2023-11-28 13:20 |

Crypto investment products have experienced another week of inflows, bringing the run to nine consecutive weeks of inflows. According to CoinShares’ latest report on digital asset investment funds, inflows into crypto products totaled $346 million last week, with some cryptos receiving more investments than others.

With last week’s numbers, the total value of inflows into crypto investment funds this year now stands at $1.663 billion.

Overview Of Institutional Investment In Crypto This WeekAlthough volatile and still in its nascent phase, the crypto market has attracted its fair share of rich visionaries and institutional traders. While companies like MicroStrategy and Tesla are investing on the spot end of things by buying crypto assets, others are getting exposure to assets through exchange-traded products (ETPs). This is particularly good, as institutional backing in ETPs also brings more stability and legitimacy to the space.

According to CoinShares, Bitcoin has attracted most of the inflows. Bitcoin has been in the spotlight for the past few months, particularly with Spot Bitcoin ETFs waiting to be approved in the US.

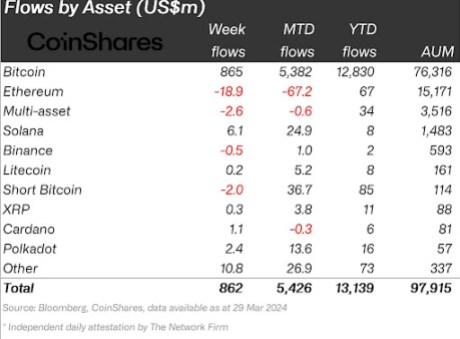

Bitcoin ETPs received a total of $312 million in new inflows last week, bringing its total inflows this year to $1.55 billion. At the same time, Ethereum ETPs witnessed an inflow of $33.5 million, a 915% increase from the previous week’s inflows of $3.3 million.

Solana ETPs on the other hand, saw an inflow of $3.5 million, a 74% drop from the previous week’s inflow of $13.6 million. Polkadot and Chainlink also saw inflows of $0.8 million and $0.6 million respectively. On the other hand, short Bitcoin products had outflows of $0.9 million last week, a third consecutive week of outflows.

What Is Driving The Institutional Interest?Institutional investments in digital asset products are now at the highest point since the bull market in late 2021. According to CoinShares, the total assets under management (AuM) are now at $45.3 billion. Most of the momentum for this surge came after the announcement of applications of spot Bitcoin ETFs in the US.

Applications of spot Ethereum ETFs joined the list last week, spiking the flurry of inflows into Ethereum ETPs last week to extend a positive four-week run of $103 million.

ETPs are still one of the best ways for institutional investors to get exposure to cryptocurrencies like Bitcoin and Ethereum. Their use has been on the rise in recent months, and ETP volumes as a percentage of total spot Bitcoin reached 18% last week.

This is poised to change soon when spot ETFs are approved and institutional investors have another way to get exposure to Bitcoin. Experts say the first approval for spot ETFs could come early in 2024.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|