2022-7-12 02:14 |

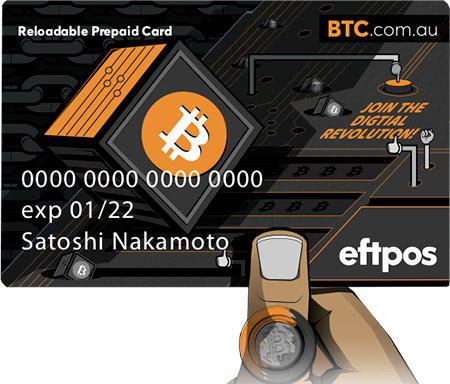

Crypto credit card holders are on the move. This is according to a new report which claims that traditional credit cards are being ditched in favor of crypto rewards credit cards. Examples are Crypto.com’s Visa and BlockFi’s Visa.

Other findings thrown out there are that 46% of crypto credit card holders aim to use their crypto credit cards for every purchase. And, 80% think Bitcoin will totally replace traditional credit cards.

Crypto Credit Card Rewards – in BitcoinThe researchers behind the survey say, “It’s hard to imagine consumers preferring a different currency from the traditional U.S. dollar. But apparently, many of them do! We found that Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC) are the most preferred cryptocurrency reward coins among our study’s respondents. This is understandable since these are some of the most valuable.”

Pic source. Other RewardsAs the digital currency space expands, respondents to the survey say they are content to accept varying types of crypto rewards for using their crypto credit cards. This includes non-fungible tokens (NFTs). Says CouponFollow, the company that conducted the research, “We found that 95% of our study’s crypto credit card holders are interested in receiving NFTs as a crypto credit card reward. Most top crypto rewards credit cards provide digital cash back when you dine out, get groceries, or buy those concert tickets you’ve been eyeing. Among the Americans we surveyed, the most popular crypto rewards credit card is the BlockFi Rewards Visa, which 40% of them currently use. That’s understandable since it offers over ten types of cryptocurrency rewards – a perk for all you anti-Bitcoiners! Crypto.com’s Visa came in at a close second, with some cards enabling users to earn up to 5% back in crypto rewards.”

Pic source. Popular IdeaMaking a switch to a crypto rewards card is quite a popular idea. “According to our survey, 46% of crypto credit card holders plan to make every purchase with their crypto credit card. It’s a good thing, then, that many of them plan to spend their cryptocurrency rewards wisely: 60% of respondents intend to reinvest their crypto rewards balance back into cryptocurrency.”

There are drawbacks. Credit card fees could be higher than usual cards, and you could be faced with higher interest payments, so be sure to do your research.

Got something to say about crypto credit cards or anything else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

The post Crypto Credit Cards Rise as Traditional Credit Cards Get Ditched appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

BlockMason Credit Protocol (BCPT) на Currencies.ru

|

|