2025-11-18 08:53 |

Tuesday saw major developments across the world with major geopolitical decisions, sharp moves in digital assets, regulatory milestones in technology, and renewed political pressure in Washington.

UN Security Council’s backing of a new Gaza peace framework to Bitcoin’s renewed downturn, SoftBank’s deepening push into AI chip infrastructure, and the US House’s mounting drive to force the release of Jeffrey Epstein files.

UN endorses Trump-backed Gaza peace framework amid Israeli resistanceThe UN Security Council has approved a resolution supporting proposals put forward by US President Donald Trump for a long-term peace process in Gaza.

Passed with a 13–0 vote and abstentions from Russia and China, the measure endorses an international stabilisation force (ISF) and outlines a potential path toward a sovereign Palestinian state.

Support for Palestinian statehood was a key concession to secure backing from Arab and Islamic nations, who are expected to provide peacekeepers.

However, Israeli Prime Minister Benjamin Netanyahu reiterated his opposition to Palestinian statehood just hours before the vote, raising uncertainty about the resolution’s future.

Hamas also rejected the plan, describing it as an “international guardianship mechanism” and vowing not to disarm.

The resolution establishes oversight via a “board of peace,” chaired by Trump, though its membership and authority remain unclear.

Questions also linger over the ISF’s mandate, the viability of disarming Hamas, and the formation of a Palestinian technocratic committee to manage Gaza’s governance.

Despite its ambiguities, the vote marks a rare moment of unified UN action after two years of diplomatic gridlock.

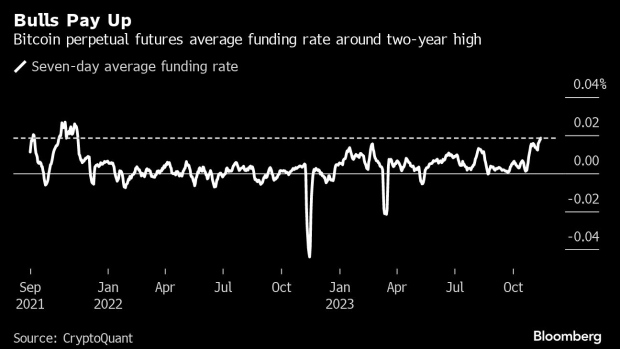

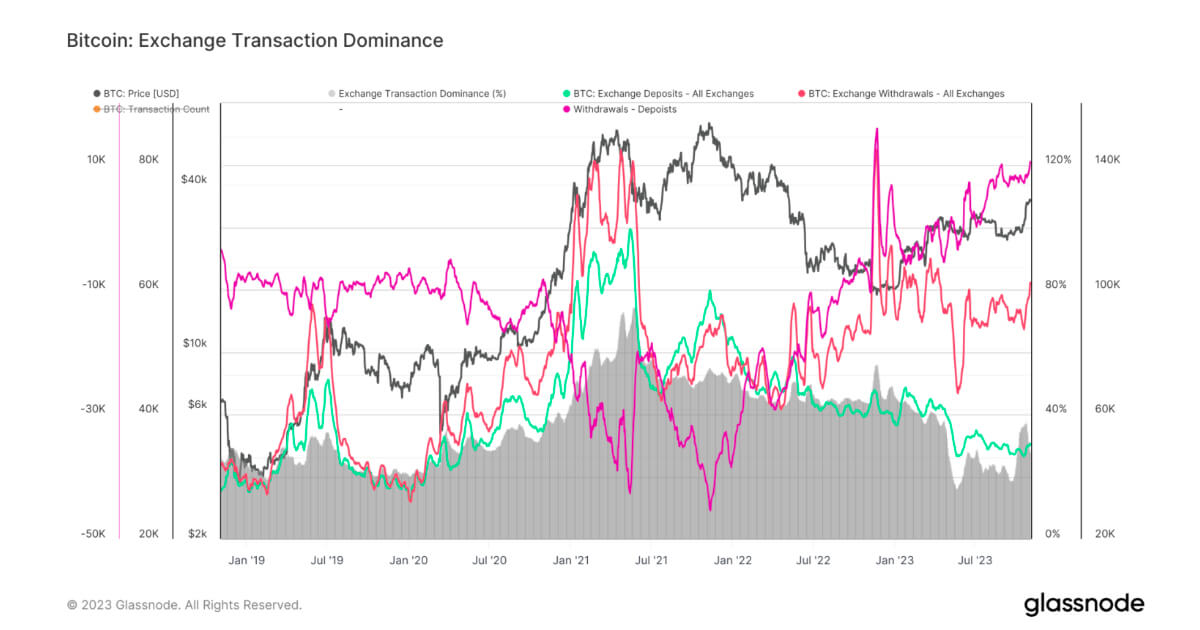

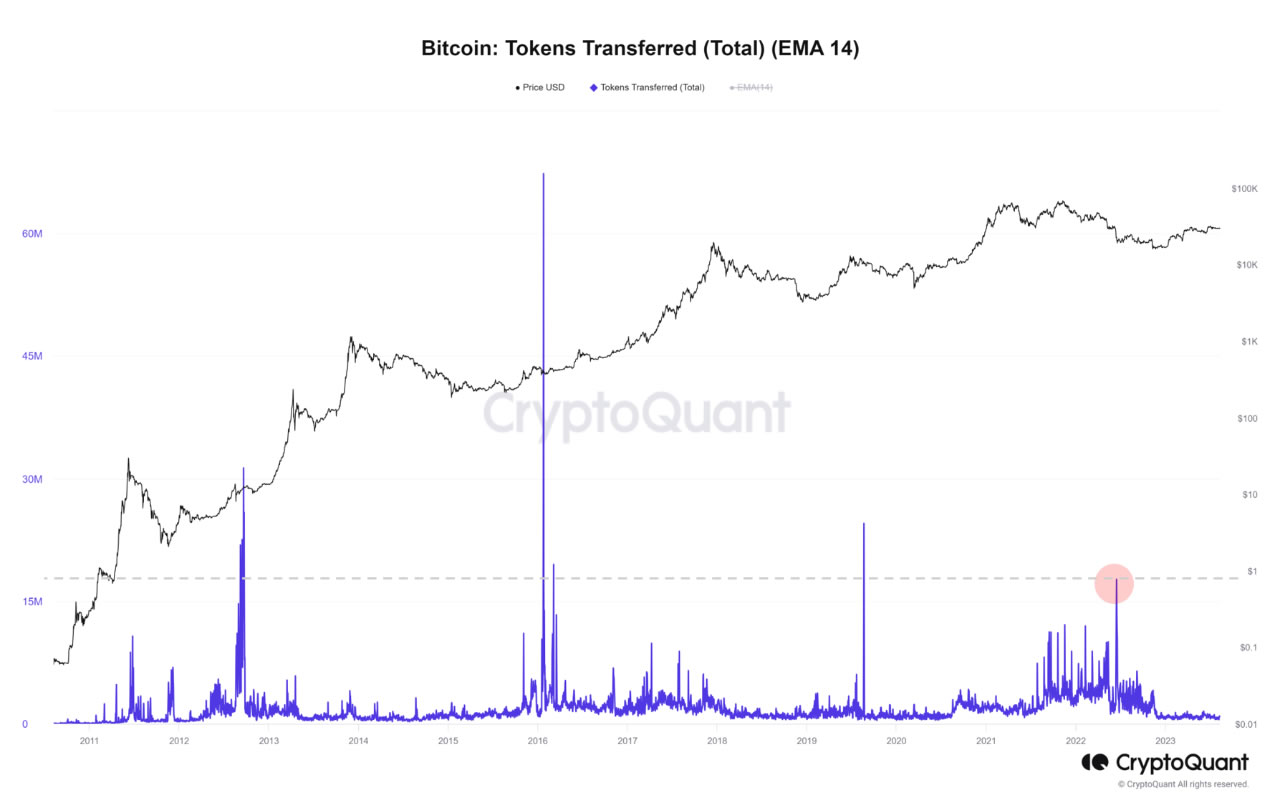

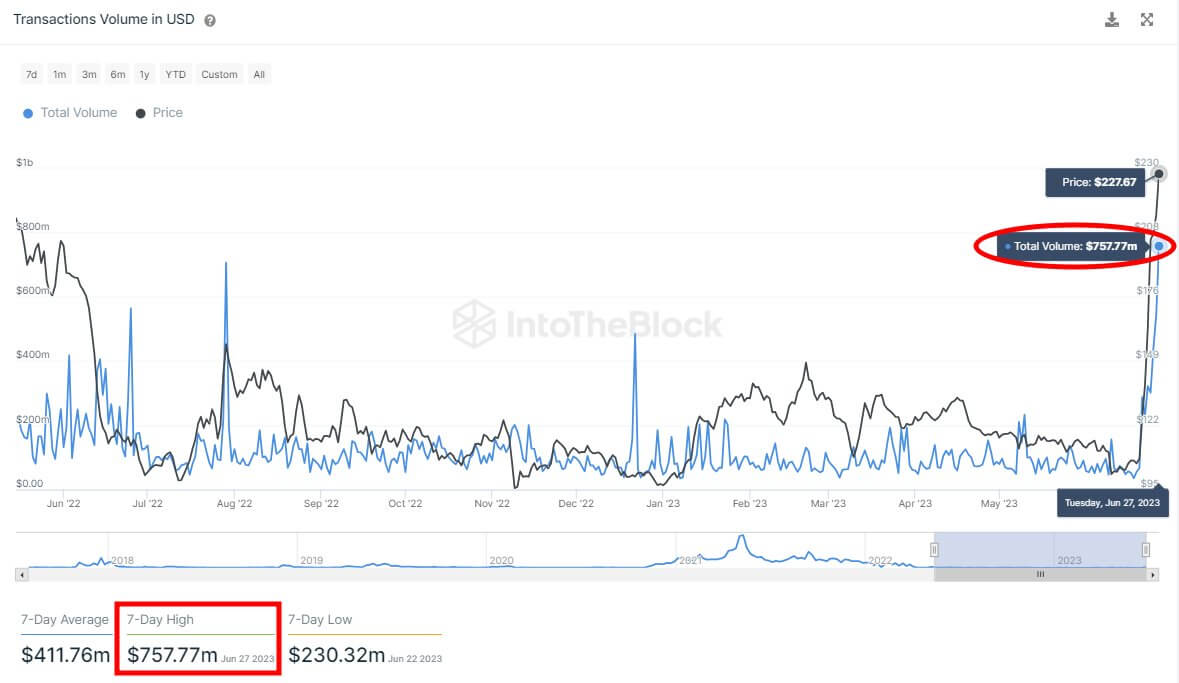

Bitcoin slides below $90,000 as macroeconomic pressures mountBitcoin has fallen below the $90,000 threshold for the first time since April, deepening a month-long decline that has erased its gains for 2025.

The token traded near $89,928 after dropping as much as 5% in 24 hours, extending its retreat from October’s record above $126,000.

Shifting expectations for US monetary policy, particularly fading odds of a December rate cut, have weighed on risk assets.

The selloff follows an early-October rout that triggered over $19 billion in liquidations and erased $1 trillion in crypto market value.

Retail investors have pulled back sharply, and companies with large crypto treasuries face growing pressure as prices fall below acquisition levels.

Options markets indicate increased demand for downside protection, with puts at $85,000 and $80,000 dominating flows.

XRP has mirrored Bitcoin’s weakness, slipping below key support levels and showing limited signs of recovery.

FTC ends review of SoftBank’s $6.5B Ampere acquisitionThe US Federal Trade Commission has ended its review of SoftBank’s $6.5 billion acquisition of semiconductor designer Ampere Computing, clearing a regulatory hurdle for the deal.

The early termination signals the end of an investigation that had previously expanded into an in-depth probe.

The acquisition strengthens SoftBank founder Masayoshi Son’s strategy to consolidate critical AI chip infrastructure.

SoftBank already controls Arm Holdings and holds stakes in other chip design firms, including Graphcore, positioning the conglomerate at the center of global AI hardware development.

House set for vote to release Epstein RecordsThe US House is preparing to vote on legislation compelling the Justice Department to release all unclassified records related to Jeffrey Epstein.

The measure has gained significant bipartisan support, bolstered by Trump’s sudden reversal in favor of the bill.

A veto-proof majority is now possible, putting pressure on Senate Republicans to advance the legislation.

The move follows years of scrutiny over Epstein’s network and the handling of previous investigations.

The bill includes provisions to protect victim identities, while the House Oversight Committee continues to release thousands of DOJ documents tied to the case.

The post Morning brief: UN adopts US plan for Gaza and Bitcoin slide below $90k appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|