2021-4-9 16:35 |

Emerging DeFi project, CrossFi, has this week announced details of the protocol’s cross-chain liquidity sharing solution. Developed as a way to grant liquidity to locked digital assets, the CrossFi protocol utilizes industry-leading interoperability technology to connect different assets across public chains and drive further development in the DeFi space. With the project’s one-stop filecoin ($CRFI) lending platform scheduled to be online mid-April coinciding with the launch of native ecosystem token, CROSS, CrossFi is pushing to be the filecoin decentralized finance platform of choice for users.

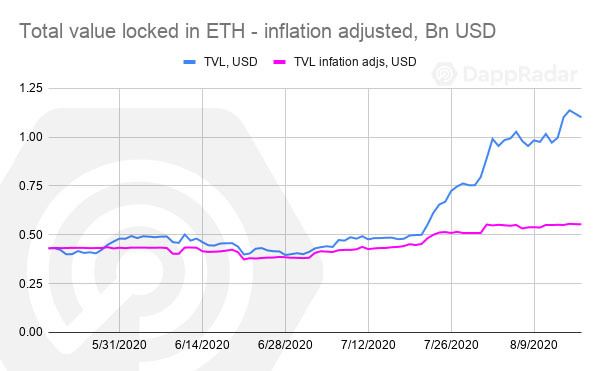

Throughout 2020, DeFi experienced rapid growth in user adoption as technical innovations in critical infrastructure, smart contracts, and clever token economics incentivized pooled lending and borrowing, giving rise to the very lucrative practice of yield farming and ‘wrapping’ to create synthetic assets. The end of the year saw two major developments take place: the Ethereum 2.0 pre-launch ‘lock-up’ and the main net launch of highly-anticipated Filecoin. For ETH 2.0, more than 3.6 million ETH (approx. $7 USD billion) has already been staked with currently no option to un-stake. For Filecoin, miners must stake FIL tokens to receive mining rewards which are locked for a minimum of 180 days and are incentivized to continue locking for up to 540 days. This locking and staking slows down the expansion of DeFi by reducing the amount of liquid capital; something CrossFi protocol can resolve.

CEO David Hong said, “We are very excited to be working with some key movers in the DeFi space to bring the CrossFi protocol solution to the world of blockchain and especially to Filecoin ecosystem participants. We are committed to making digital assets more liquid and expanding the capabilities of DeFi.”

Underpinning the protocol’s superior interoperability is its use of the Multi-Asset Adaptor Protocol (MAP) which functions as both a bridge between compatible public chains and an adaptor network between non-compatible chains. Maintained by an independent network of nodes, the MAP is essentially a separate aggregating public chain built upon Substrate. This chain effectively works as a universal bridge, allowing digital assets to be seamlessly transferred from one public blockchain to another.

The key value CrossFi brings to the DeFi space is to give liquidity to locked digital assets similar to a bond. For example, Filecoin users can stake their FIL on the Filecoin network using the CrossFi protocol and mint an equivalent value amount of ERC20 token compliant cFIL. This is a two-way reversal process, meaning users wanting to later unlock their staked Filecoin must send the equivalent amount cFIL to the redemption contract, executing a burn of the synthetic cFIL for a small settlement fee. As the protocol-supported liquidity pool is chain-agnostic, there is virtually zero slippage for asset swapping.

As innovation in the DeFi space continues to grow in speed and complexity, more and more people are joining the movement, leading speculators to concede the revolution is less about making people rich, and more about returning financial freedom to the people.

origin »Bitcoin price in Telegram @btc_price_every_hour

Liquidity Network (LQD) на Currencies.ru

|

|