2023-5-11 22:26 |

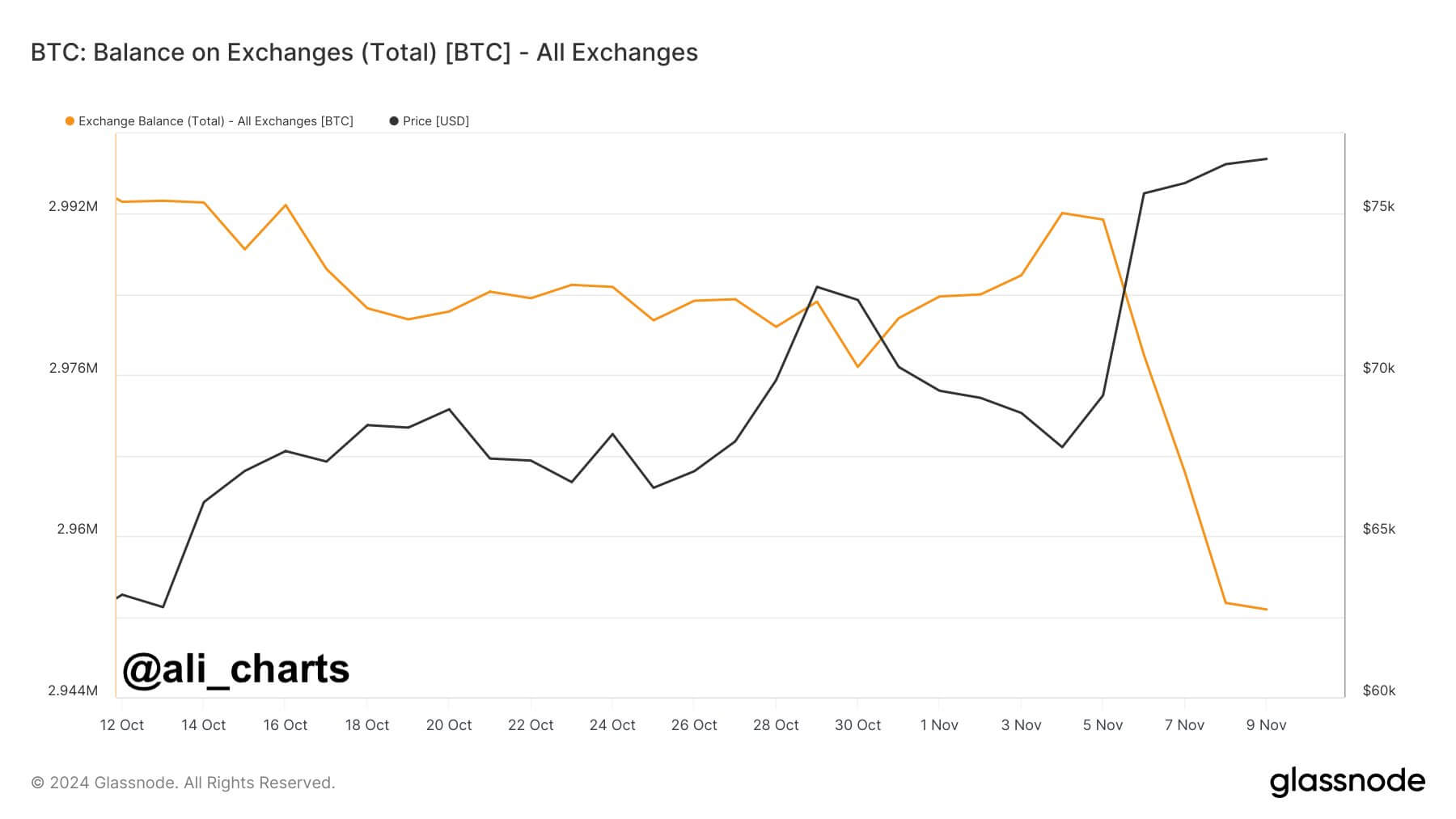

Crypto exchanges saw a significant decline in their overall trading volume in April, with Binance trading volume dropping by almost 50%.

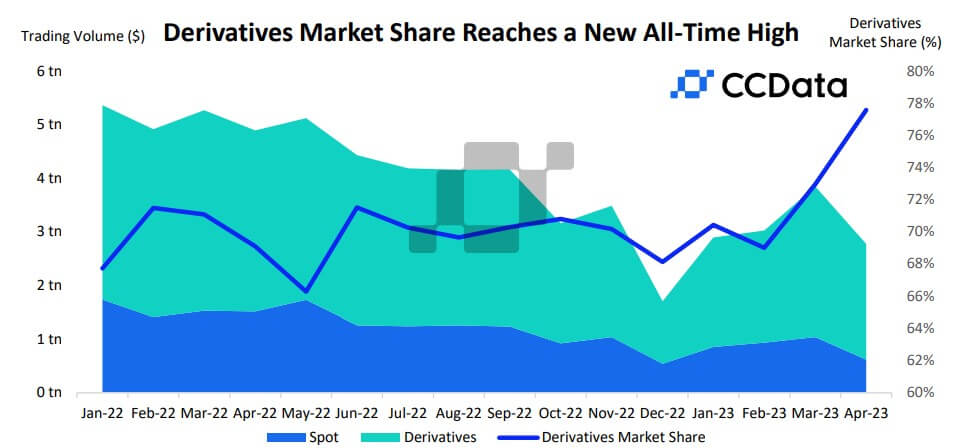

According to CCData, the trading volume for spots and derivatives on centralized exchanges fell by 27.9% to $2.77 trillion in April — the lowest since December 2022.

A breakdown of these trading activities showed that spot trading volume declined 40.2% to $621 billion — the second-lowest since July 2020 and the lowest since December 2022.

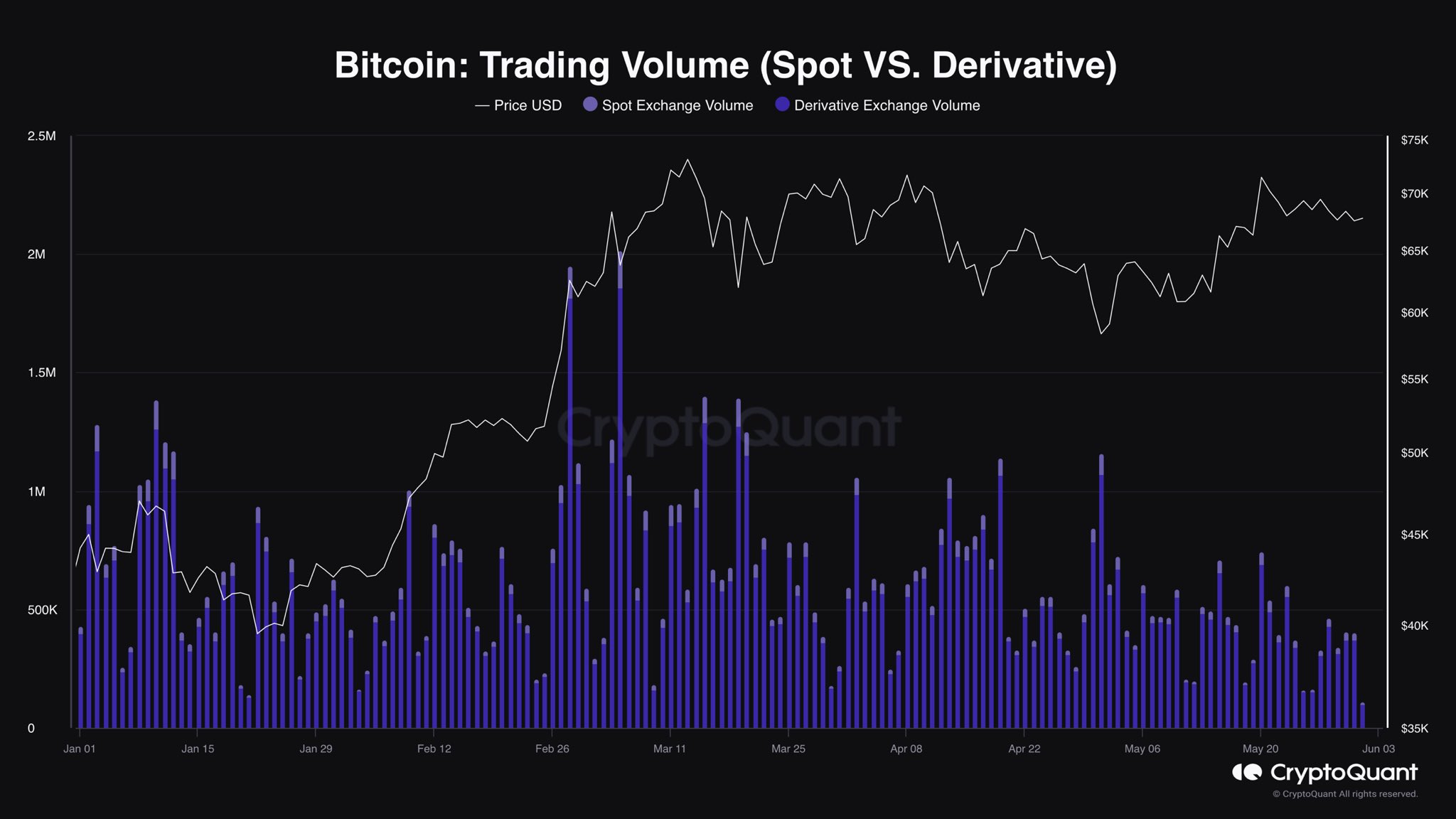

Market becoming more speculativeIn a sign of how speculative the crypto market has become, 77.6% of all trading activities on the crypto market were based on derivatives trading. CCData noted that this was an all-time high.

“This is an all-time high for the market share of derivatives, highlighting the increase in usage of leverage as traders speculate on the current uncertain macroeconomic conditions over the potential pause on rate hikes.”

Despite its increasing market share, the derivative market volume declined by 23.3% to $2.15 trillion in April.

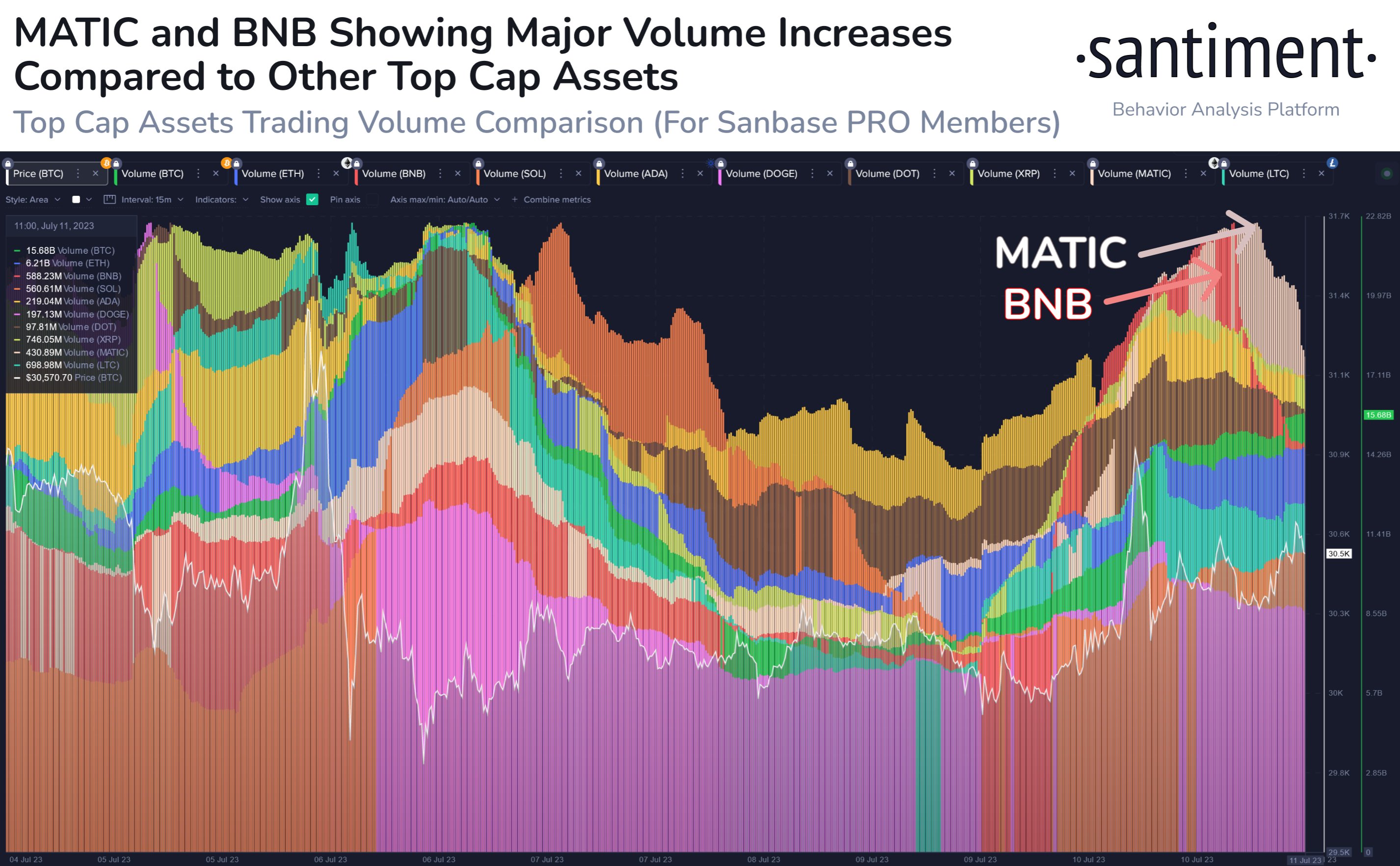

Source: CCDataThe top three platforms for derivative trading activities were Binance, OKX, and ByBit, which cumulatively control 91% of the market.

Binance trading volume declinesOn an exchange-by-exchange basis, spot trading activities on Binance dropped by 48% to pre-FTX collapse levels of $287 billion — its second-lowest month since 2021.

As its spot volume declined, its overall market share fell for the second consecutive month to 46.3%. This is also its lowest market share since October 2022.

Source: CCDataDespite its falling numbers, Binance remains the undisputed leader in the space. Its closest rivals — Coinbase and OKX — both control around 10% of the market.

Meanwhile, Binance introduction of zero-fee trading for its Bitcoin/TrueUSD trading pair has made TUSD the third-largest stablecoin by trading volume on centralized exchanges, surpassing USDC for the first time since June 2020.

CCData reported that the move saw the trading volume for the pair increase by 851% in April, while that of USDT/BTC declined by 65.9%.

The post Crypto exchanges spot trading volume declines in April; Binance takes major hit appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Volume Network (VOL) на Currencies.ru

|

|