2022-9-15 18:00 |

The Ethereum Merge went live this morning. With it, the Ethereum blockchain is moving from Proof-of-Work (PoS) to Proof-of-Stake (PoS) protocol. Thus, cryptocurrency miners have been forced to turn off their computers or possibly switch to the upcoming Ethereum PoW (ETHW) blockchain.

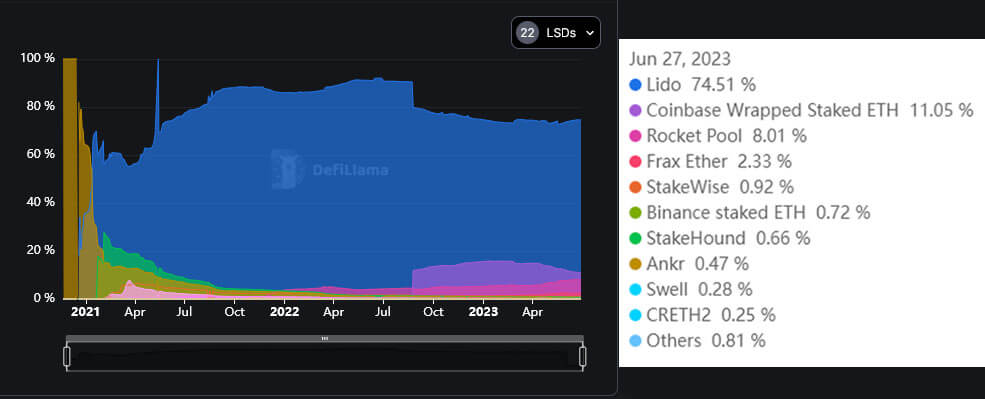

Today’s on-chain analysis looks at some basic parameters of the Ethereum blockchain a few hours after the Merge update. One of the most interesting indicators is the very high rate of ETH inflows to exchanges. In addition, we look at the distribution of staked ETH 2.0, which seems to be dominated by 4 entities: Lido, Coinbase, Kraken, and Binance.

Ethereum network hash rate is disappearingHash rate is the basic parameter of blockchains based on the Proof-of-Work protocol, determining the speed at which new blocks are mined. It is the average-estimated number of hashes per second produced by miners in the network. The more computers are connected to the network, the faster the calculations are done. In turn, this affects the difficulty of mining, which is the estimated number of hashes needed to mine a block.

With Ethereum’s transition to the Proof-of-Stake protocol, it was expected that Ethereum’s hash rate would drop and eventually reach zero. Indeed, this happened, and today at 7:00 UTC the hash rate reached 0/s. This means that currently no computer equipment is producing hashes and no miner is receiving rewards in the form of new ETH.

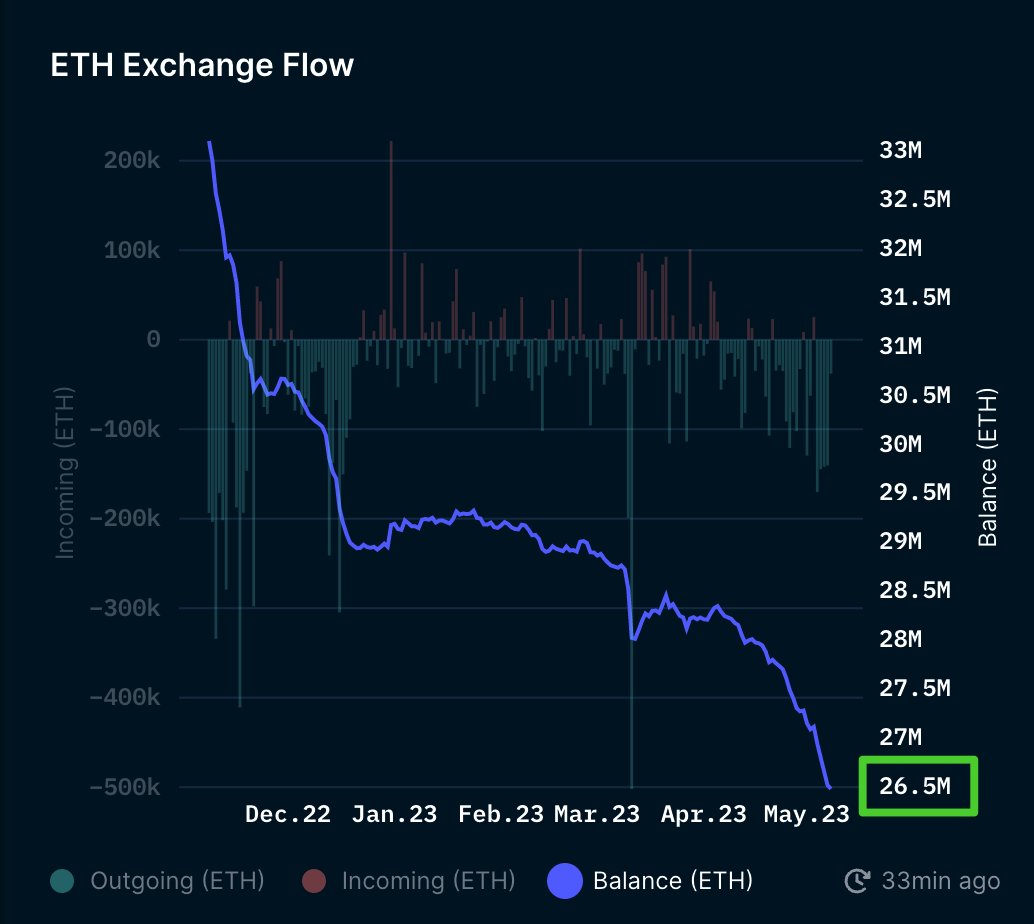

Ethereum hash rate chart by Glassnode ETH inflows to exchanges after MergeAs the Merge update went into effect, a record amount of ETH flowed onto exchanges. According to data from Glassnode, nearly 1.5 million ETH were transferred to exchanges in just 24 hours – 1,469,379 ETH to be exact. The last time such large ETH inflows were recorded was in February 2019, 3.5 years ago.

Chart by GlassnodeNaturally, this led to a surge in ETH balances on exchanges. It quickly returned to the March 2022 level and currently stands at 22,614,536 ETH.

Chart by GlassnodeThere have been various speculations on Twitter about the reasons for such a sharp increase in ETH on exchanges. Usually, increased inflows of an asset are a signal that investors intend to sell it. Therefore, many expected a rapid decline in the price of ETH.

However, the price has been oscillating steadily around $1,600 in recent hours. Therefore, others commented that the inflows are related to the desire to pick up Ethereum PoW (ETHW) fork tokens. Still, others joked that traders intend to use ETH as collateral to short Bitcoin.

Number of addresses with 32 ETH is growingRecent days have seen a significant increase in addresses that have at least 32 ETH. This seems to be an effort to accumulate enough Ether to become a standalone validator in the new PoS protocol. It is the number 32 ETH that is the threshold from which ETH 2.0 can be independently staked.

The peak of these increases was reached in November 2020, a few months after the announcement of the staking requirements for the new ETH. Back then, the indicator peaked at 127,255 addresses, which met the minimum requirement of 32 ETH. Today it stands at 121,732, so only 4.3% below the ATH. This shows not only the dynamic development of validators of the new Ethereum network but also the progressive accumulation, which in the long term may lead to an increase in the price of ETH.

Number of addresses with Balance above 32 ETH by GlassnodeMeanwhile, investors who do not own 32 ETH have been delegating their Ether to centralized and decentralized intermediary platforms since the end of 2020. Currently, 4 entities are leading the way, collectively holding as much as 59.3% of the total supply of staked ETH.

These are the decentralized platform Lido (4.17 million ETH) and 3 large centralized cryptocurrency exchanges: Coinbase (1.92 million ETH), Kraken (1.14 million ETH), and Binance (905 thousand ETH). The total amount of ETH staked, on the other hand, is 13.7 million.

Chart by GlassnodeFor Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here.

The post ETH On-Chain Analysis: Huge Ethereum Post-Merge Inflows on Exchanges appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|