2023-8-29 18:00 |

The on-chain analytics firm CryptoQuant has discussed how the Bitcoin market has changed during the past year.

Bitcoin Has Been Going Through Some Changes RecentlyIn a new post on X, CryptoQuant has broken down the changes that the cryptocurrency’s landscape has observed recently. The first would be that the US-based exchanges have been registering withdrawals, while the global platforms have seen growing holdings.

The relevant on-chain indicator here is the “exchange reserve,” which keeps track of the total amount of Bitcoin stored inside the wallets of a centralized exchange or a group of exchanges.

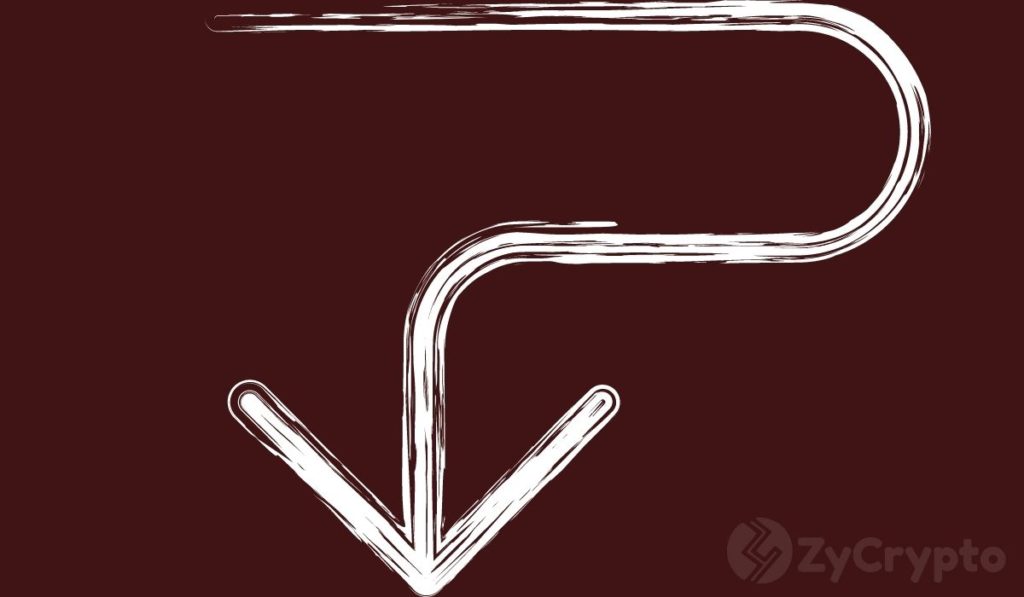

First, here is a chart that shows the trend in this metric for the foreign platforms:

The above graph shows that the Bitcoin exchange reserves for Binance, Bitfinex, and OKX have increased during the past year. In total, the indicator’s value for these non-US platforms has increased by 10% in this period.

This increase would naturally suggest that these exchanges have seen net deposits in the last year. However, the exchange reserve for the US-based platforms paints a different picture.

While the foreign exchanges have seen deposits, the platforms based in the US, such as Coinbase, Gemini, and Kraken, have observed declining reserves during the past year.

In general, the reserves of these platforms have dropped by at least 30%, which is a very significant value. The opposite trends being followed by the two groups of exchanges could imply a migration of coins between them, with investors increasingly preferring the non-US platforms.

The second change in the BTC market is that institutional investors have started displaying an accumulation behavior. “Considering the amount withdrawn and the deposit and withdrawal records of the wallets, institutions are continuously buying Bitcoin,” explains the analytics firm.

CryptoQuant notes that in August alone, Gemini has seen a huge withdrawal of more than 20,000 BTC, which can be a sign that institutional investors are buying.

Finally, there is a change in how market participants have been looking at the futures sector recently, as they have increased their exposure to derivative products.

The ratio of the trading volume of the asset between spot and derivative platforms has dropped to pretty low values recently, a sign that activity on the derivative exchanges is overwhelmingly more than on the spot ones.

The open interest, a measure of the number of positions open on the derivative market, also showcases this change, as the metric’s value hit very high just recently.

The chart shows that while the open interest was at highs just a while ago, it has since observed a plummet. The reason behind this plunge was the latest Bitcoin crash, which resulted in a cascade of liquidations in the market.

BTC PriceBitcoin is trading around the $25,900 level, unchanged from one week ago, showing how stagnant the cryptocurrency has been recently.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|