2024-2-17 00:00 |

On-chain data from Glassnode shows that the Bitcoin short-term holders have recently participated in a massive $647 million profit-taking event.

Bitcoin Short-Term Holders Have Realized Large Net Profits RecentlyAccording to data from the on-chain analytics firm Glassnode, the short-term holders have given a strong reaction to the $52,000 break. The “short-term holders” (STHs) here refer to the Bitcoin investors who bought their coins within the past 155 days.

Statistically, the longer an investor holds onto their coins, the less likely they become to sell at any point. The STHs have a relatively low holding time, so they easily sell during price rallies or crashes.

On the other hand, the “long-term holders” (LTHs), which make up the rest of the userbase (that is, those withholding time greater than 155 days), tend to carry a strong resolve.

Since the STHs are fickle-minded, it’s not surprising that they have made some selling moves after the latest rally in the asset. One way to gauge the reaction of this cohort is through the “Net Realized Profit/Loss” metric.

This indicator keeps track of the net profit or loss the investors realize across the network. The metric finds this value by going through the on-chain history of each coin being transferred right now to check the price it was moved at before.

Assuming that a change of hands occurred in the previous transfer and that another such change is happening with the current one, then the coin’s sale would realize a profit or loss equal to the difference between the two prices.

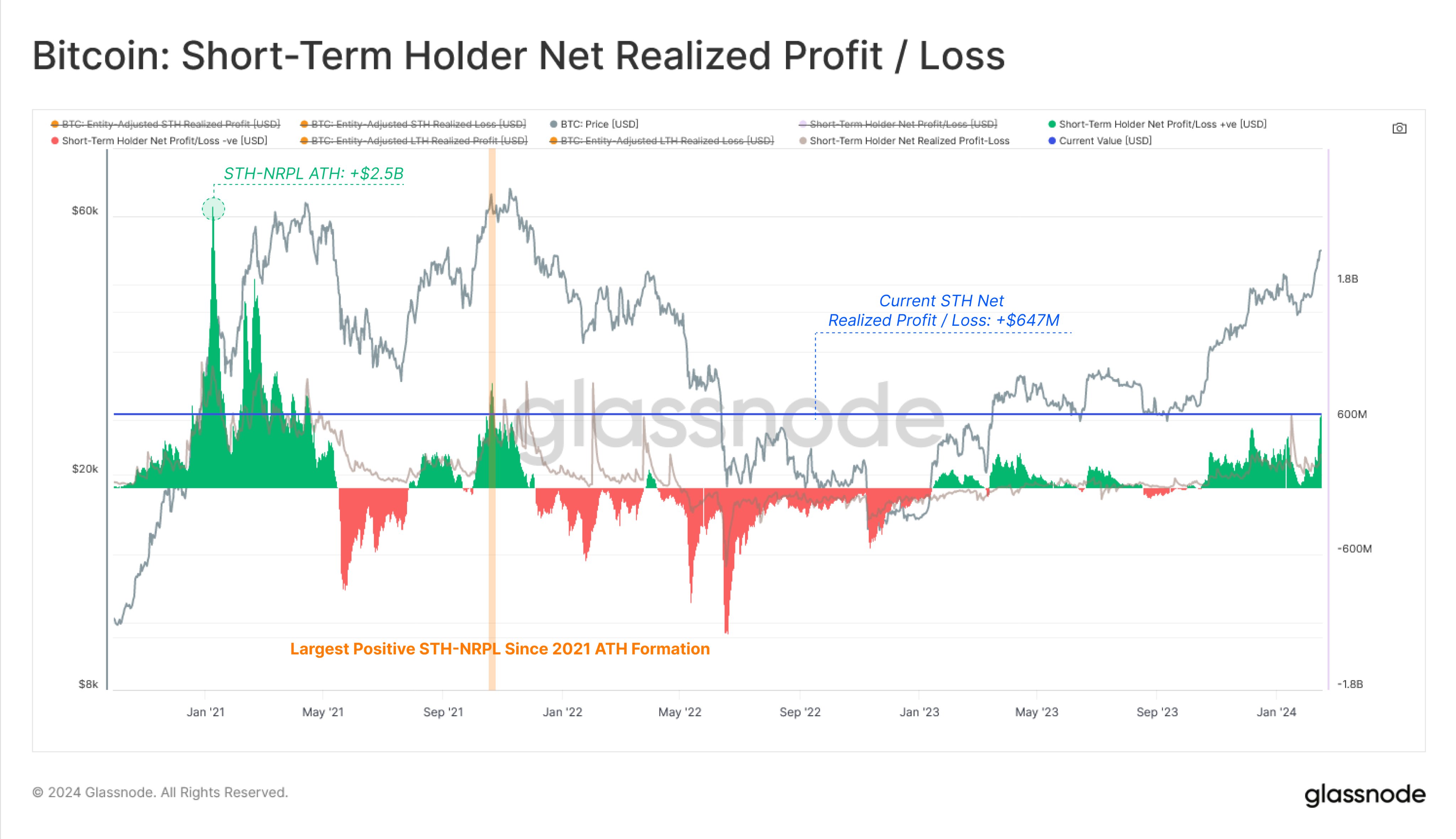

The Net Realized Profit/Loss sums up all such profits and losses and outputs the net value. Now, here is a chart that shows the trend in this indicator specifically for the Bitcoin STHs over the past few years:

As displayed in the above graph, the Bitcoin STH Net Realized Profit/Loss has spiked to highly positive levels recently, implying that these investors’ profits have significantly outweighed the losses.

This cohort has realized $647 million in net profits during this latest selling spree. The chart shows that the last time the indicator was at higher positive values was back around the formation of the 2021 all-time high.

The current values aren’t off this mark, but the STH Net Realized Profit/Loss levels that hit back during the first half of the 2021 bull run are still far away. For perspective, the peak in the metric achieved back then was $2.5 billion, which remains the all-time high for the indicator.

BTC PriceSince the rapid surge above $52,000, Bitcoin has calmed down slightly, as it has moved sideways in the past few days. At present, BTC is trading at around $52,500.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|