2025-11-14 18:19 |

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee — this one’s worth sitting with. The once-unshakable link between MicroStrategy’s stock and its Bitcoin fortune is showing cracks. The company that turned corporate balance sheets into crypto vaults now faces a market reckoning as its long-standing Bitcoin premium has vanished. The timing could not be more symbolic.

Crypto News of the Day: MicroStrategy’s Bitcoin Premium Finally BreaksMicroStrategy’s famed Bitcoin premium, a key symbol of institutional faith in the crypto market, has officially evaporated. This comes five months after the metric was under stress, reported in a mid-May US Crypto News publication.

The company’s market capitalization ($64.54 billion as of this writing) fell below the value of its Bitcoin holdings ($66.15 billion), a first in years for the world’s largest corporate Bitcoin holder.

MicroStrategy Market Cap vs BTC Holdings Value. Source: Strategy Website“Wait, what? MicroStrategy’s total market cap has already fallen below the value of the Bitcoin it holds!? … Now, the premium market for MicroStrategy has truly come to an end,” wrote analyst AB Kuai Dong.

Floating Profits Still Strong For Now As Financing Momentum SlowsDespite the loss of premium, MicroStrategy’s balance sheet remains deeply tied to Bitcoin’s performance. The firm holds 641,692 BTC at an average cost of $74,085 per coin, meaning it still enjoys roughly 39.10% in unrealized gains even if Bitcoin retraces to $102,918, Dong noted in a follow-up post.

MicroStrategy BTC Holdings. Source: Bitcoin TreasuriesMicroStrategy has built its massive Bitcoin position through a unique and aggressive convertible bond financing model.

Unlike Tom Lee’s BitMine Immersion, discussed in the previous US Crypto News, MicroStrategy’s allows the company to acquire Bitcoin without diluting its shareholders.

Investors purchasing these bonds typically accept lower yields in exchange for the potential to convert them into shares at a later date. This is an attractive proposition if both MicroStrategy’s stock and the Bitcoin price rise.

“…once MSTR gets the money, it will directly go buy BTC. If BTC rises in the future and the stock price rises in tandem, investors will convert the bonds into shares and earn more money. In this way, the debt issued by Strategy disappears into thin air,” Dong explained.

However, Dong warned that MicroStrategy’s financing momentum has begun to weaken, with the company’s stock price under pressure and bond buyers growing more cautious.

“After the stock price performs poorly, will anyone still buy the new bond issuances? The amount of Bitcoin they add each week has shown a clear trend of decreasing, with some insufficiency in financing momentum,” he posed.

Market observers have also confirmed this slowdown. Crypto commentator Sun Xinjin noted that MicroStrategy has not issued new convertible bonds since February 2025, shifting instead to preferred share offerings (the STR series) beginning in September 2025.

These preferred shares carry significantly higher interest rates, suggesting investors now demand stronger incentives amid tightening market conditions. Dong confirmed that the latest fundraising effort in Europe followed this newer structure.

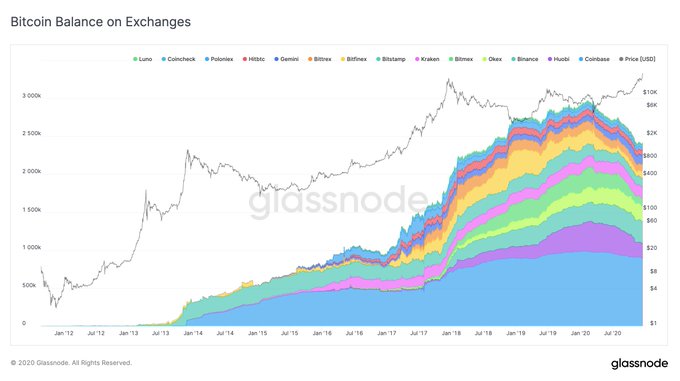

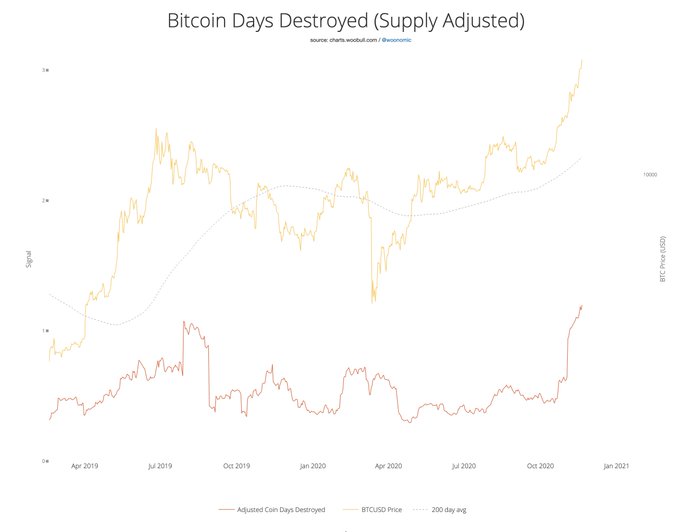

Long-Term Bitcoin Holders Take ProfitsThe developments come as on-chain data shows long-term Bitcoin holders (LTHs) are increasingly taking profits near the $100,000 mark.

Analytics firm Glassnode reported that LTH supply is declining fast, with the net position change falling sharply into negative territory, signaling an acceleration in long-term distribution.

Long-term $BTC holders are accelerating their distribution, with supply declining fast and net position change falling sharply into negative territory.

LTHs are booking profits as bulls defend $100k. https://t.co/yatqA1O7nd pic.twitter.com/rZ8XMSRZXR

Chris Kuiper, vice president of research at Fidelity Digital Assets, echoed this trend, saying that the recent price stagnation has left many veteran holders fatigued.

“Bitcoin’s performance has recently lagged gold’s, even the S&P, and people are getting tired…Long-term holders are looking to make year-end tax and positional changes, calling it a day with the gains they already have,” Kuiper explained.

For MicroStrategy and its CEO, Michael Saylor, this moment marks a critical test. The firm remains profitable on paper but faces tightening financing options and shifting investor sentiment.

As bond markets cool and Bitcoin holders take profits, the company’s ability to sustain its accumulation strategy may hinge on whether Bitcoin’s next leg higher materializes before 2026.

Chart of the Day MicroStrategy Stock vs BTC Dynamics. Source: Bitcoin Treasuries Byte-Sized AlphaHere’s a summary of more US crypto news to follow today:

Big short investor exits Wall Street again —Is crypto the only trade left standing? XRP goes mainstream: First-ever US spot XRP ETF approved—trading starts tomorrow. Historic shutdown ends; Fed left blind without data as Congress presses forward. SharpLink’s Ethereum bet pays off: Massive Q3 profit and 1,100% revenue jump. Analysts reveal the chart that predicts Bitcoin better than M2 ever did. Bitcoin stares at its next peak from the bottom, but one level blocks the view. Solana at a breaking point: $1,000 moonshot or crash back to $100? BitMine stock (BMNR) holds a bullish structure, but one roadblock remains. Will crypto crash in 2026 – Predicting the next bear market. Crypto Equities Pre-Market Overview CompanyAt the Close of November 12Pre-Market OverviewStrategy (MSTR)$224.61$225.70 (+0.49%)Coinbase (COIN)$304.00$305.00 (+0.33%)Galaxy Digital Holdings (GLXY)$31.27$31.42 (+0.48%)MARA Holdings (MARA)$14.41$14.40 (-0.069%)Riot Platforms (RIOT)$15.46$15.42 (-0.26%)Core Scientific (CORZ)$16.44$16.37 (-0.435%)Crypto equities market open race: Google FinanceThe post MicroStrategy’s Bitcoin Premium Vanishes as Long-Term Holders Cash Out | US Crypto News appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|