2021-4-6 04:00 |

The initial growth of the DeFi industry helped to lay the foundation of the current bull market. Innovation in the decentralized finance sector helped fuel Ethereum’s growth, and once Bitcoin got going, the rising tide lifted all other boats.

Doing away with any fears of the tide rolling back out just as quickly as it rolled in, the total value locked in DeFi applications has achieved a staggering milestone of $50 billion and climbing. Here’s a look back at the year since the sector began to shine, how it has helped Ethereum soar to new highs, and what’s next for decentralized finance.

Total Value Locked In DeFi Achieves Milestone $50 Billion As Ethereum Hits New HighsDuring the 2017 bull run, the promise of ICOs and altcoins with the potential to beat Bitcoin helped to drive the uptrend to unimaginable heights. But it all came crashing down once the bubble popped because there was little value or actual activity and adoption taking place.

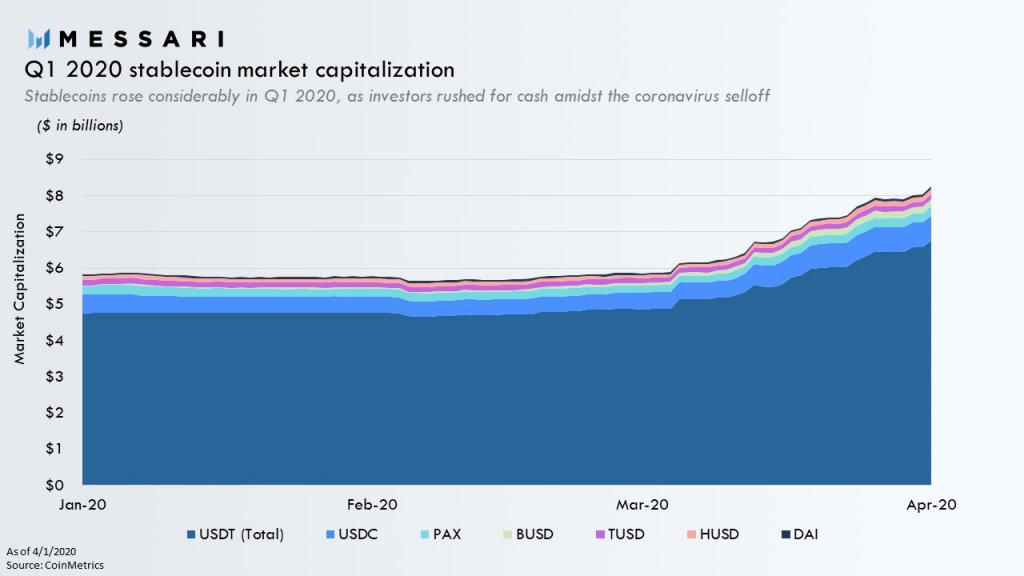

At the start of 2020, the DeFi began to blossom, reaching milestone after milestone in terms of total value locked. With so many projects built on Ethereum, demand for the native cryptocurrency token began to rise and so did the price per ETH.

Related Reading | How One Ethereum Could Soon Be Worth Half A Bitcoin

In no time at all, Ethereum was back trading near highs, but once 2021 rolled around, the cryptocurrency set a new high on the back of not just DeFi, but also NFTs.

NFTs have since taken a dive in interest, sentiment, and sales volumes, while DeFi is back setting yet another massive milestone: A grand total of more than $50 billion in value locked.

Total Value Locked reaches more than $50 billion in collateral | Source: DeFiPulse Defying All Odds: More Capital Locked Than Entire Altcoin Market Cap Last YearAt $50 billion locked, the sum is more than what the total Ethereum market cap was from July 2018 to July 2020. It is also more than the entire crypto market cap sans Bitcoin was worth at the very bottom of the Black Thursday market collapse just over a year ago – to put things into perspective.

DeFi dominance could continue to climb after taking out resistance on the index | Source: DEFIPERP on TradingView.comFrom a technical standpoint, DeFi isn’t anywhere near done according to the DEFIPERP Index from FTX. The index is a “weighed average” of the prices of 25 different tokens, ranging from Compound to Uniswap and almost two dozen more.

Related Reading | The Top Decentralized Finance Projects To Follow In 2021

Fundamentally, the total value locked should continue to climb as the sector itself grows and more capital is parked as collateral for the various borrowing or lending services and products decentralized finance has to offer.

Featured image from Deposit Photos, Charts from TradingView.comSimilar to Notcoin - TapSwap on Solana Airdrops In 2024

Growth DeFi (GRO) на Currencies.ru

|

|