2025-6-15 15:25 |

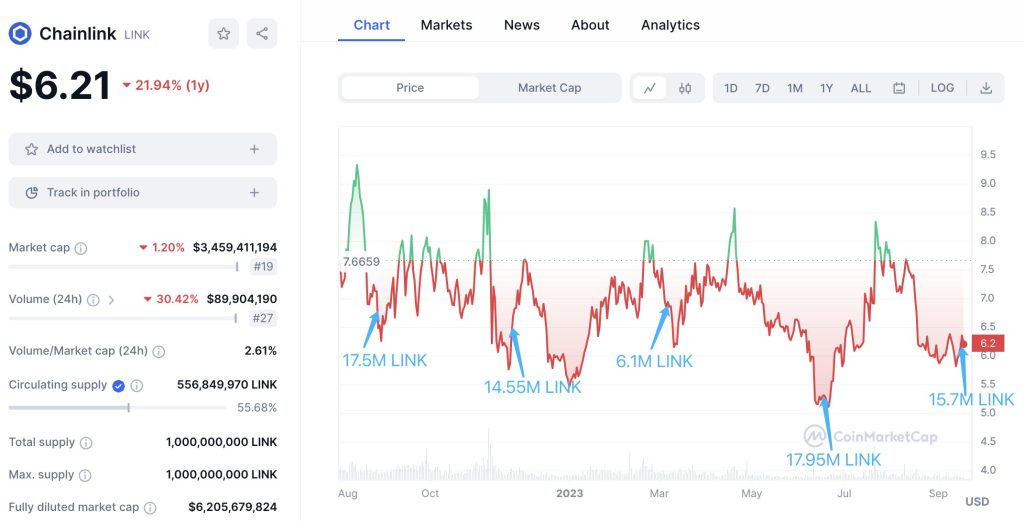

While Chainlink (LINK) continues to climb following news of a major oracle integration, another DeFi project is turning heads with explosive user growth and utility-driven innovation.

Mutuum Finance (MUTM), currently in Phase 5 of its presale, has recorded over 12,000 holders and raised approximately $10.55 million so far.

The project’s current token price sits at $0.03, triple the value offered during Phase 1—delivering a 200% increase for early investors.

With six more phases remaining, entering now means capturing more upside before prices increase in the final rounds.

Presale momentum signals strong investor confidenceMutuum Finance (MUTM) started its presale at just $0.01 in Phase 1, gradually increasing in subsequent phases.

With Phase 5 priced at $0.03, early participants have already secured significant returns.

The next phase will bring the token price to $0.035, reducing the return potential for latecomers.

As demand surges and allocation tightens, the incentive to act early grows stronger.

Unlike many speculative tokens, Mutuum Finance (MUTM) is actively building a functional and audited DeFi infrastructure.

A beta version of the protocol is scheduled to launch by the time the token goes live, and an ongoing $100,000 giveaway further fuels user acquisition.

Backed by a CertiK audit and a high Token Scan score of 80.00, the team is demonstrating its commitment to transparency and security.

P2C and P2P lending models, layer-2 integration and passive incomeMutuum Finance (MUTM) will support both pool-based (P2C) and peer-to-peer (P2P) lending. In the P2C model, assets will be lent and borrowed from shared liquidity pools with dynamically adjusting interest rates based on real-time usage.

Meanwhile, the P2P model will allow users to lend or borrow directly with custom terms.

What will set the P2P model apart is its flexibility. It will support tokens that are rarely available on pool-based platforms, such as memecoins like Pepe (PEPE), Dogecoin (DOGE), or Shiba Inu (SHIB).

This will open the door for holders of unconventional tokens to access liquidity or earn yield without needing to convert their assets.

It will be an appealing option for traders who prefer niche assets.

Mutuum Finance (MUTM) is developing on a Layer-2 network to address one of the biggest challenges in DeFi—high gas fees and slow transaction speeds.

By integrating Layer-2 scalability, Mutuum Finance (MUTM) is positioned to deliver a superior user experience.

Traders, lenders, and borrowers will benefit from near-instant transactions and significantly lower fees, making the protocol practical for both retail and institutional users.

One of Mutuum Finance (MUTM)’s key value propositions is its dynamic income-generation model.

Investors who deposit tokens such as Ethereum (ETH) or Avalanche (AVAX) into the protocol will receive mtTokens like mtETH or mtAVAX—interest-bearing representations of their deposits.

These mtTokens not only track principal and accrued interest but also make users eligible for passive dividends.

For example, an investor who deposits $5,000 worth of ETH into the protocol can expect annual returns aligned with the utilization of the pool.

At an average utilization rate of 5-6%, this will generate approximately $275 annually in interest, excluding any additional dividend rewards.

These passive earnings come with non-custodial control, as the deposited assets remain secured in smart contracts.

Utility of the MUTM tokenThe MUTM token isn’t just a placeholder—it’s a revenue-generating asset. Users benefit from protocol-driven buybacks where a portion of revenue is used to purchase MUTM on the open market.

Those purchased tokens will then be sent to safety-module participants who stake mtTokens in designated contracts.

This creates upward demand pressure on the token while rewarding long-term contributors, tying MUTM’s value to the protocol’s success.

By staking mtTokens, participants gain access to passive income, reinforcing the token’s role in the Mutuum ecosystem.

Mutuum Finance (MUTM) is also building a decentralized, overcollateralized stablecoin backed entirely by on-chain assets already held within the protocol.

Unlike centralized stablecoins that depend on off-chain fiat reserves, Mutuum’s stablecoin will be minted directly from existing protocol assets, with supply adjusting algorithmically.

At the current Phase 5 price of $0.03, an investor who buys $100 worth of MUTM tokens will see that amount grow to $3,000 if the token appreciates 30x.

With the token expected to hit $0.06 in Phase 11, investors entering now are securing their position at a 100% discount compared to the final presale price.

Those who bought during Phase 1 at $0.01 have already tripled their investment before the token even goes live.

The data speaks for itself: users are actively participating, the token’s value is rising with each phase, and utilities are rolling out with speed and transparency.

CertiK audit and roadmap transparencyMutuum Finance (MUTM)’s smart contracts underwent a comprehensive audit by CertiK, including static analysis and manual review.

The audit process began on February 25, 2025, and was revised on May 20, 2025, culminating in a robust security profile and an audit score of 80.00.

The team has publicly shared its development roadmap, which includes the beta launch of the platform with the public listing of the token.

The ongoing community engagement, and rapid presale traction underscore a project built for growth.

As Chainlink (LINK) rides the momentum of a major partnership, Mutuum Finance (MUTM) is building a DeFi ecosystem from the ground up—prioritizing security, speed, and income-generation.

From Layer-2 optimization and overcollateralized stablecoins to dynamic lending pools and peer-to-peer innovation, the project offers real solutions backed by audited infrastructure.

Investors who recognize this early have already locked in 200% gains.

With only six phases left before the final listing price, now is the time to get in—before the price climbs and early-phase profit margins shrink.

Whether you’re seeking passive income, long-term growth, or utility-driven rewards, Mutuum Finance (MUTM) delivers.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

The post LINK soars on major oracle partnership, while MUTM sees record wallet sign-ups appeared first on Invezz

origin »ChainLink (LINK) на Currencies.ru

|

|