2020-5-13 21:08 |

Since falling off $10,000, Bitcoin’s price is hovering at around $9,000.

For now, the bitcoin halving didn’t have much impact on the market. The miner liquidation or much-feared miner capitulation as a result of block reward halving didn’t materialize, not yet.

Moreover, “New miners w/ better equipment w/ better efficiency would come online in the coming months & the surviving miners would benefit from cheaper electricity during China flood season,” said Lenny Lai, Director of Financial Markets at OKEx.

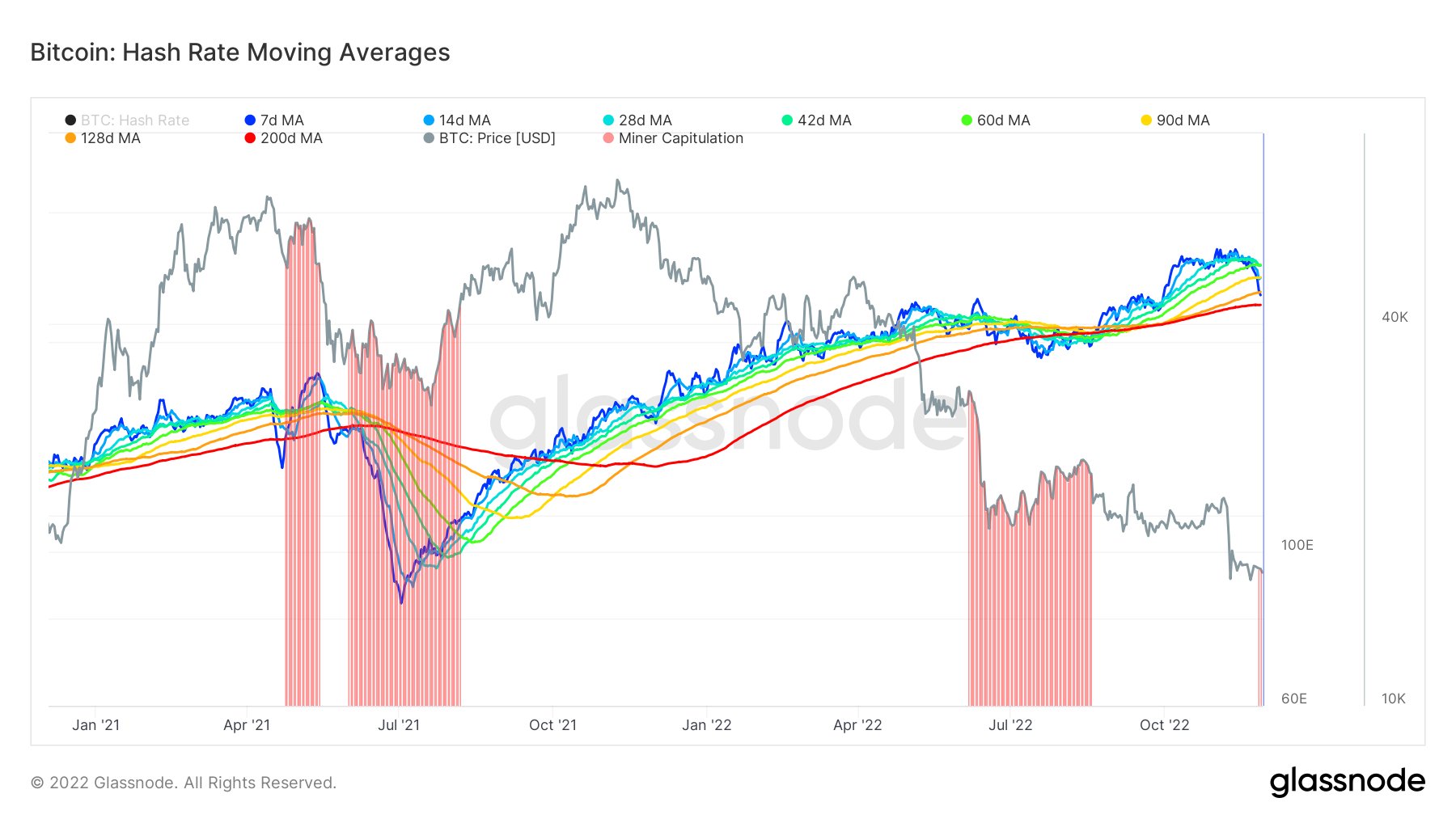

The network hash rate that jumped to a new all-time high at 145.9 Eh/s on halving day dropped 31.8% to 99.4 Eh/s yesterday. Currently, at 102.4 Eh/s, the hash rate is at a level it was on the weekend.

About this development, while congratulating “bitcoin for surviving yet another major event,” Cardano creator and CEO, Charles Hoskinson said,

“We should see the economic fallout of that in coming months as miners reallocate.”

“Markets react this weekend was pretty turbulent as a one and a half billion dollars worth of Bitcoin liquidated which is what pushed the price down from 10,000 but these things always happen people trade the rumor and sell the news,” he said.

Bitcoin “Supply is Limited, But Demand is Increasing Exponentially”In an interview with Bloomberg from Singapore, Chnagpeng “CZ” Zhao, CEO of leading spot exchange Binance said, “The halving should be very positive for the crypto industry.”

On Monday, the halving happened and the mining reward is now officially 6.25 BTC. According to Zhao, miners will be more willing to hold onto their BTC for longer instead of selling at prices lower than their break-even costs.

As we reported, the bitcoin mining pool’s BTC balance spiked more than 100% in the past six months. he said,

“There’s a psychological effect, which also pushes the price up, but fundamentally I believe supply is limited, but demand is increasing exponentially.”

This demand is further fueled by the governments printing money as “with the exceptional quantitative easing from central banks it's leading to a growing number of investors to consider to coin as a hedge against through existing portfolios and a hedge against inflation,” shared Dave Chapman, executive director of Hong Kong-based crypto firm BC Group, which operates OSL, one of Asia’s biggest digital-asset platforms for professional investors.

Millennials and Gen Z on the MoveTalking about the effect of coronavirus on Binance, while the outbreak affected the global economy, “we’ve seen a large increase in activity both in trading volume and, as a result, in income” in the last few months or so, Zhao said.

They have rather a lot of work and in need of more staff, “Right now is a good time to hire,” he said.

During the first quarter of 2020, a lot of crypto companies saw a huge increase in new sign-ups even after the March sell-off.

But the crypto market is not the only one seeing record volume and users as a spike in new accounts were seen at major online brokers as well, — Charles Schwab, TD Ameritrade, Etrade, and Robinhood — growing as much 170% in 1Q20.

Retail investors have been taking their first shot at the stock market in March, while the equities fell over 30%.

About this retail surge, Axios said it all has been “thanks to zero fees, easy access afforded by the internet, and an unexpected glut of free time on their hands, millennials, and Gen Z are opening online brokerage accounts at a record pace.”

Younger generations are the new investors who do not have much background in the equity space.

This time is seen as “a unique time to start portfolios” and they are “often crowding into the tech arena, purchasing the stocks whose services or products they know and use,” Citi chief U.S. equity strategist Tobias Levkovich said.

Bitcoin (BTC) Live Price 1 BTC/USD =$9,096.5194 change ~ 2.37%Coin Market Cap

$167.16 Billion24 Hour Volume

$9.16 Billion24 Hour VWAP

$8.98 K24 Hour Change

$215.4802 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|