2023-2-1 03:00 |

Litecoin (LTC) has seen one of the highest rallies among the top 20 largest cryptocurrencies, jumping over 89% since the market crash following the FTX collapse. While there are a number of factors that could’ve prompted this news, on-chain data suggests that sharks are the likely culprit.

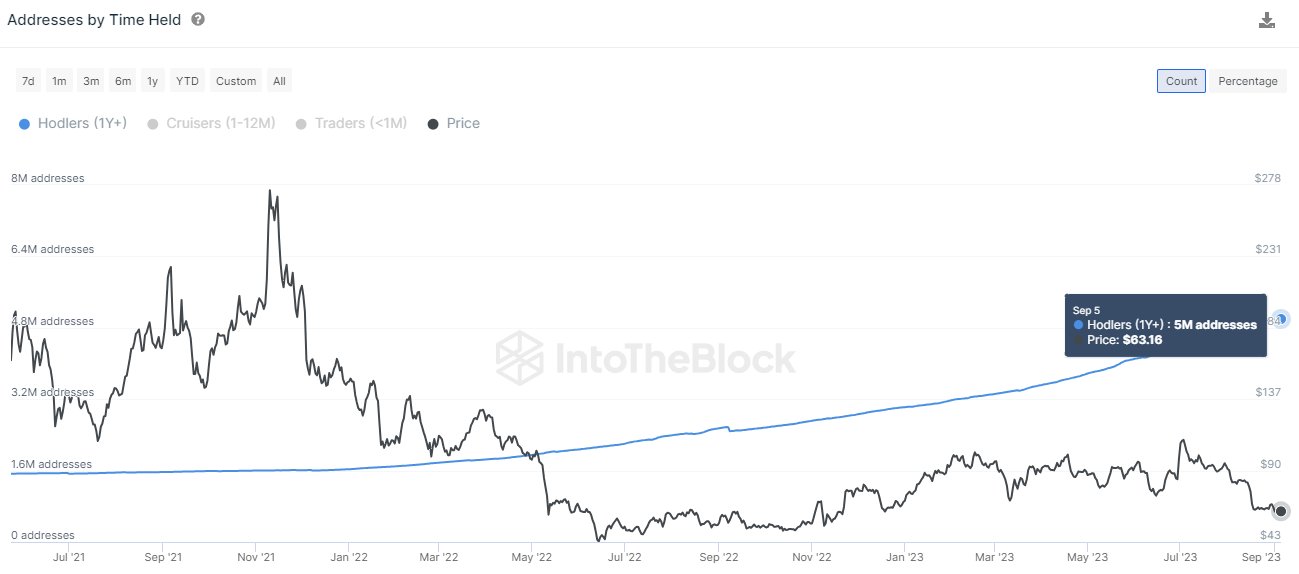

Sharks Holding 100-10,000 Coins Went On A Feeding FrenzyAccording to a Sentiment report, the sharks may be the ones behind the upward rally that Litecoin has embarked on in the last two months. It shows that these shark addresses holding between 100-10,000 LTC on their accounts went on a massive accumulation trend that saw them add a reasonable portion of supply to their holdings.

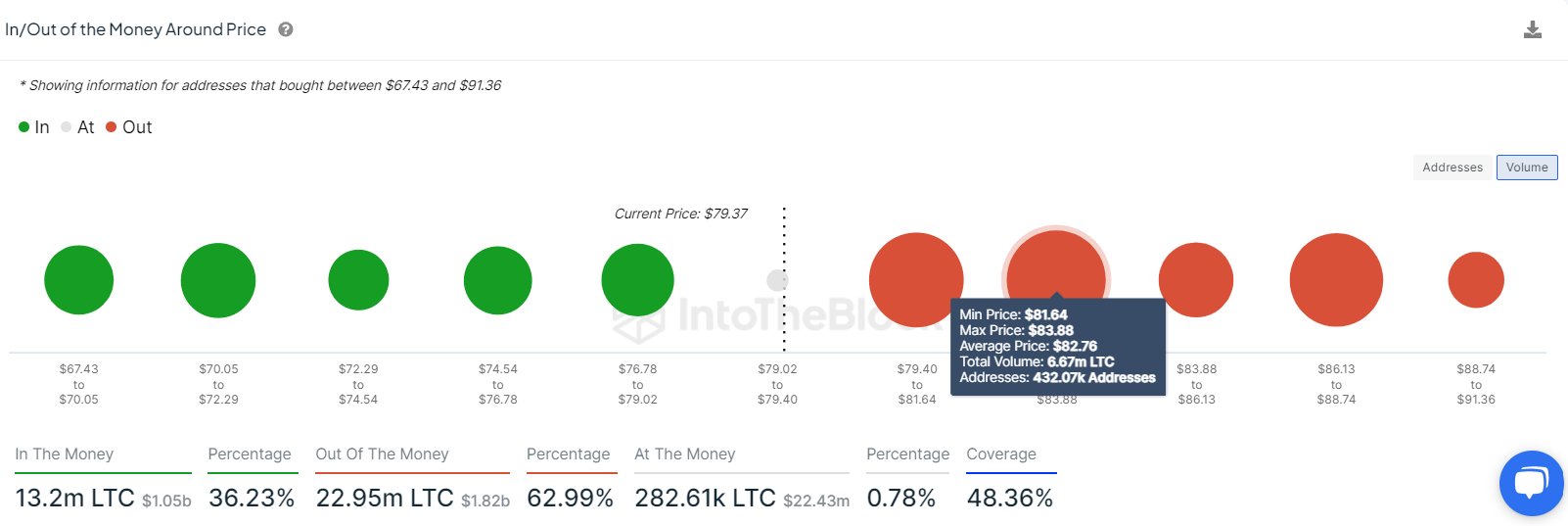

Santiment reveals that in the two-month period, these addresses accumulated 1.15 million LTC. This works out to around a 4.92% increase in their holdings and 0.5% of the total LTC supply. As the image below shows, there was a significant uptick around this point coinciding with the increase in the price of the digital asset.

The accumulation trend continued into January 2023 when LTC’s price movement had ramped up. Thus, this shows that while accumulation by sharks may not have been the main driver of the price rally, they may have played a significant role.

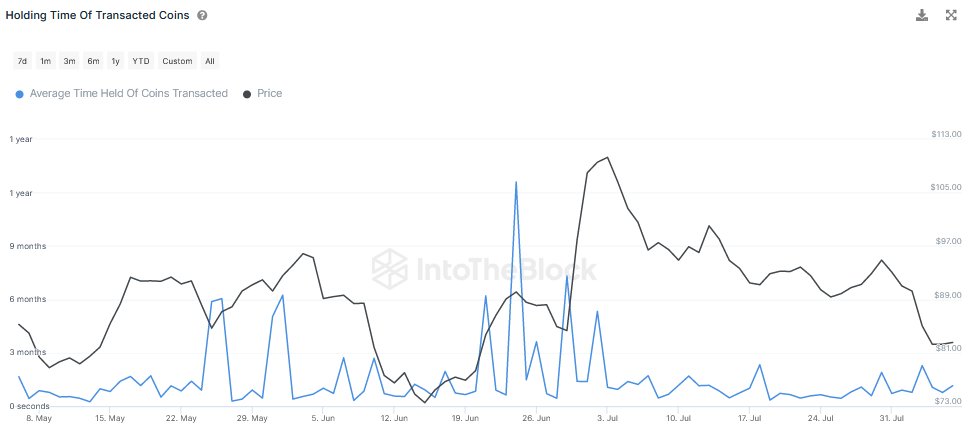

Further movements point toward these shark addresses having an effect on the price. Like the chart shows, there has been some profit-taking after LTC hit its local peak of $97 and this profit-taking coincided with the price of the cryptocurrency falling back down to the $94 level.

Will Litecoin Continue To Rally From Here?Despite the sharks taking profit on their Litecoin buys over the last two months, the bull case for LTC is still not destroyed. The chart shows that even these large investors are still holding on to a good portion of the coins accumulated over the last two months. As long as there is still a large gap between what was accumulated and what is being sold, the price of LTC can be expected to hold up.

It is also important to note that 2023 is an important year for Litecoin. A lot of the bullish sentiment around it has originated from the expectations surrounding the Litecoin halving. Litecoin, which works similarly to bitcoin, is about to reduce its block reward once more, reducing the number of coins going into circulation, and triggering FOMO (fear of missing out).

The halving is expected to take place in early August which puts it about six months away. But already, positive sentiment is already ramping up, contributing to the price increase that the coin has recorded.

Perhaps the most important thing is the fact that LTC is currently trading at almost 50% above its 100-day and 200-day moving averages. This suggests that despite the market drawdown, the LTC price is likely to hold at the $90 support.

origin »Bitcoin price in Telegram @btc_price_every_hour

Streamr DATAcoin (DATA) на Currencies.ru

|

|