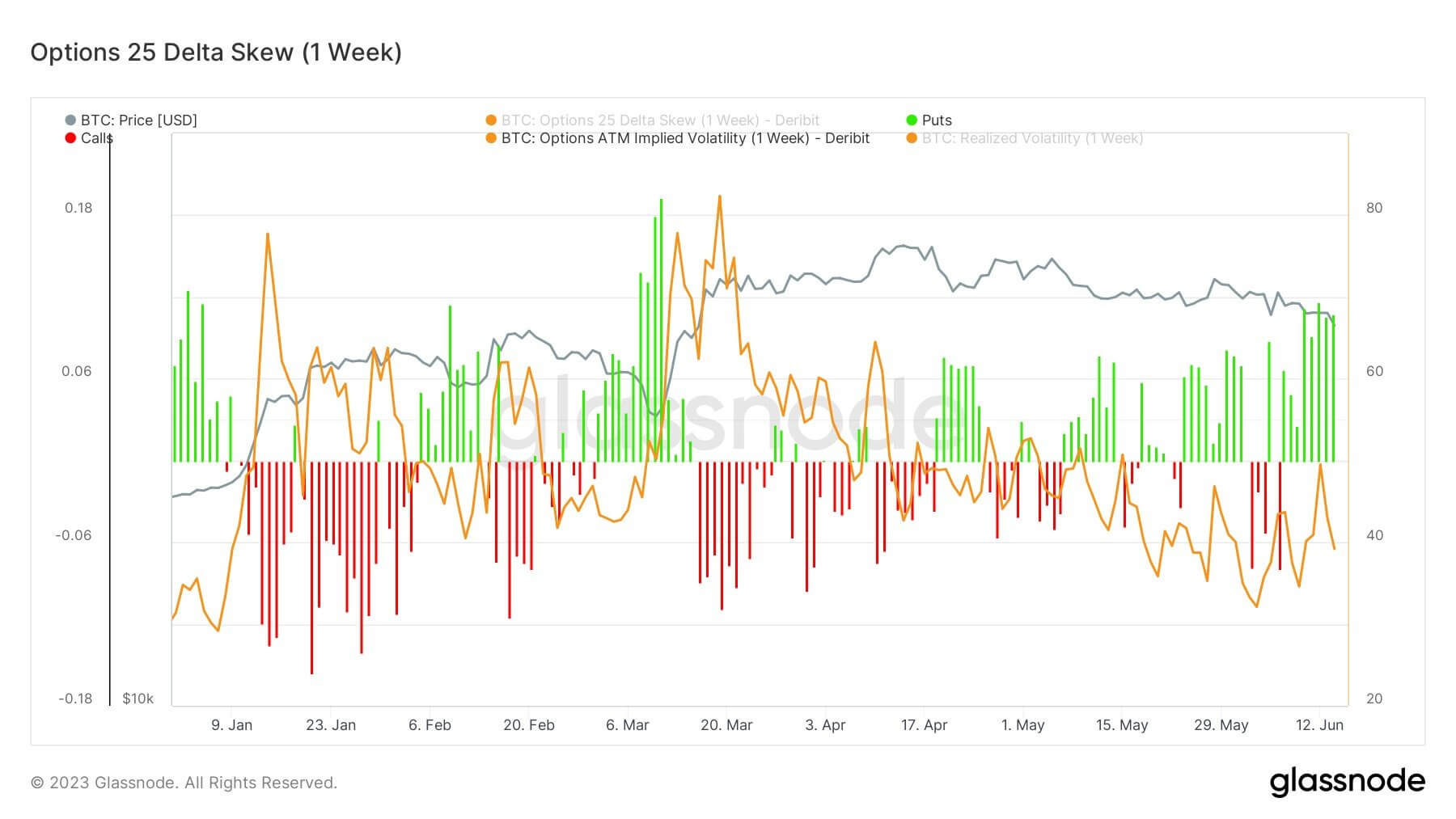

Options markets reinforced the defensive tone. Implied volatility remained elevated and trading exhibited a clear skew toward protective put contracts, with traders willing to pay up for downside insurance. Overall options activity has cooled compared with October, a sign that market participants were adopting a cautious, rather than opportunistic, short-term stance.

Struggles of the MarketThe report also contrasts crypto’s struggles with recent strength in U.S. equity markets following the end of a 43-day government shutdown. While equities staged a rebound, crypto spot markets repeatedly ran into resistance on rally attempts, and elevated implied volatility suggested investors were not ready to price in sustained optimism for digital assets.

Derivatives positioning, the authors argue, left important support levels exposed. The October downturn, which the reporting notes triggered one of the largest liquidation episodes in recent crypto history, appears to have sapped traders’ willingness to take on leverage, and the resulting defensive posture helped set the stage for the more recent slide in spot prices.

Taken together, the data-driven analysis in the Bybit x Block Scholes report suggests the market’s own risk management and hedging behaviour signalled growing fragility before prices broke lower. The full Bybit x Block Scholes Crypto Derivatives Analytics Report is available from the firms for readers who want the underlying charts and datasets.

Bybit, founded in 2018 and serving more than 70 million users, said the weekly analytics series aims to help traders and institutions interpret derivative flows and sentiment as a complement to spot-market analysis, highlighting how derivatives positioning can sometimes foreshadow bigger moves in price.

origin »Blocknet (BLOCK) на Currencies.ru

|

|