2020-8-20 19:55 |

Coinspeaker

CoinShares Hits $1 Billion in Assets Under Management as Demand for Bitcoin Increases

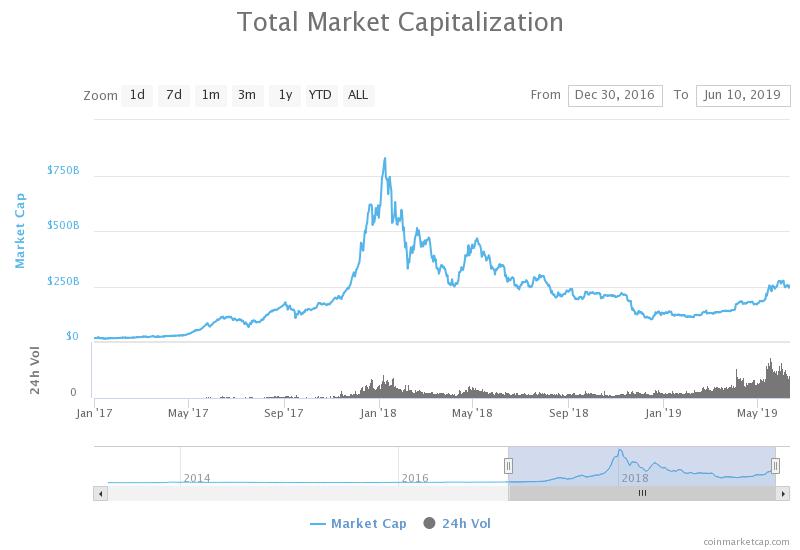

As the demand for Bitcoin and other cryptocurrencies surges globally, the CoinShares fund hit $1 billion. The Ethereum and Bitcoin fund manager hit the nine-figure mark in assets under management (AUM).

With CoinShares, traders can invest in its XBT Provider products. This will enable them to access the crypto market without owning actual cryptos or managing private keys.

CoinShares Hits $1 BillionAccording to CoinShares, investors are convinced to make bigger bets in the crypto space despite its instability. Referring to the growth in assets under management, the firm said:

“The rapid growth of AUM within CoinShares’ XBT Provider family illustrates the increased drive from investors of all types to adopt cryptocurrencies into their investment strategy.”

The CEO of CoinShares, Jean-Marie Mognetti, believes that cryptocurrency has a place in a diversified investment portfolio. Backing her conclusion with the $1 billion achievement, she said:

“If we compare with gold, we believe Bitcoin is better positioned to react aggressively to a current easing in fiscal and monetary policy.”

As the need for a store for value rises, CoinShares’ chief revenue officer, Frank Spiteri believes that digital assets will always “fascinate and intrigue” investors. Also, he added that financial institutions, brokerages, and asset managers are attending to their clients, and the clients want Bitcoin.

CoinShares Grow as Demand for Bitcoin IncreasesA large number of private and institutional investors now consider Bitcoin and gold as alternatives to cash and equities.

Earlier this month, MicroStrategy (NASDAQ: MSTR) announced the purchase of 21,454 BTC worth $250 million, including fees and expenses. Following this, the largest independent publicly-traded business intelligence company revealed its decision to make Bitcoin its primary treasury reserve asset. This however means that the company’s CEO, Michael Saylor, has changed his view on Bitcoin after predicting the death of BTC in 2013.

Similarly, Wall Street legend Paul Tudor Jones told CNBC that he has almost 2% of his assets in Bitcoin. In addition, a Bloomberg report revealed that the billionaire predicts inflation and is holding BTC as a hedge against it.

CoinShares’ Recent DevelopmentsIn June, CoinShares and Ledger partnered with Japanese bank Nomura, to launch Komainu, a crypto custody firm. It was finally launched after the first announcement in 2018 and will be managed by the three companies. With the new outfit, the three companies hope to offer crypto custody to corporate financial institutions.

A Reuters report revealed that the crypto custody platform received approval from the Jersey Financial Services Commission as at the time of launch. Also, CoinShares CEO said the joint venture is open to expanding its client base.

Considering that customers may not be assured of their assets’ safety, Komainu revealed plans to provide security. The new venture will benefit from the experience of CoinShares and other partners. This experience covers different sectors, such as fund management, banking, and cybersecurity.

The CEO of Ledger, Pascal Gauthier, commented on the advantage of learning from the three companies’ experience. He said that the combined experience would create an advanced financial and security solution for customers.

CoinShares Hits $1 Billion in Assets Under Management as Demand for Bitcoin Increases

origin »Bitcoin price in Telegram @btc_price_every_hour

Decentralize Currency Assets (DCA) íà Currencies.ru

|

|