2023-6-15 13:45 |

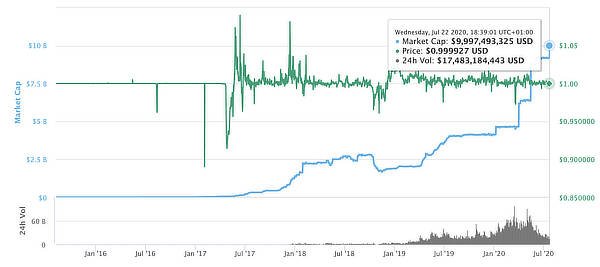

Tether’s USDT deviated from its dollar peg in the early hours of June 15, falling to $0.9979 at the time of writing, according to CryptoSlate’s data.

Some traders took advantage of this opportunity, profiting by shorting USDT and setting up arbitrage trades.

The price deviation was attributed to unusual DeFi liquidity pool activity, particularly on Uniswap and Curve – with aggressive USDT selling causing pools to become imbalanced.

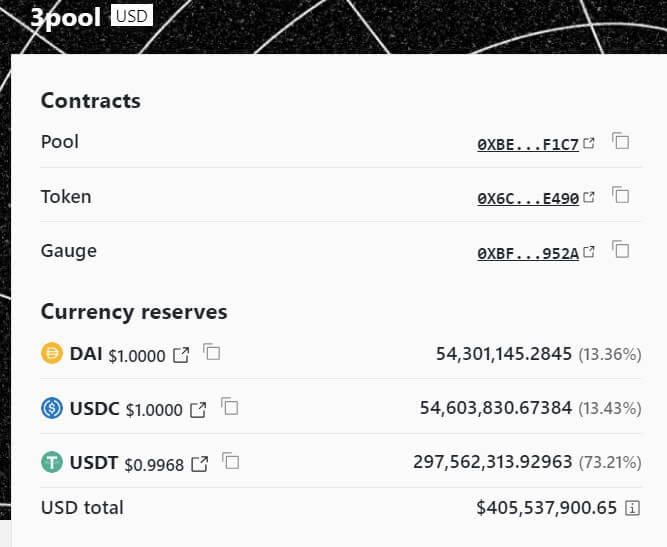

DeFi pool imbalanceAnalysis of Curve’s 3pool, the largest liquidity pool on the DeFi protocol, showed a heavy USDT imbalance, accounting for 73.2% of the reserve, while USDC and DAI made up the 26.79% balance as of press time.

Source: Curve 3PoolBlockchain analytical firm Delphi Digital stated that Curve 3pool’s USDT concentration is the highest it has been since November 2022.

Tether to honor redemptionsDespite these concerns, Tether’s CTO Paolo Ardoino assured users that the issuer was “ready as always” to honor redemptions. He said:

“Markets are edgy in these days, so it’s easy for attackers to capitalize on this general sentiment. But at Tether, we’re ready as always. Let them come.”

While its major rivals have struggled, Tether’s market cap had increased in 2023, adding more than $16 billion to reach a new all-time high.

The stablecoin issuer also recently expanded its business into Bitcoin mining and revealed intentions to invest its profits in BTC.

However, the current uncertainty surrounding USDT has led to a net outflow of over $200 million from its market cap during the early trading hours, according to CryptoSlate’s data.

Crypto traders look to profitGiven the uncertainty, traders are taking opportunistic bets against USDT. Blockchain data analytics platform Spot on Chain reported that CZSamSun took a short position by borrowing 31.5M USDT from AaveV2 and swapped for 31.8M USDC at $0.9978.

On-chain analyst Lookonchain corroborated this, adding that CZSamSun also made other transactions that involved borrowing USDT and depositing USDC.

Similarly, another trader borrowed 50 million USDC from Aave after USDT depegged and started buying USDT.

0xScope pointed out that another whale trader had deposited USDC into Aave V2 and V3 to borrow USDT. He explained that the profit came via arbitrating the different interest rates between the Aave V2 and V3 protocols.

The post Crypto traders scramble for arbitrage as Tether’s USDT strays from dollar peg appeared first on CryptoSlate.

origin »Tether (USDT) на Currencies.ru

|

|