2023-7-22 01:30 |

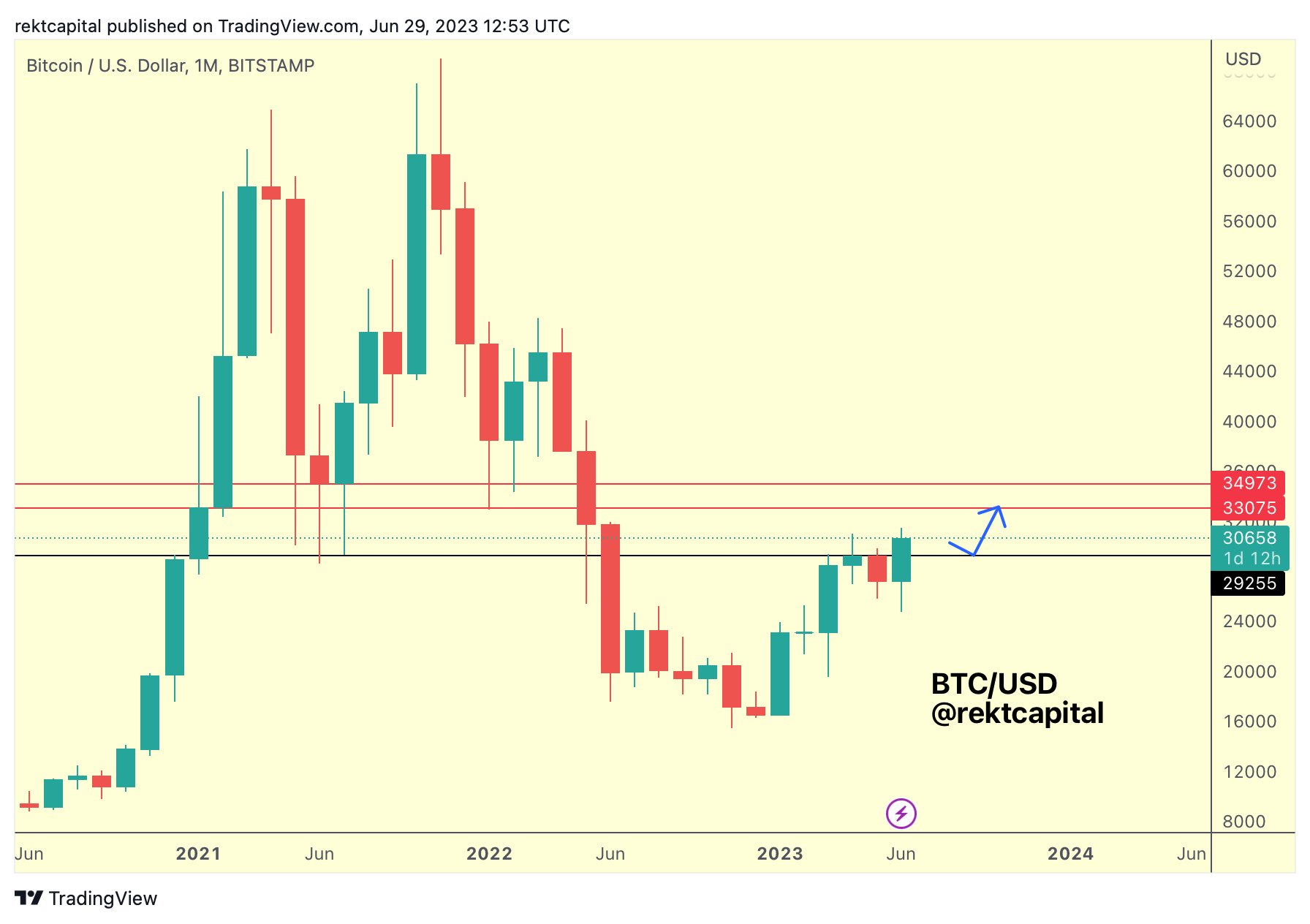

The distribution of Bitcoin (BTC) across various addresses has been relatively stable, with minimal fluctuations observed. This stability, however, does not imply a lack of activity within the market.

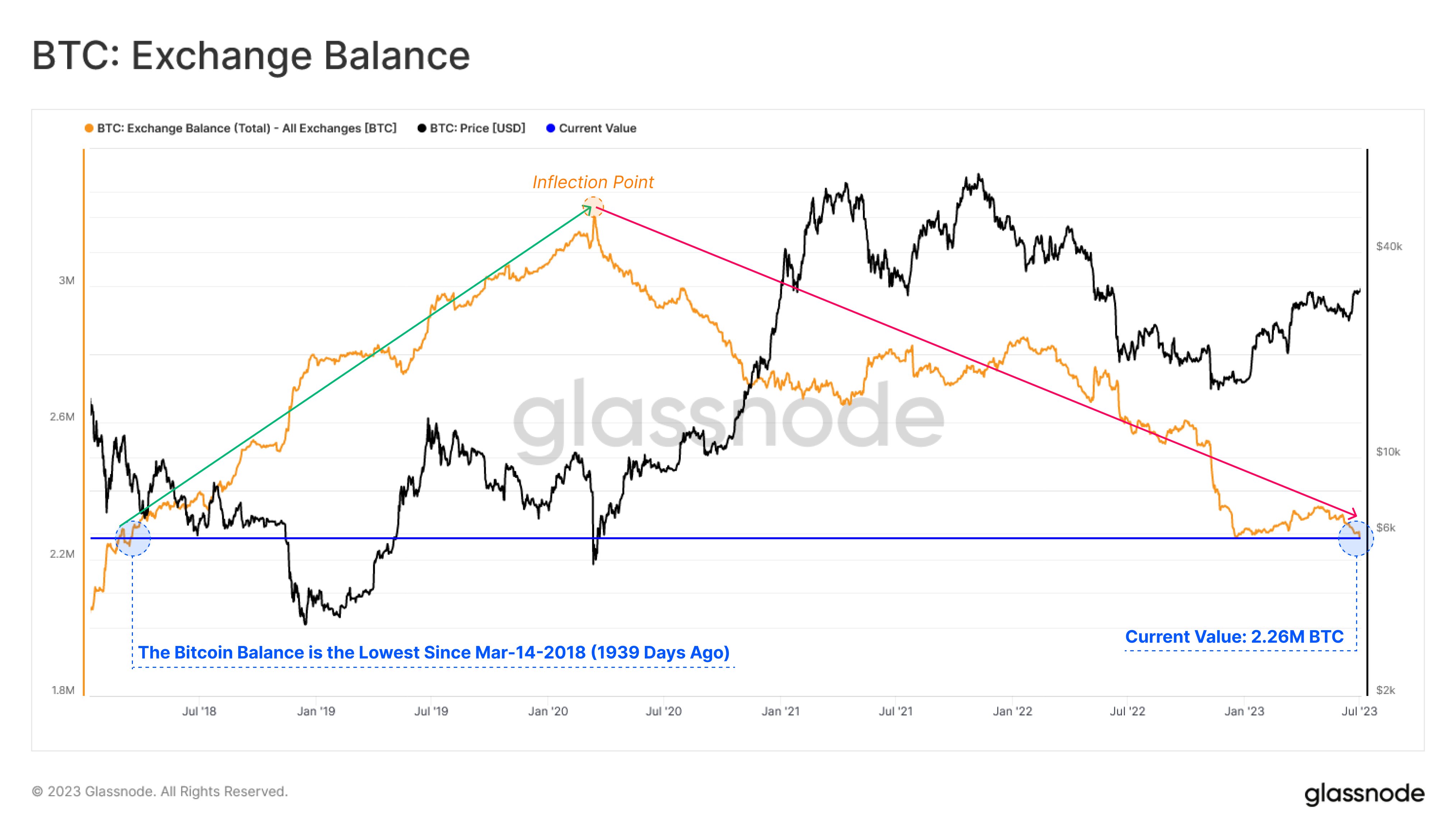

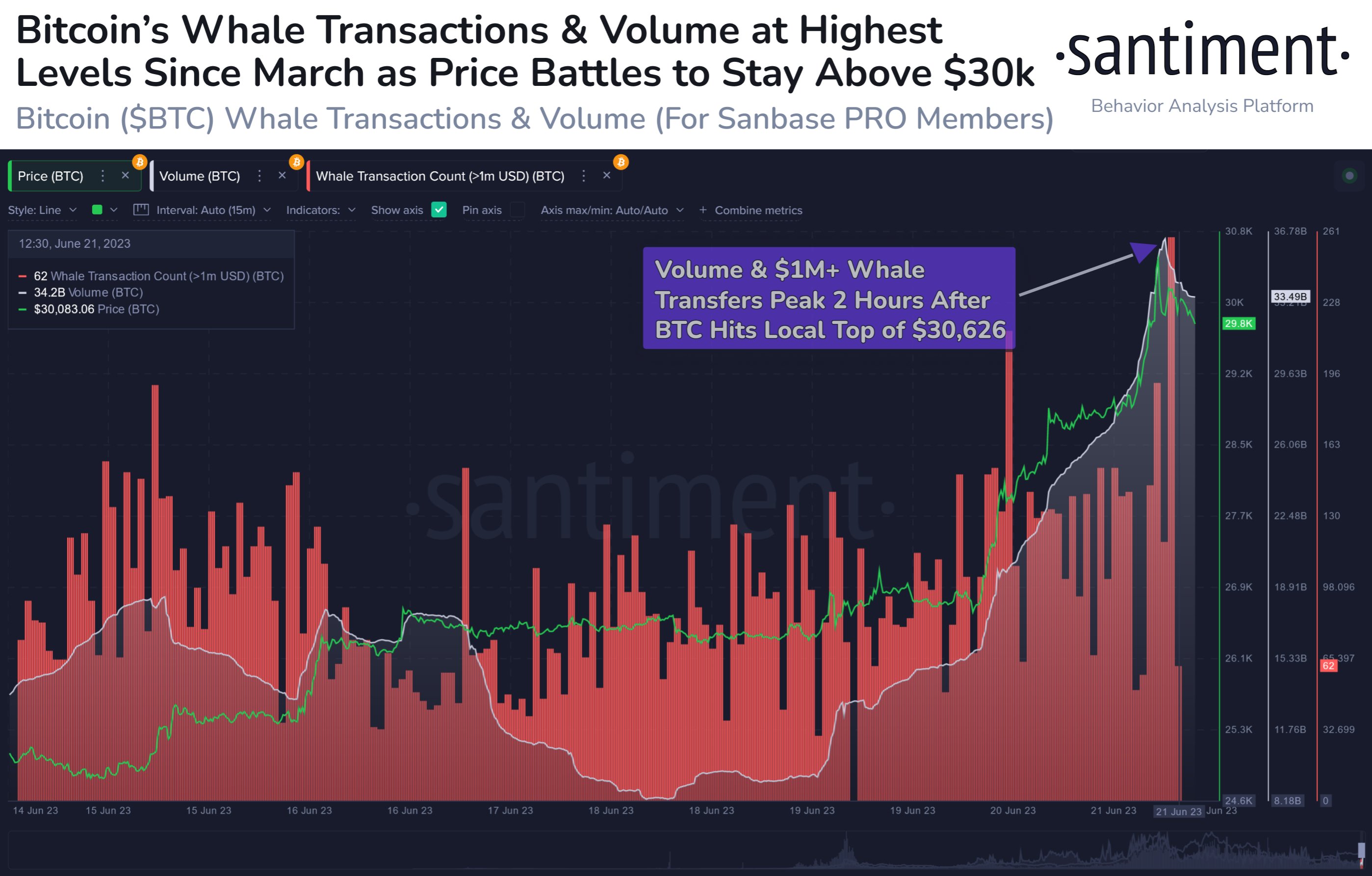

In the past week alone, the largest Bitcoin holders, those with holdings between 10 to 10,000 BTC, have reduced their exposure by a significant $94 million USD. This reduction in holdings by the market’s major players is a noteworthy development, indicative of shifting dynamics within the Bitcoin ecosystem.

This substantial decrease could indicate a variety of strategic moves, such as profit-taking, portfolio diversification, or an attempt to reduce market influence and volatility. Simultaneously, it could also point towards a broader trend of increasing decentralization in the Bitcoin ecosystem, as smaller investors continue to increase their holdings.

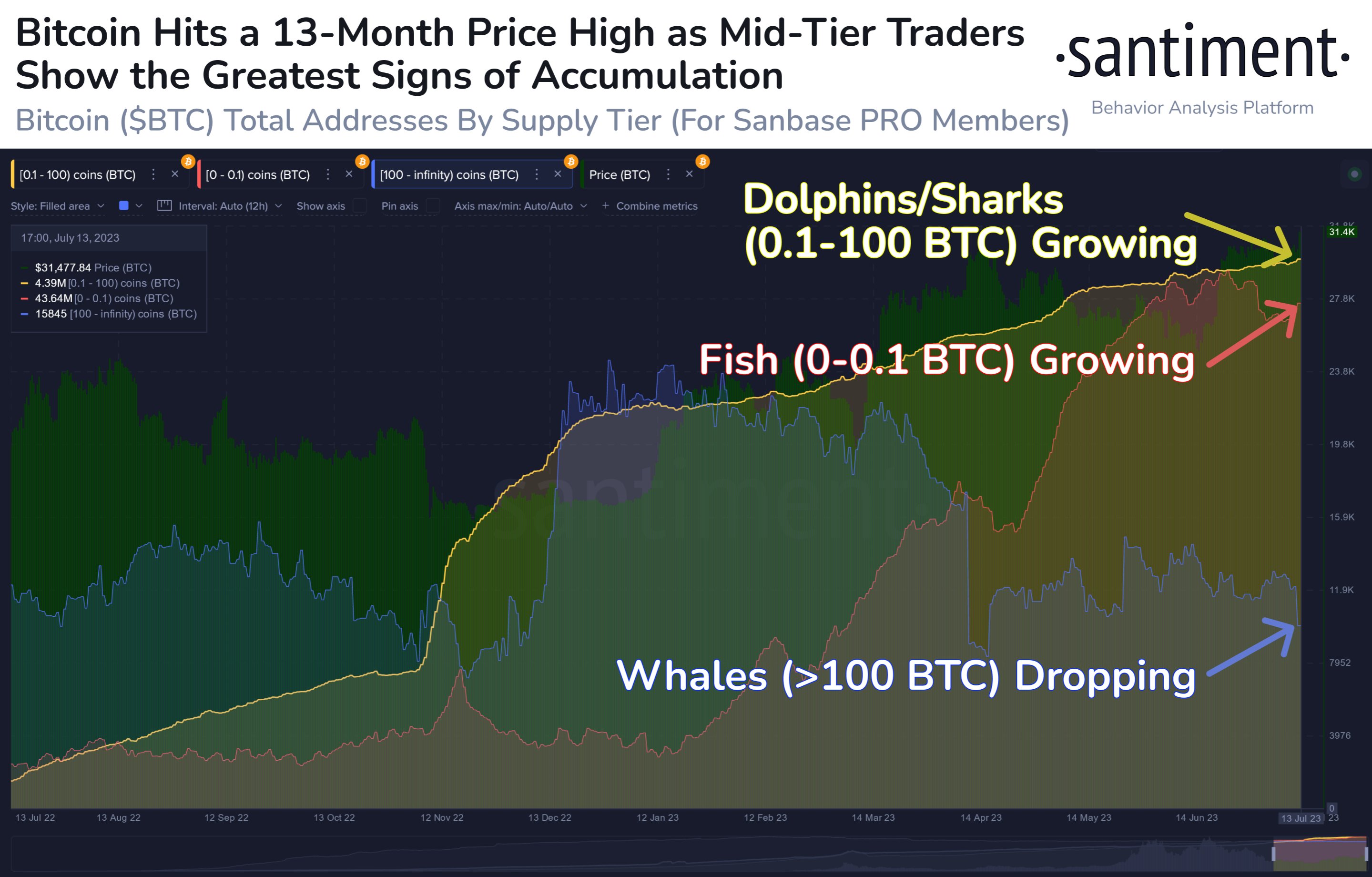

When we delve deeper into the liquidity changes amongst cohorts, categorized by wallet size in terms of BTC, an interesting pattern emerges. Over the course of the past year, smaller addresses have systematically increased their Bitcoin holdings. This trend signifies a monumental acquisition of BTC by smaller investors, a testament to the growing democratization of the cryptocurrency market.

In contrast, larger addresses have made substantial contributions over the last month and the preceding 180 days. Historically, holders with 10 to 10,000 BTC have had the most significant influence on Bitcoin’s price, making their recent activity particularly impactful.

However, it’s important to note that these statistics are nominal estimates. They represent a destination rather than a singular identity for addresses, making the transcription of fund flows a non-trivial task. A single entity can control an arbitrary number of addresses, and a single Bitcoin can be distributed across multiple addresses. Furthermore, the movement of funds can serve a variety of purposes, adding another layer of complexity to the analysis.

The interpretation of these statistics is not a question of one being superior to the other, but rather that they offer different types of insights. Understanding this distinction is crucial when interpreting the data provided.

In light of these findings, the future of Bitcoin appears to be one of increasing decentralization. The rise in holdings by smaller addresses suggests a broadening base of Bitcoin investors, while the decrease in holdings by larger addresses could indicate a redistribution of power within the market. As the landscape continues to evolve, these trends could have profound implications for the stability and growth of Bitcoin as a leading cryptocurrency.

The post Decoding Bitcoin’s Dynamics: What the Recent $94 Million Reduction Tells Us appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|