2020-9-13 05:20 |

Like other crypto assets, LEND underwent a strong correction last week. The cryptocurrency came under pressure due to Bitcoin and Ethereum diving lower as the legacy market slipped. LEND also suffered from a short-term collapse in DeFi, caused by the exit of Chef Nomi from SushiSwap.

Analysts remain optimistic on the cryptocurrency, which is the native token of Aave, for a variety of fundamental and technical reasons.

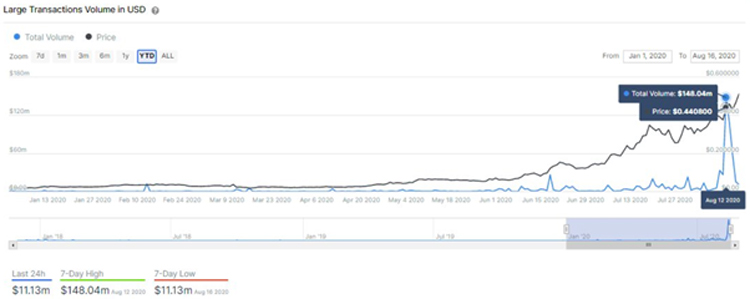

Related Reading: This European Crypto Exchange Was Just Hacked for $5 Million LEND Could Double: Analyst Shows HowA fractal analysis first noticed by a leading cryptocurrency trader suggests that LEND will surge over 100% in the months to come.

The fractal suggests that LEND’s macro price action looks similar to gold’s price action since the abolishment of the gold standard. The comparison suggests that LEND is on the verge of a parabolic growth trend, having consolidated after an initial uptrend.

Chart of LEND's price action over the past few years with a fractal analysis/comparison to gold's price action over the past few decades by crypto trader SmartContracter (Twitter handle). Chart from TradingView.com Related Reading: Here’s Why This Crypto CEO Thinks BTC Soon Hits $15,000 VCs Are Bullish on the CoinTop venture capitalists in the industry are optimistic about LEND’s potential in the ever-changing DeFi space.

Spencer Noon of DTC Capital argued that the fact Aave has managed to garner over $1 billion worth of value locked in its contracts without liquidity mining schemes is a positive sign for the protocol’s product-market fit:

“One of the best signals of PMF in #DeFi is if a project can succeed w/o extra incentives (liquidity mining). @AaveAave doesn’t have LM yet it’s still one of the biggest beneficiaries of new yield farming activity. At $1.26B TVL and only $759M mcap—the fundamentals are so strong.”

This was echoed by Multicoin Capital managing partner Kyle Samani. He said that Aave’s product-market fit would mean that if he had to choose one DeFi asset on Ethereum to own for two years, it would be LEND:

“If I had to hold a single Ethereum based DeFi asset for 2 years, it would be $AAVE. By far the best combination of: product/market fit, token distribution, community, pace of innovation, and reasonable valuation with upside to go.”

How these long-term trends will affect short-term price action, though, is currently not clear.

Related Reading: CNBC’s “Mad Money” Host Jim Cramer Is Finally Buying Bitcoin Featured Image from Shutterstock Price Tags: lendusd, lendbtc Charts from TradingView.com Gold Fractal Predicts the Ethereum-Based LEND Could Double in the Months Ahead origin »ETHLend (LEND) на Currencies.ru

|

|