2020-9-8 03:30 |

Independent developer and consultant Udi Wertheimer believes it’s only a matter of time before Defi projects move off of Ethereum and onto centralized platforms.

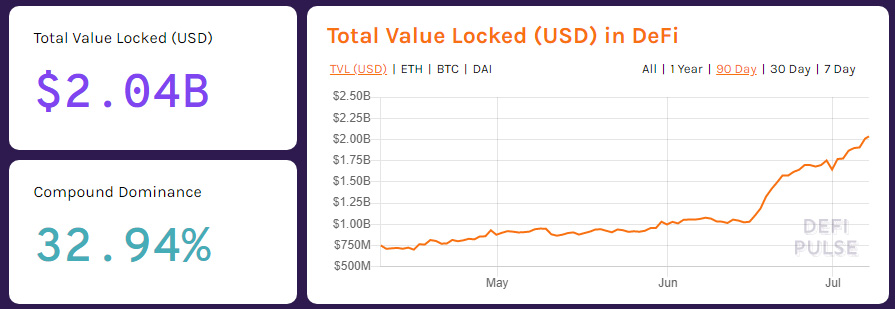

Wertheimer, who was featured as a guest on the Funky Crypto Podcast with retired MMA fighter Ben Askren and Litecoin Foundation Chief Evangelist John Kim, discussed the recent downturn in the crypto markets. He pointed to DeFi, describing the ethers locked in vaults that are extremely levered and how they explain why the bottom fell out in the ETH price in recent days.

There is no reason whatsoever you’d need Ethereum to “yield farm”

These projects are centralized anyway, using Ethereum is just overhead

Yield farming will move to fully centralized platforms

Few understand https://t.co/hD658Pu1gs

— Udi Wertheimer (@udiWertheimer) September 6, 2020

‘There’s Nothing Decentralized About DeFi’In addition to being a software developer, Wertheimer is also a self-proclaimed Ethereum basher. He bemoaned the platform for its slow transaction speeds, lofty fees and the complicated MetaMask, but he had nothing but good things to say about co-founders Vitalik Buterin and Joe Lubin. Wertheimer suggested that DeFi doesn’t need Ethereum, saying,

In my opinion, this whole DeFi thing, it stands for decentralized finance. And actually, there’s nothing really decentralized about it because there’s always someone who controls those projects. As we saw now with the SUSHI thing…They launched a token but they actual project hardly even exists. So obviously it’s not decentralized…All of these projects have someone who is in control.

Funky Crypto Podcast EP: 38 Livestream: @udiWertheimer Bitcoin, Ethereum, Defi, Master Troll, Adversarial Thinker, Developer/Engineer. #Bitcoin #crypto #defi #Ethereum https://t.co/PZkJbIESDx

— Bionic Ben (@Benaskren) September 7, 2020

He also used the example of yearn.finance (YFI), whose price skyrocketed from zero to more than $30,000 before losing one-third of its value since the peak. Wertheimer said the project is interesting but pointed out that it’s also controlled by someone — Andre Cronje. On the podcast, Wertheimer predicted that DeFi won’t be on the Ethereum network for long.

In my opinion, the way it’s going, if it survives, it’s going to get out of Ethereum and into centralized platforms simply because they’re cheaper and they’re faster. And you don’t lose anything because it’s already decentralized…Whatever decentralized even means is up for debate, but we know these projects aren’t that.

The Thrill Is GoneWertheimer is so turned off by the DeFi space that he is no longer thrilled about blockchain technology. He said that while there are financial and economic benefits to using bitcoin, he’s also a blockchain skeptic.

“I just don’t think that the blockchain technology applies to many things if at all. I don’t think it can make a very good use of most cases…Just as a recent example, this whole DeFi stuff…Why are they using a blockchain? It’s just slowing things down. It’s just making things expensive. So I think that most applications that use a blockchain will eventually migrate off of it.”

What the blockchain is good for, according to Wertheimer, is creating digital assets that aren’t controlled by anyone else — like bitcoin.

The post ‘DeFi Will Migrate to Centralized Platforms,’ Says Dev appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|