2024-3-24 20:30 |

The price of Ethereum has not exactly lived up to its promise as the month has gone on, despite a stellar start to the month. While this bearish pressure has been widespread in the general cryptocurrency market, regulation uncertainty has been an additional concern for ETH, igniting a negative sentiment around the “king of altcoins.”

Interestingly, the latest on-chain revelation shows a substantial amount of Ethereum has made its way to exchanges so far in March, suggesting that investors might be losing confidence in the long-term promise of the cryptocurrency.

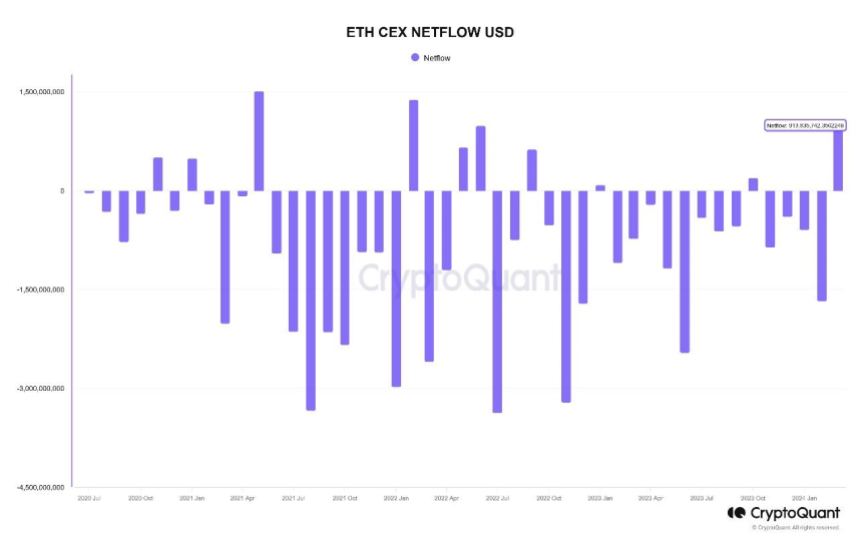

Are Investors Losing Confidence In Ethereum?According to data from CryptoQuant, more than $913 million has been recorded in net ETH transfers to centralized exchanges so far in March. This on-chain information was revealed via a quicktake post on the data analytics platform.

This net fund movement represents the largest volume of Ethereum transferred to centralized exchanges in a single month since June 2022. Even though March is still a week from being over, this exchange inflow appears to be a complete deviation from the pattern observed over the past few months.

As shown in the chart above, October 2023 was the last time cryptocurrency exchanges witnessed a positive net flow. It is worth noting that there was significant movement of Ethereum tokens out of the centralized platforms in subsequent months up until this month.

Meanwhile, a separate data point that supports the massive exodus of ETH to centralized exchanges has come to light. Popular crypto analyst Ali Martinez revealed on X nearly 420,000 Ethereum tokens (equivalent to $1.47 billion) have been transferred to cryptocurrency exchanges in the past three weeks.

The flow of large amounts of cryptocurrency to centralized exchanges is often considered a bearish sign, as it can be an indication that investors may be willing to sell their assets. Ultimately, this can put downward pressure on the cryptocurrency’s price.

Substantial fund movements to trading platforms could also represent a shift in investor sentiment. It could be a sign that investors are losing faith in a particular asset (ETH, in this case).

Moreover, the recent regulatory headwind surrounding Ethereum specifically accentuates this hypothesis. According to the latest report, the United States Securities and Exchange Commission is considering a probe to classify the ETH token as a security.

ETH PriceAs of this writing, the Ethereum token is valued at $3,343, reflecting a 4% price decline over the past /4 hours. According to data from CoinGecko, ETH is down by 11% in the past week.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|