2023-6-13 12:30 |

The U.S. war on crypto has not just targeted crypto exchanges and digital assets, it has also created a huge shift in the stablecoin ecosystem. As a result, a widening divergence has occurred between the market-dominant stablecoin issuers.

The stablecoin landscape has shifted dramatically over the past year, and it is partially to do with America’s push to regulate the industry out of existence.

Stablecoin Ecosystem DivergenceOn June 12, crypto industry researcher and analyst Nic Carter revealed the extent to which U.S. regulators have altered the stablecoin ecosystem.

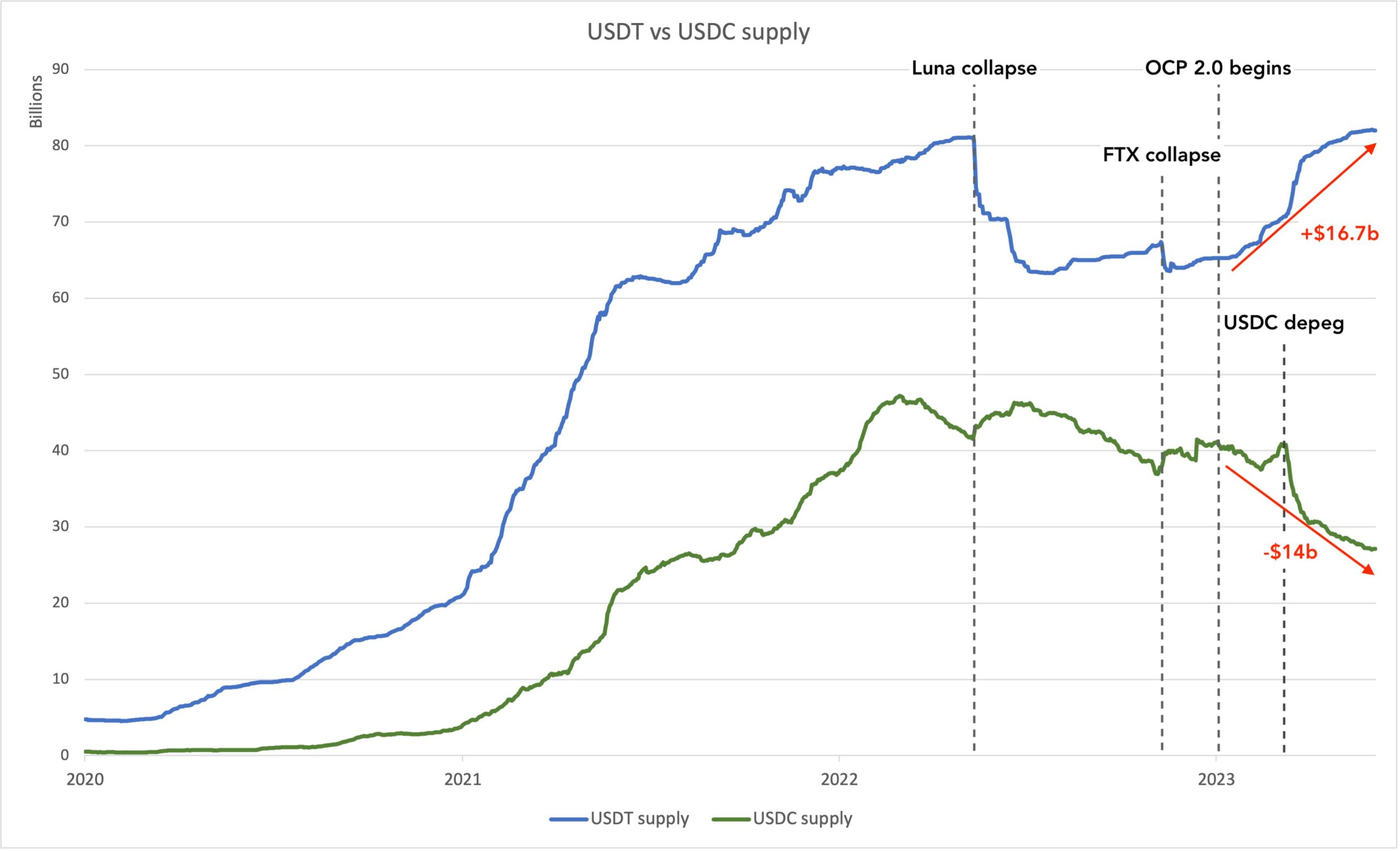

Tether’s USDT market share has surged at the expense of Circle’s USDC share over the past year.

USDT supply hit a new peak of 83.36 billion this week. Furthermore, that supply has surged 26% since the beginning of the year, giving it a commanding market share of 64.5%.

Conversely, USDC supply has fallen to a 22-month low of 28.31 billion. It has seen a supply shrink of 36.4% this year as its market share dwindles to 22%.

Stablecoin supplies over time. Source: Twitter/@nic__carterCarter noted that this could be the fault of U.S. policymakers.

“US policymakers have successfully pushed investors out of onshore, regulated stables, into offshore, unregulated stables.”

Circle, a fully regulated company, was previously favored by U.S. institutions. However, a lot of that confidence corroded due to its exposure to the now-bankrupt Silicon Valley Bank and the de-pegging event that followed.

Find out more about stablecoins:

What is a Stablecoin and How do They Work?

Furthermore, the decline in USDC is correlated to a decline in American bank deposits. U.S. citizens have more access to Treasury Bills and money market mutual funds that are higher yielding.

Additionally, Tether is favored more internationally, and demand has increased despite the bear market and war on crypto.

Carter added that this explains some of the variances:

“The fact that USDC holders are more ‘treasury proximate’ whereas USDT holders may not be able to get into treasuries as easily,”

Additionally, Glassnode has reported that more crypto capital is leaving the U.S. destined for Asia.

SEC Warpath Doing More DamageSecurities and Exchange Commission Chair Gary Gensler has made his views perfectly clear. America does not need cryptocurrencies or stablecoins because it has the dollar, he said last week. Meanwhile, the Federal Reserve has loaned billions to bail out embattled banks.

However, in his mission to protect investors, Gensler is actually achieving the complete opposite by suing exchanges and trying to freeze their (customers’) assets.

On June 12, Binance.US made a legal filing asking courts to reject the SEC’s demand to freeze its assets. The action would only hurt its customers as operations would quickly grind to a halt, read the filing.

“With a freeze of all corporate assets, banking partners would most likely cease to honor requests to transfer funds for any purpose, including customer redemptions,” it stated.

Meanwhile, Gensler and his team of crypto cops continue to attack the industry, wiping billions from investor portfolios and sending capital offshore.

The post How US’ War on Crypto Altered the Stablecoin Ecosystem appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

USDx stablecoin (USDX) íà Currencies.ru

|

|