2022-8-25 23:00 |

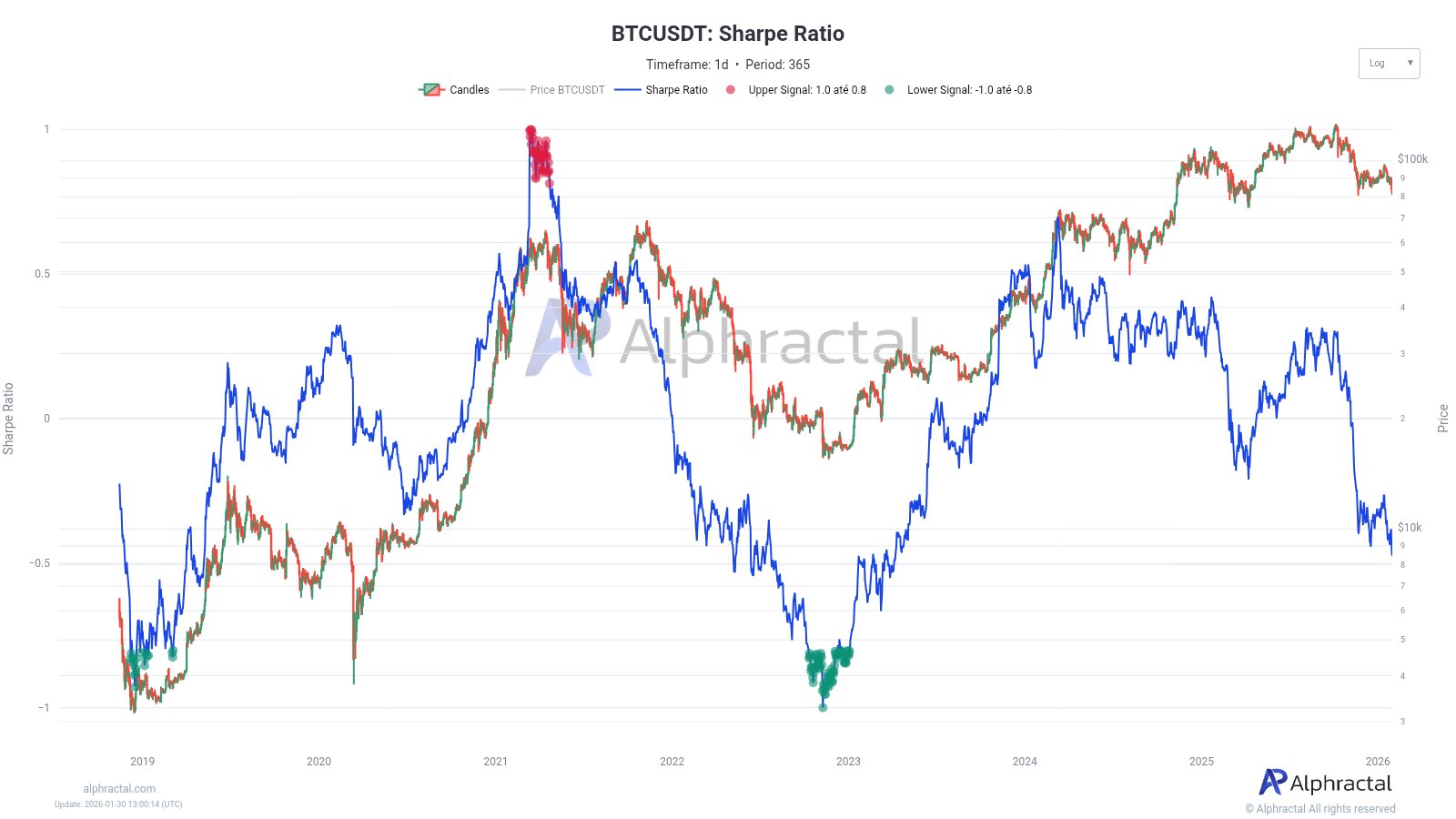

Crashing from an all-time high at around $69,000, Bitcoin has lost over 70% of its value since November 2021. New data reveals that BTC’s price might have entered one of its worst bear markets since its inception, as the cryptocurrency loses critical levels and remains trading in the red on high timeframes.

At the time of writing, Bitcoin trades at $21,600 and records a 10% loss over the past 7 days. The entire sector is experiencing downside price action and moves at a make-it-or-break-it level.

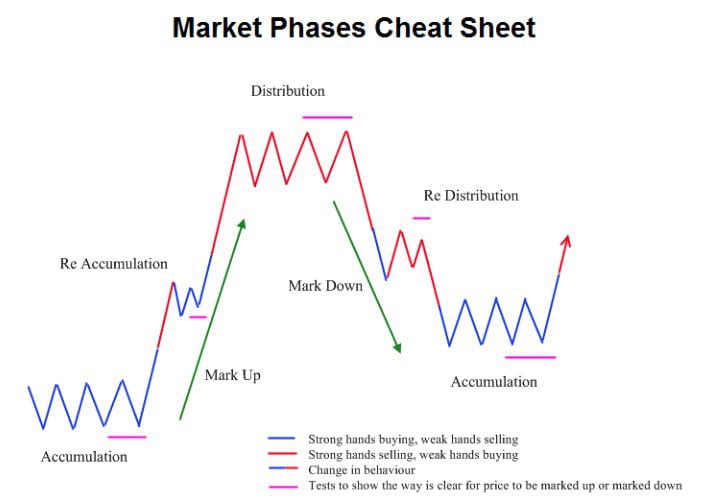

BTC’s price moving sideways on the 4-hour chart. Source: BTCUSDT TradingviewData from Arcane Research firm claims Bitcoin’s price might be tracking its 2017 to 2018 performance. At that time, the price of Bitcoin rallied from below $3,000 to its previous all-time high of $2,000.

The cryptocurrency then lost over 80% of its value crashing back into its breakout levels. This bear market lasted for years as the price of BTC consolidated below its previous all-time high before re-entering price discovery mode in late 2020.

Arcane Research claims the current bearish price action has lasted for 286 days with BTC’s price trending down 70% off its all-time high. In 2017 and 2014, BTC trended downwards for 12 to 13 months before forming a convincing bottom.

During this period, the cryptocurrency lost over 84% of its value hinting at further room for BTC to crash into its 2020 levels at around $10,000. Arcane Research said:

If history is to repeat, a bottom could be expected to form near the year-end. Stil, the market is a different beast this time around. Last year’s double top in April and November was unlike what we’ve previously seen in bitcoin, and so was the push down below the previous ATH experienced during the massive liquidation of 3AC (Three Arrows Capital) in June.

These factors have contributed to Bitcoin experiencing relentless selling pressure in a macro-economic environment unfavorable for risk-on assets.

Will Bitcoin See Final Push Down?If the price of Bitcoin continues to track its 2018 bear market, market participants might want to prepare for a final push into 2020 levels. In the coming days, the crypto market will most likely see a spike in volatility and sudden moves as Ethereum deploys “The Merge”.

The event that will complete its transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS), “The Merge” has generated a lot of hype amongst market participants. Some consider it a bullish catalyzer, while others believe ETH’s price might face short-term hurdles pushing the sector down.

Post-Merge, digital assets might experience short-term volatility, but if the price of the largest crypto compressed, that could further confirmation of a 2018-like bear market. Arcane Research noted:

The 2018 bear market saw compressed volatility for prolonged durations with a 140-day leg of prices ranging from $6-$7k before the final climax down towards $3k, resulting in flat market for 120 days. Similar tendencies are evident today (…).

Source: Arcane Research origin »Bitcoin price in Telegram @btc_price_every_hour

High Voltage (HVCO) на Currencies.ru

|

|