2023-4-24 15:00 |

Stablecoin transfer volumes have dipped in the past week, declining 19.2% in the seven days to Sunday. The data, from Dune, reveals that BUSD has led the fall in volume.

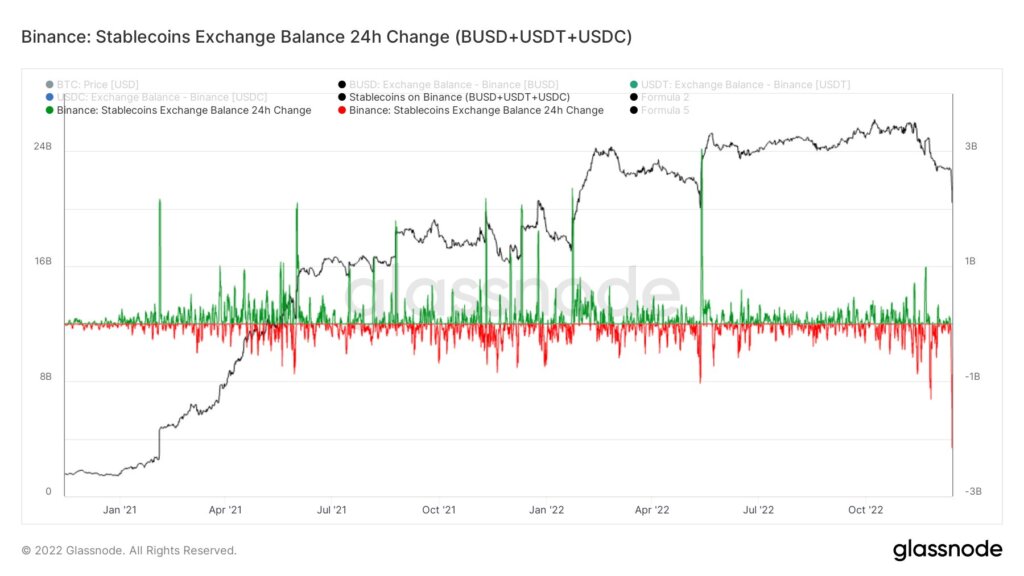

BUSD Transaction Volumes SlideThe slump was propelled by a major slowdown in the use of Binance’s BUSD, which was down by 353.3% over the course of the week. This represents just the latest decline in the stablecoin’s general downward trajectory in recent months.

Beside transaction volume, BUSD’s market cap has also been falling. On April 15, it dropped below $7 billion, marking the lowest amount of BUSD in circulation since April 2021.

BUSD Market Cap (Source: BeInCrypto)BUSD Market Cap: (Source: BeInCrypto)

Declining Stablecoin SupplyBinance USD isn’t the only stablecoin suffering from weak demand. Other major tokens that have seen their total supply dwindle include well known dollar-pegged stablecoins USDC and TUSD.

BeInCrypto has reported that the top four stablecoins have seen their market cap shrink by 23% from peak levels. In fact, since their respective peaks, USDC supply has fallen by $20 billion, and BUSD supply has lost $11 billion. While less dramatic, supplies of TUSD and Dai have also dropped $1.3 billion and $4.4 billion respectively.

It must be noted that stablecoins’ various peak market caps were observed during a wider crypto bear market that saw the distribution of investment shift in favor of less volatile assets. From accounting for close to half of all crypto investments at one point, stablecoins now represent closer to 10% of the total crypto market capitalization. Instead, in 2023 liquidity has moved into BTC and ETH.

BUSD’s Ongoing ChallengesLooming over BUSD’s fate is the U.S. Securities and Exchange Commission’s (SEC) potential enforcement action against its issuer Paxos.

After news of the SEC probe broke in mid-February, in the weeks that followed BUSD supply shrunk by 60%.

According to BeInCrypto data, ranked by market capitalization, BUSD has now fallen to 13th place among cryptocurrencies. With a string of altcoins outperforming Binance’s dollar-pegged token, Shiba Inu even briefly overtook the stablecoin earlier this week.

Maintaining their position at the top, TUSD and USDC currently have the third and fifth highest supply.

The post BUSD Drives 19% Slump in Stablecoin Transfer Volumes appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

USDx stablecoin (USDX) на Currencies.ru

|

|