2023-11-10 03:00 |

Galaxy Digital Holdings Ltd., led by Michael Novogratz, appears to have confronted a turbulent market, reporting a ‘widening’ of its quarterly losses amid a period marked by declining crypto prices and low volatility in the digital asset market.

The firm, known for its range of crypto services, faces the headwinds of a challenging quarter, even as it lays the groundwork for future ventures, including a bid for a Bitcoin exchange-traded fund (ETF).

Financial Fluctuations Amid Expansion And OptimismIn the latest financial disclosures, Galaxy Digital revealed a net loss of $94 million for the third quarter, a notable increase from the $68 million loss reported during the same period last year.

This figure also represents a jump from the $46 million loss recorded in the second quarter, defying consensus estimates that had projected the company’s losses to remain relatively stable at around $44 million.

Despite the losses, Galaxy’s diverse operations — spanning trading, asset management, and mining — demonstrated resilience. The firm’s trading revenue stood at $14 million, slightly declining from the previous quarter.

However, this comes against a backdrop of a 70% surge in trading volume and an expansion of its average loan book size to $553 million.

On a brighter note, Galaxy Digital has experienced a turnaround post-quarter, boasting an income before tax of $124 million and trading revenue of $24 million in October alone.

According to the report, this sharp recovery was fueled by favorable market conditions, including the uptick in digital asset prices, with Bitcoin’s value climbing over 30% in the past month.

Resilience Amid VolatilityGalaxy Digital’s earnings from its asset management division experienced a notable increase, with a quarter-over-quarter growth of 11%. The company’s preliminary report on assets under management highlighted a significant boost, with a valuation reaching $3.9 billion as of the end of September, a 58% rise from the second quarter.

However, Galaxy Digital did not emerge unscathed from the market’s volatility, recording a substantial financial adjustment charge of $44.9 million due to a reduction in the value of its smaller stake holdings.

This figure contrasts sharply with the reassessment gain on previous write-downs totaling $128.1 million recognized earlier in the year, underscoring the quarter’s financial pressures.

Meanwhile, Novogratz maintains an optimistic outlook, projecting that the US Securities and Exchange Commission (SEC) will green-light a direct Bitcoin ETF by the close of 2023 — a move Galaxy Digital is preparing for in partnership with investment management firm Invesco.

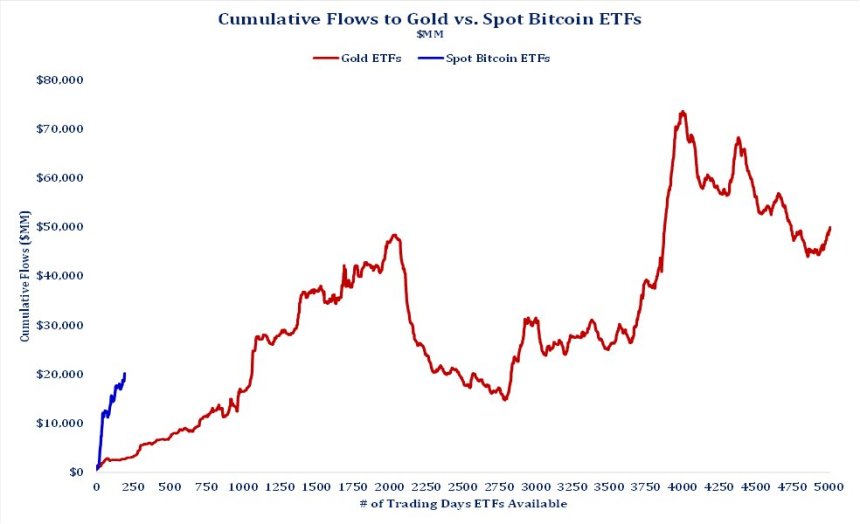

Furthermore, Galaxy Digital’s recent analysts suggest that a spot Bitcoin ETF could see inflows exceeding $14 billion in its inaugural year. They argue that existing investment options have limitations, including high fees and poor liquidity, which limit their appeal to a broader investor base. In contrast, a spot Bitcoin ETF would offer investors a more accessible route to direct Bitcoin exposure without self-custody complexities.

Featured image from Unsplash, chart from TradingView

origin »Bitcoin price in Telegram @btc_price_every_hour

Digital Rupees (DRS) на Currencies.ru

|

|