2025-10-11 11:05 |

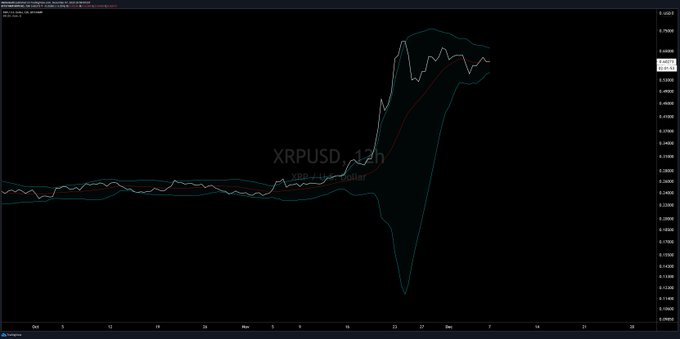

XRP first reached $1.00 in late 2017, during the height of the 2017–2018 crypto bull run. According to historical price charts, XRP closed above $1 in November 2017 and even peaked around $1.10–$1.20 that month.

The climb from sub-$0.01 levels in early 2017 to above $1 happened over several months as crypto markets exploded in value that year.

XRP’s partial comeback has refocused investors on DeFi coins poised for the next breakout. Traders and retail investors are monitoring crypto prices today, while the crypto fear and greed index signals cautious optimism.

Amid market shifts, Mutuum Finance (MUTM) is emerging as a project with strong growth potential. Its dual lending and borrowing model creates real utility, and its transparent CertiK audit provides credibility. MUTM’s ecosystem will reward early adopters while offering measurable returns.

Mutuum Finance (MUTM): Dual-market lending model and testnet milestonesMutuum Finance (MUTM) presale has raised around $17.05M overall in the presale. The current price per token is $0.035, with 60% of 170M tokens already sold.

Over 16,850 holders have participated so far. Phase 7 will increase the price to $0.04, a 15% jump. MUTM has a total supply of 4B tokens.

CertiK will validate its security through a Manual Review and Static Analysis, with a Token Scan Score of 90.00 and a Skynet Score of 79.00.

The project’s social reach includes more than 12K Twitter followers. These factors will give investors confidence in the presale and long-term growth prospects.

Mutuum Finance (MUTM) will operate two complementary markets. Peer-to-Contract (P2C) will allow users to deposit major tokens such as ETH and USDT into liquidity pools. Depositors will receive mtTokens, representing their share of the pool and future accrued interest.

Peer-to-Peer (P2P) will handle higher-risk tokens, providing additional yield opportunities for willing participants. Borrowers will post collateral and receive loans based on protocol-defined limits. This system will generate real on-chain activity, making lending and borrowing meaningful rather than speculative.

The V1 Sepolia Testnet, scheduled for Q4 2025, will test the protocol’s foundational components. Liquidity Pools, mtTokens, Debt Tokens, and the Liquidator Bot will operate in a controlled environment.

Early participants will interact with ETH and USDT markets, experiencing the full mechanics of borrowing, lending, and liquidation before the mainnet launch.

Layer-2 integration will reduce transaction costs and increase throughput, making MUTM more scalable and affordable than traditional Layer-1 DeFi platforms.

Buy-and-distribute mechanism and growth catalystsMutuum Finance (MUTM)’s revenue model will convert platform activity into recurring token demand. Interest collected from borrowers and fees generated from liquidations will fund periodic MUTM repurchases. mtToken stakers will receive rewards from these buybacks.

This creates a continuous link between real usage and token value, incentivizing long-term participation.

The platform has already featured a live dashboard for investors to monitor their holdings and projected returns.

A leaderboard will highlight the top 50 holders, offering bonus MUTM as recognition for high engagement through investment. This gamified approach will maintain community interest and encourage consistent participation.

The project’s roadmap will continue driving momentum. The beta launch will allow users to experience live borrowing and lending features before exchange listings.

Stablecoin integration will anchor long-term utility. Future targeted exchange listings on platforms like Binance and MEXC will expand visibility and liquidity. Each milestone will create new demand catalysts, supporting MUTM’s price trajectory.

Investors who join Phase 6 at $0.035 will get the Phase 7 price of $0.04 right away, which is a 15% increase.

People who join Phase 1 early and pay $0.01 will see their holdings grow to $0.035, which is a 250% increase in value. Early entrance will give you lower prices, staking rewards, and the opportunity to use the platform more.

There are only a few days left to buy tokens before the price goes up by 15%, and 60% of Phase 6 has already been sold.

Mutuum Finance (MUTM) will use dual lending markets, Layer-2 efficiency, buy-and-distribute rewards, and the approaching beta launch to ride the wave of XRP’s success and become the next big DeFi project.

Getting involved early will give you the best edge before more exchanges list the coin and it becomes widely used.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

The post DeFi market expands fast, an altcoin could be next to hit $1 after XRP appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Ripple (XRP) на Currencies.ru

|

|