2020-6-10 19:28 |

The DeFi market cap has doubled within a span of two months according to analytics firms', DeFi Pulse, and DeFiMarketCap.

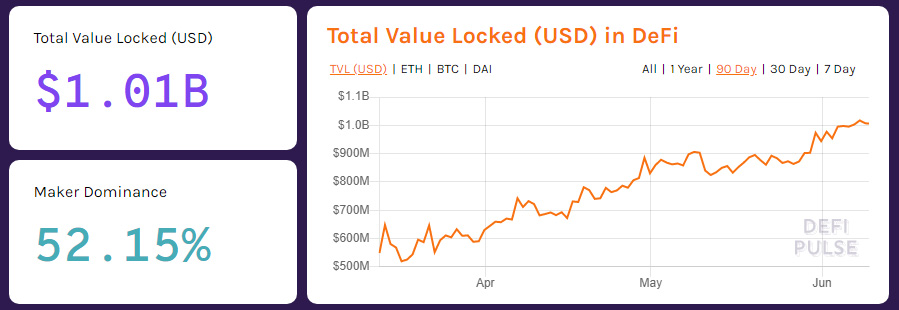

However, the two entities differ in the analytics that they provide. DeFi Pulse focuses on the exact total value locked (TVL) within this upcoming market. While DeFiMarketCap tracks the value of tokens within the DeFi space. According to the former, the value stands at $1 billion while the latter shows a $2.288 billion valuation as of press time.

The market had been thriving, hitting the $1 billion mark in February as per DeFi Pulse stats. These gains were wiped out a month later on Black Thursday as the crypto market dipped together with international global commodity prices. At the time, TVL went to a low of $559 million but has since recovered based on the prevailing stats.

Source: DeFi Pulse The DeFi Market Bounce BackDeFiMarketCap which was launched in April to compete with the likes of DeFi Pulse and CoinMarketcap shows that the TVL in Decentralized Finance crossed the $2 billion mark over the weekend.

The platform reveals that Maker protocol currently dominates the DeFi market with around $568 million; roughly a quarter of the total market capitalization. It is followed by Ox and Kyber Network Crystal which are both ERC-20 compliant.

On the other hand, DeFi Pulse shows a bounce back to the $1 billion mark on June 8; a level which was last surpassed at the beginning of March. While both platforms agree to a spike by almost double, the approach in TVL measures may have caused the difference in values. DeFi Pulse tracks the TVL of digital assets like ETH and DAI which are used in liquidity creation and staking. Its newly established counterpart, however, tracks the total value of all tokens attributed to certain protocols such as Maker.

Fundamental Value DriversThe DeFi market return to its attractive TVL can be pegged to a number of fundamental factors. One of the leading narratives is a general reversal of the downtrend experienced by global markets at the height of the COVID-19 pandemic.

The crypto market seems to have replicated performance, a development that has left some questioning the value of digital assets in violating ‘market norms'.

The recent addition of wBTC as collateral for minting DAI stablecoins within Maker's protocol has also spurred DeFi activity.

This Bitcoin-based digital asset was added as recently as May and is already the second most popular within MakerDAO's staking portfolio. Its value proposition lies in tapping Bitcoin's liquidity into an ETH dominated ecosystem. Given these developments, investor confidence in the DeFi markets has significantly grown despite global uncertainty in financial markets.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|