2024-3-6 11:21 |

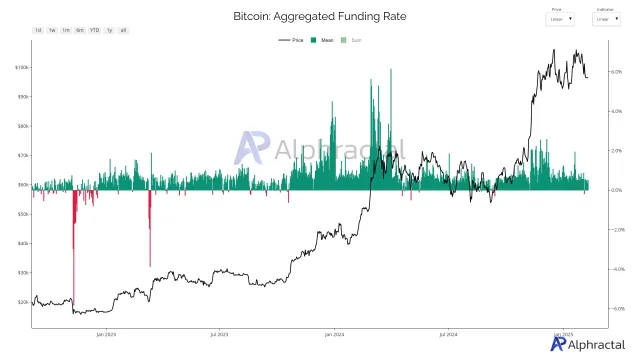

Funding rates are an often overlooked yet vital aspect of the crypto market. These rates are essential in perpetual futures contracts — financial instruments that allow traders to bet on Bitcoin’s price without an expiration date.

Funding rates help align the price of these contracts with the actual market price of Bitcoin through periodic payments between buyers and sellers. Buyers pay sellers if the rate is positive, showing a bullish market mood. Conversely, a negative rate indicates bearish sentiment, with sellers paying buyers.

Funding rates show the market’s leverage direction and overall sentiment. High funding rates suggest a strong bullish sentiment, with traders willing to pay more to hold onto their bets for rising prices. Meanwhile, low or negative rates hint at a bearish outlook, where expectations lean towards a price drop.

According to CoinGlass data, the open interest-weighted funding rate of 0.0921% and the volume-weighted funding rate of 0.0942% showed a high cost for traders holding long positions in perpetual futures prior to Bitcoin’s March 5 correction. The slight difference between these rates comes from the distribution of open interest and volume across different price points or times, showing a slight difference in market sentiment and leverage.

Screengrab showing the open interest-weighted funding rate and the volume-weighted funding rate for Bitcoin perpetual contracts on March 5, 2024, 15:00 UTC (Source: CoinGlass)This high cost of holding long positions shows that most of the market was expecting prices to rise even further in the near future. This is especially significant as BTC had been struggling to regain its ATH of $69,000. Bitcoin briefly broke $69,000 on several exchanges on March 5, but a swift correction brought its price back to $59,500 before recovering to around $67,000.

The bullish sentiment was seen in the dramatic increase in the Bitcoin APR. On March 1, Bitcoin’s price was $61,480, and the funding rate APR stood at 27.72%. And while an uptick in APR was seen in the last few days of February, it wasn’t until the beginning of March that it picked up momentum. The progression from 27.72% APR on March 1 to a sharp increase to 117.52% by the morning of March 5 followed Bitcoin’s price increase from $61,480 to $68,296 over the same timeframe.

Screengrab showing the Bitcoin funding rate heatmap from February 27 to March 5, 2024 (Source: CoinGlass)The increase in funding rate APRs, particularly the jump observed on March 5, shows bullish sentiment among traders has intensified. The market is increasingly willing to pay higher premiums to hold long positions in anticipation of further price appreciation.

The rapid escalation in APR between March 1 and March 5, particularly the hourly jump between 01:00 and 09:00 on March 5, represents the culmination of speculative fervor, potentially driven by FOMO as traders rush to capitalize on the bullish trend. This scenario often leads to a highly leveraged market where the cost of maintaining long positions becomes exceptionally high, reflected in the surging APR. The fallout of the March 5 price correction saw the Open Interest weighted funding rate fall to 0.0504% as of press time following $309 million in BTC liquidations over the past 24 hours.

Such conditions increase the market’s vulnerability to volatility and corrections. An over-leveraged market is susceptible to sudden price pullbacks, where even minor sell-offs can trigger a cascade of liquidations of leveraged positions, leading to sharp price corrections. Historically, significant run-ups in price and funding rates have occasionally preceded corrections.

The post Funding rates soared as traders bet big on Bitcoin’s future gains before correction appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

United Traders Token (UTT) на Currencies.ru

|

|