2021-11-12 16:30 |

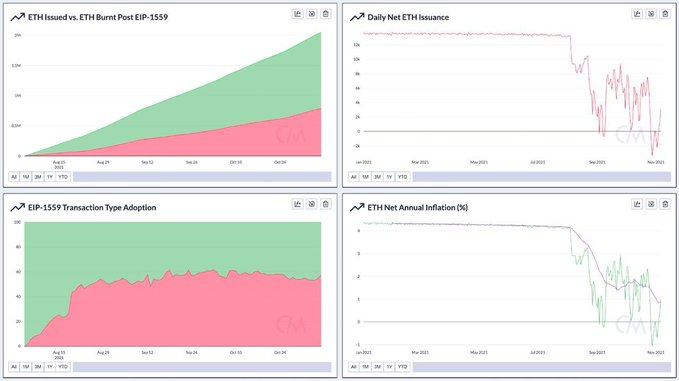

Since the implementation of EIP-1559, almost 860,000 ETH worth $3.2 billion have been burnt, which is about 40% of the ETH issued in that period.

Daily net ETH issuance has now dipped below zero in 10 days, making the crypto asset deflationary. This has now significantly dropped ETH’s expected rate of net annual inflation. According to Coin Metrics, based on the 30-day moving average, ETH’s net annual inflation has now dropped under 1%.

This is despite the fact that the number of transactions implementing EIP-1559 type fees is still around 60%.

The total supply of wrapped Bitcoin (WBTC) on Ethereum has also risen to 235,000, representing more than 1% of the total bitcoin supply. The fact that 90% of all average transfer size for WBTC has been greater than $1k in value likely suggests that WBTC is mainly used on Ethereum in DeFi protocols for trading and other financial activity.

Amidst this, Ether has also hit a new all-time high this week at $4,870, up 550% YTD. As of writing, ETH has been trading at $4,550.

As Ether hit new highs, Ethereum Foundation, a non-profit organization supporting the development of the second-largest cryptocurrency and its developers, has moved its ETH to cryptocurrency exchange with an intention to sell them.

On-chain data shows, Ethereum developer, sent 20,000 ETH worth about $95 million to Kraken.

In the past as well, Ethereum Foundation has sold its Ether stash to provide financial support to the ecosystem.

Everyone as happy, fat, and complacent as suckling pigs.

Unnoticed as they suckle on the teat of alts – the Ethereum Foundation shipped $90mm to Kraken to sell and the Bitfinex whale claimed $2b in ETH margin longs, most likely with the intent to quietly exit stage left. pic.twitter.com/90Wya8bhXm

— light (@lightcrypto) November 12, 2021

With Ether price surging and activity resuming on-chain, ETH gas fees are rising as well. Over the last week, the Ethereum transaction fee averaged $50, with a median of $26. As of writing, the average fee is still above $50.

Daily active addresses meanwhile have averaged $650,000 over the last week, the highest level since August this year. NFT activity, however, is currently not the main factor behind the jump in gas fees as daily ERC-721 transfers averaged $67k over the last week, down from a peak of $200k per day in early September.

“Activity that might be less cost-sensitive such as trading is likely the biggest contributing factor to the rise in fees,” noted Coin Metrics.

While high network usage means there is high demand for Ethereum block space from users, it also limits scalability on layer-1 Ethereum, pricing out smaller users.

This week, however, the L2 solution Optimism released one of its biggest upgrades to improve the developer experience building on layer 2. With this, Optimism is currently offering the cheapest experience at $0.01 ETH transfer cost, as per Cryptofees.

Ethereum/USD ETHUSD 4,555.7462 -$187.24 -4.11% Volume 19.35 b Change -$187.24 Open$4,555.7462 Circulating 118.31 m Market Cap 539.01 b baseUrl = "https://widgets.cryptocompare.com/"; var scripts = document.getElementsByTagName("script"); var embedder = scripts[scripts.length - 1]; var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}}; (function () { var appName = encodeURIComponent(window.location.hostname); if (appName == "") { appName = "local"; } var s = document.createElement("script"); s.type = "text/javascript"; s.async = true; var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=ETH&tsym=USD'; s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName; embedder.parentNode.appendChild(s); })(); var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~ETH~USD"); The post ETH’s Net Annual Inflation Now under 1%, Ethereum Foundation Selling Ether first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|