2025-11-4 17:09 |

Bitcoin Magazine

Bitcoin Price Slump Could Spark Next Bull Run

Recent bitcoin price action has left many investors frustrated. Despite setting new all-time highs above $120,000 earlier this year, the bitcoin price has struggled to keep pace with equities and Gold in recent months. The S&P 500 and precious metals have surged to new records, while Bitcoin has remained range-bound, giving the impression that it’s lagging behind. But when analyzing the market through a lens of capital rotation, this period of underperformance may not last much longer.

Relative Gains in the Bitcoin PriceWhile Bitcoin has appeared weak in dollar terms, it remains one of the strongest performers over the past year. BTC has still outperformed both Gold’s 46% and the S&P 500, yet even with that outperformance, the structure of the market makes it feel as though Bitcoin is still under-delivering. Measuring Bitcoin against other assets like equities and Gold rather than the dollar, which is itself depreciating, gives a more accurate view of its purchasing power and real market standing.

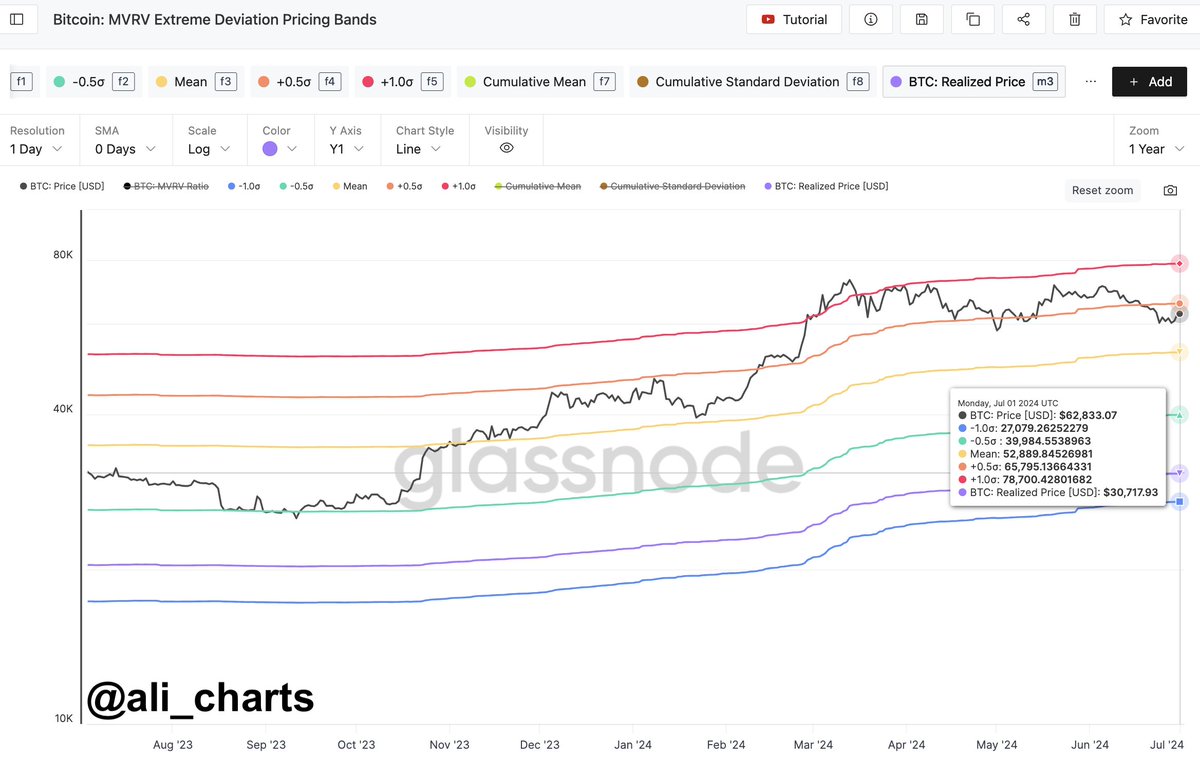

When charted against the S&P 500, Bitcoin’s performance shows an interesting divergence. The BTC to S&P ratio reveals that while Bitcoin set new USD highs in 2024, its relative value against equities is only just above the previous cycle’s peak. In other words, Bitcoin’s additional purchasing power has barely expanded. If Bitcoin were to reclaim the previous S&P 500 ratio high of ~19.6, it would equate to a bitcoin price of roughly $135,000, given current equity levels.

Bitcoin Price vs GoldThe Bitcoin to Gold ratio tells a similar story. Despite reaching new highs in dollar terms, BTC actually remains well below its previous cycle’s all-time high when priced in Gold. A full recovery to that ratio would place the bitcoin price near $150,000, and reclaiming the brief 2024 high would push it closer to $160,000. These comparisons help explain why sentiment feels more muted despite record prices. Measured against real-world stores of value, Bitcoin’s performance still trails prior peaks.

However, an interesting dynamic has repeated across multiple cycles. Each time Gold has experienced a sharp rally, Bitcoin has followed with a major bull phase shortly after. The pattern appeared in 2012, 2016, and again in 2020 — Gold rallied first, then Bitcoin followed with exponential gains. These Gold spikes seem to mark the early stages of capital rotation, as liquidity moves from defensive safe havens into more speculative, higher-beta assets like BTC.

Capital Rotation and the Bitcoin PriceThat rotation may already be underway again. Gold recently set new highs before losing momentum, while equities have begun to strengthen. Historically, when Gold begins to underperform the S&P 500 after a major rally, it has signaled the start of risk-on conditions in broader markets — the kind that favor Bitcoin.

The same capital rotation that occurs within crypto markets, from stablecoins into Bitcoin, then into large-cap and smaller speculative altcoins, may also occur in traditional markets. Liquidity often flows from fiat and bonds into Gold and then equities, before eventually into risk assets like Bitcoin as investor confidence rises.

Conclusion: The Bitcoin Price May Soon Lead AgainBitcoin remains tightly correlated with the S&P 500, meaning sustained equity strength is one of the most reliable precursors to bitcoin price outperformance. With Gold potentially topping and equities gaining traction, the next few months could mark the beginning of a new phase of risk appetite.

While Bitcoin has felt stagnant and underwhelming in recent weeks, the broader context suggests otherwise. Capital is in motion. The same rotation that has defined every past cycle appears to be setting up once again — and the bitcoin price may soon move from laggard to leader.

For a more in-depth look into this topic, watch our most recent YouTube video here: Bitcoin Is Underperforming – But Maybe Not For Much Longer

For deeper data, charts, and professional insights into bitcoin price trends, visit BitcoinMagazinePro.com.

Subscribe to Bitcoin Magazine Pro on YouTube for more expert market insights and analysis!

WATCH BITCOIN PRICE VIDEO ANALYSISDisclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post Bitcoin Price Slump Could Spark Next Bull Run first appeared on Bitcoin Magazine and is written by Matt Crosby.

origin »Bitcoin (BTC) на Currencies.ru

|

|