2025-7-14 11:14 |

Ethereum (ETH) is on the verge of a dramatic supply shock as leveraged short positions soar to unprecedented levels, staking hits historic highs, and exchange liquidity plummets.

Will this be bullish for ETH, or will another “Black Thursday” event be created?

ETH Supply Shock Gaining MomentumA chart posted by ZeroHedge on X highlights the Ethereum supply shock with leveraged short positions reaching a record -13,291 in aggregate OTC and cash contracts. This marks the sharpest drop since early 2025, signaling aggressive hedge fund activity.

Ether leveraged the biggest shorts on record. Source: ZeroHedgeCrypto expert Fejau notes on X that this isn’t driven by bearish sentiment but by a basis trade strategy. Hedge funds exploit price differences between ETH futures on CME and spot markets, securing consistent profits amid contango.

“Reason for the huge ETH shorts is basis trade. Funds can capture an annualized basis of 9.5% by shorting the CME futures and buying ETH spot with a staking yield of 3.5% (this why its mostly ETH not BTC) for a delta neutral 13%.” Fejau explained.

The ETH supply shock is further intensified by staking surging to an all-time high. According to Dune Analytics, over 29.03% of the total supply is locked, leaving roughly 121 million ETH circulating.

ETH staking ratio. Source: DuneOn-chain data also shows that ETH has been leaving exchanges recently, coinciding with the price of ETH returning to its current $3,000 mark. This is partly due to the accumulation strategy of whales or large companies like SharpLink.

Reduced liquidity also contributes to the upward pressure on prices when demand exceeds supply. Last Friday, 140,120 ETH valued at approximately $393 million were withdrawn from crypto exchanges.

“More than 140,000 ETH, worth roughly $393 million, flowed out of exchanges, marking the largest single-day withdrawal in over a month,” Sentora noted.

MerlijnTrader on X forecasts ETH hitting $10,000 in this cycle, propelled by a potential short squeeze and staking dynamics. ETF staking approvals are expected by year-end, reinforcing the ETH supply shock narrative.

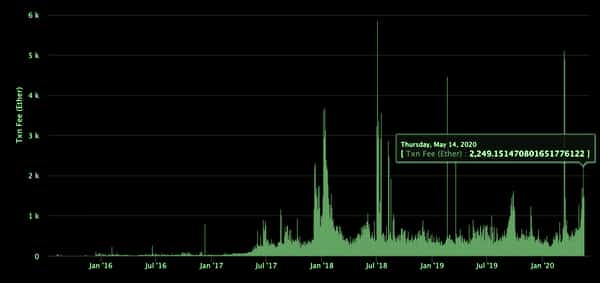

Yet, risks loom large. The basis trade, while lucrative, is vulnerable to sudden volatility, as seen in 2020’s “Black Thursday.” If the Ethereum supply shock fails to drive a price surge, funds could face losses, shaking market confidence.

ETH price action. Source: BeInCryptoETH has broken back above the $3,000 mark at the time of this writing. However, the current price is still 38% below the all-time high it reached in November 2021.

The post Ethereum Supply Shock Intensifies With 29% of ETH Locked in Staking appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|