2021-11-16 12:15 |

CoinShares reports that weekly bitcoin inflows from institutional investors totaled $97.5 million last week, while the whole market recorded $150.9 million. This is a record sum for bitcoin, despite trade volume lower than the first half of 2021 so far.

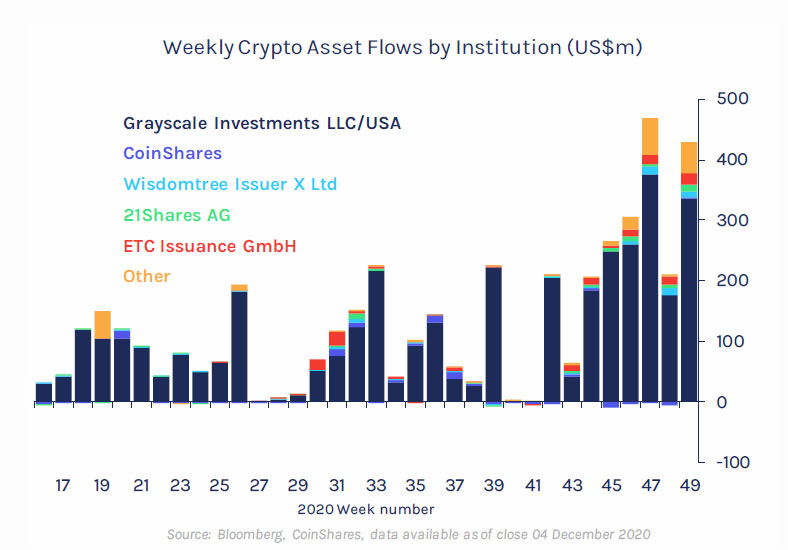

A CoinShares weekly report shows that institutional traders have locked in a record sum of capital into bitcoin investment products. A total of $97.5 million flowed into bitcoin last week, while the total inflow for cryptocurrencies totaled $150.9 million.

The record influx of capital has occurred despite trade volume declining in the second-half of 2021. The latter half of 2021 has so far seen an inflow of $750 million, as opposed to $960 million in the first half.

Among altcoins, Ethereum and Cardano saw the biggest inflow with $17.3 million and $16.4 million, respectively. Solana and Polkadot followed with $9.8 million and $5.2 million.

The most popular investment product in this was ProShares Bitcoin Strategy ETF, which has been performing excellently since its launch. The ETF is also approaching its limit on futures contracts and recorded a trading volume of 24 million shares on its debut.

Bitcoin inflows in late October were also boosted by bitcoin ETFs, which saw $1.47 billion enter the market in mid-October. At the same time, CME bitcoin open interest surged to a record $5.4 billion.

Institutional bitcoin investments likely to increaseWhile the second-half trade volume may not be as strong as the first half at this point, that may yet change. If the popularity of the ProShares ETF is anything to go by, then the imminent launch of the VanEck bitcoin futures ETF will only boost investment much more. The VanEck ETF will go live on the CBOE on Nov 16.

Several ETF applications are also waiting for SEC approval. Should the SEC approve more futures-based ETFs, which it appears they are more welcoming of, then the upcoming months could see more influx. Some U.S. Congressmen have also lobbied for Bitcoin spot ETFs, which would significantly boost capital inflow.

The market appears to be holding near the $60,000 mark, and there is an air of optimism among investors. The strength of institutional investment also bleeds into the retail market, which is also going strong. The near-term forecast, at least from some analysts, is upbeat for these reasons as well as due to general technical developments.

The post Bitcoin Sees Record Institutional Inflows Despite Lower H2 Trade Volume appeared first on BeInCrypto.

origin »Bitcoin (BTC) на Currencies.ru

|

|