2025-7-6 01:00 |

Bitcoin investors are currently holding an estimated $1.2 trillion in unrealized profits, according to on-chain analytics platform Glassnode.

This significant figure highlights the paper gains accumulated by long-term holders as Bitcoin continues to trade close to its record highs.

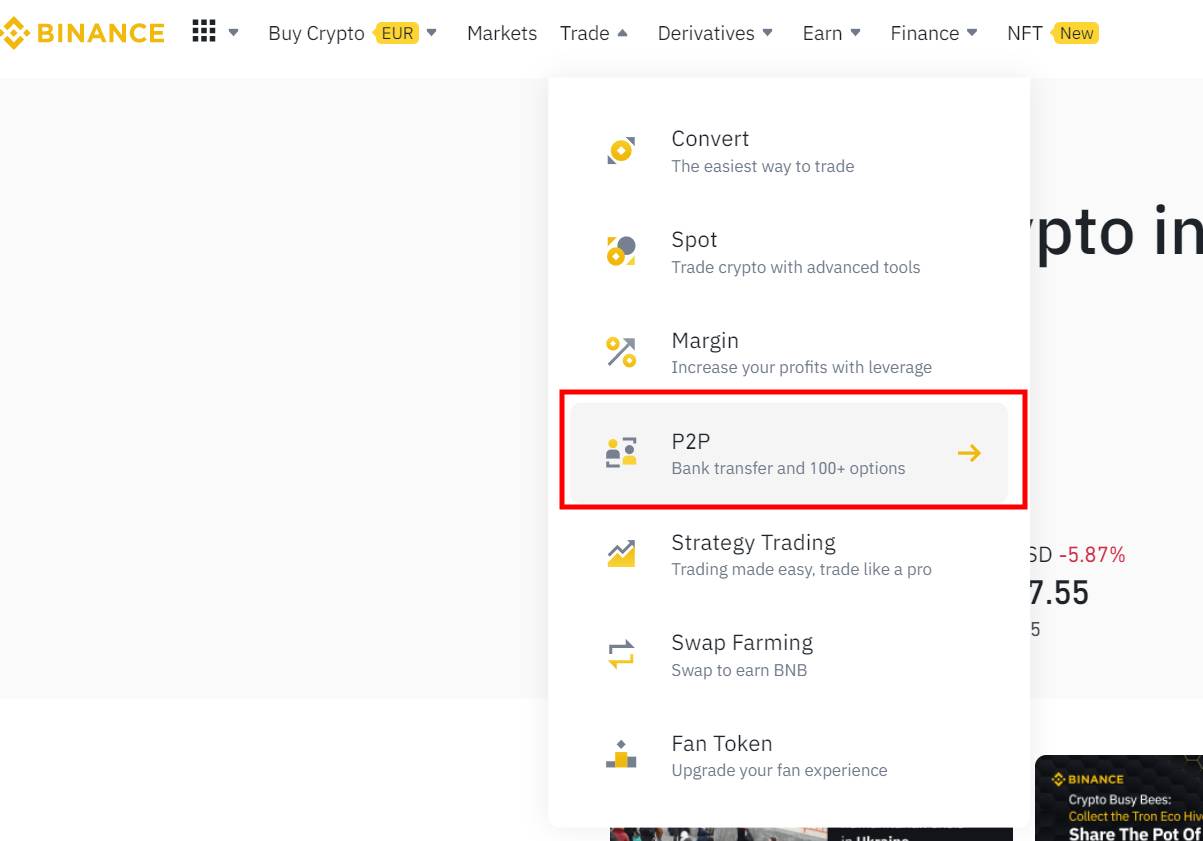

Bitcoin Investor Base Shifts From Traders to Long-Term Institutional AllocatorsGlassnode data reveals that the average unrealized profit per investor stands at around 125%, which is lower than the 180% seen in March 2024, when the BTC price reached a peak of $73,000.

Bitcoin Unrealized Profit. Source; GlassnodeHowever, despite these massive unrealized gains, investor behavior suggests no major rush to sell the top crypto. BeInCrypto previously reported that daily realized profits have remained relatively subdued, averaging just $872 million.

This starkly contrasts previous price surges, when realized gains surged to between $2.8 billion and $3.2 billion at BTC price points of $73,000 and $107,000, respectively.

Moreover, current market sentiment suggests that investors are waiting for a more decisive price movement before adjusting their upward or downward positions. The trend points to firm conviction among long-term holders, with accumulation continuing to outweigh selling pressure.

“This underscores that HODLing remains the dominant market behavior amongst investors, with accumulation and maturation flows significantly outweighing distribution pressures,” Glassnode stated.

Meanwhile, Bitcoin analyst Rezo noted that the current trend reflects a fundamental shift in the significantly evolved profile of Bitcoin holders. According to him, the typical BTC holder has shifted from short-term speculative traders to long-term institutional investors and allocators.

Rezo pointed to the increasing influence of institutional players such as ETFs and public companies like Strategy (formerly MicroStrategy).

“The holder base has changed – from traders seeking exit to allocators seeking exposure. MicroStrategy, sitting on tens of billions in unrealized gains, keeps adding. ETFs = constant bid, not swing traders,” he said.

Notably, public companies like Strategy increased their Bitcoin holdings by 18% in Q2, while ETF exposure to Bitcoin climbed by 8% in the same period.

Bitcoin Flows For ETFs and Public Companies. Source: CNBCConsidering this, Rezo concluded that most short-term sellers likely exited between $70,000 and $100,000. He added that what remains are investors who treat Bitcoin less as a speculative trade and more as a strategic long-term allocation.

The post Bitcoin’s $1.2 Trillion Unrealized Profit Pool Grows While Holders Resist The Urge to Sell appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|