2023-8-23 06:00 |

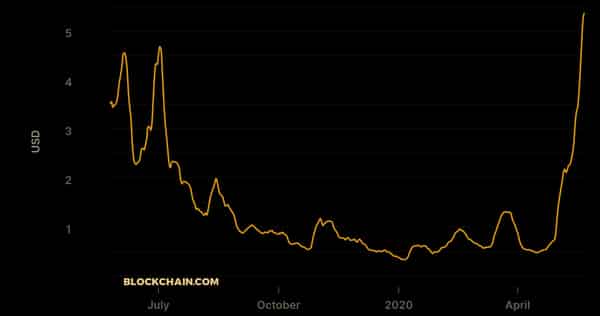

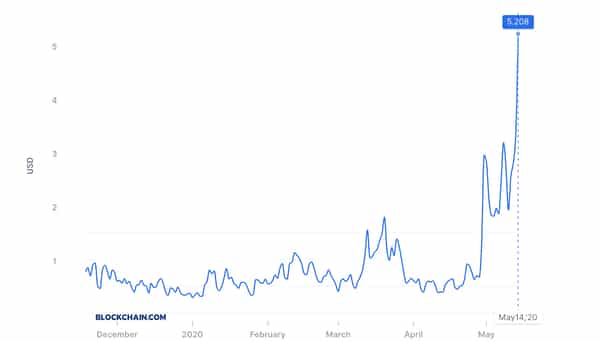

The latest data on August 22 shows that the total daily fees generated from Bitcoin Ordinals on the world’s most valuable network have crashed from around $95,000 to $72,000, a 24% drop. The contraction mirrors the general performance of BTC prices which have been under pressure in the last two weeks, notably crashing last week and forcing the coin towards $25,000, looking at price action in the daily chart.

Bitcoin Ordinals Fees SlidingAccording to Dune Analytics data, a platform that tracks the on-chain activity of various blockchains, including Bitcoin, the average daily fees generated from Bitcoin Ordinals stood at $71,709 as of August 21, down from $94,910 on August 14. This is a significant drop in activity and fees after an extended consolidation which saw Bitcoin Ordinals activity flat-line as BTC prices also moved horizontally for the better part of early August.

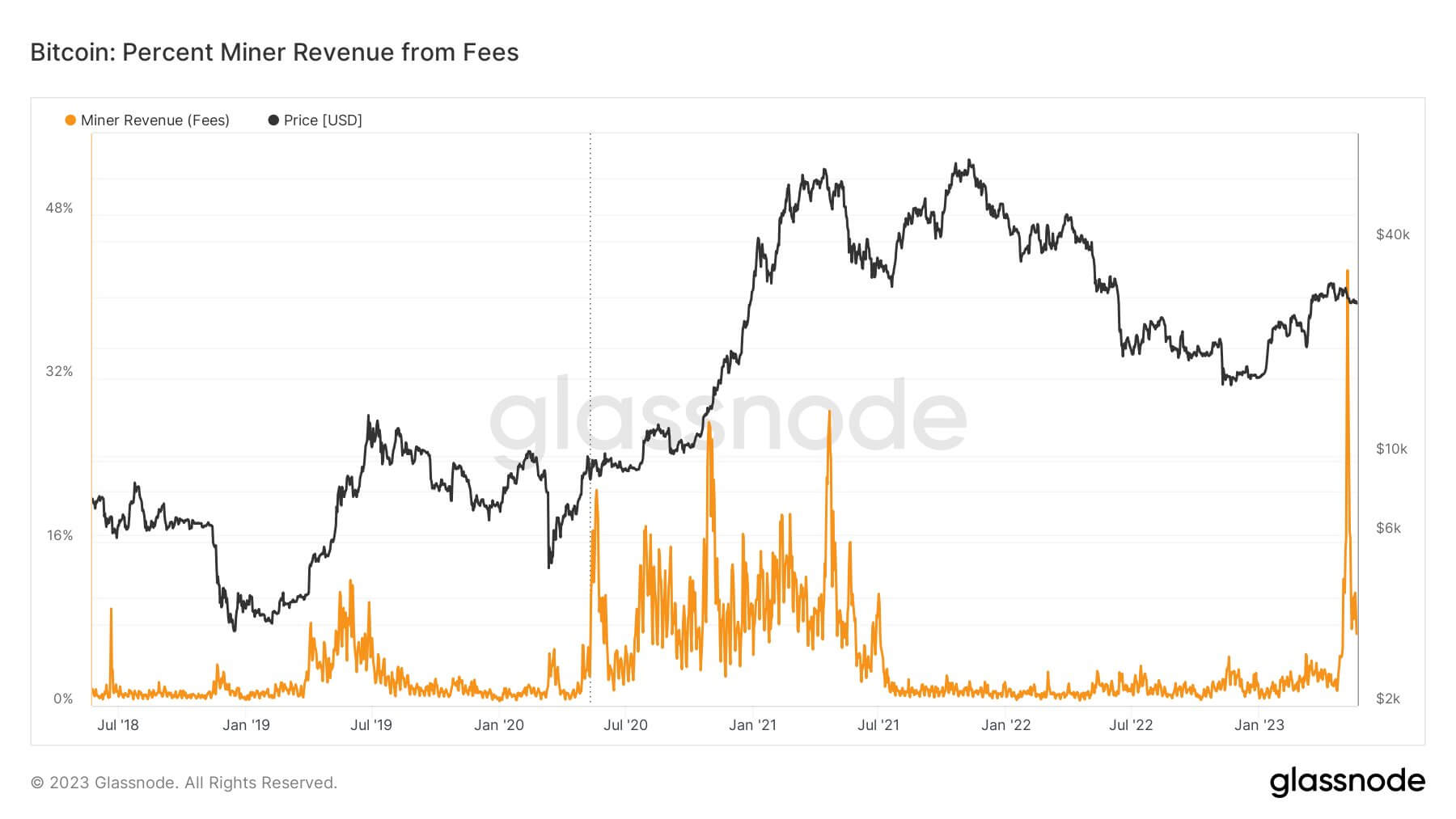

From the on-chain activity, the slump in Bitcoin prices seems to affect ordinals minting. Extending from BTC price action, how the number of ordinals will be minted going forward is yet to be seen. However, as of August 22, over 26 million inscriptions were minted, generating over $50 million in fees for Bitcoin miners.

Generally, since the Ordinals protocol allows users to “inscribe” items, including images or texts, to the smallest unit of BTC, that is, Satoshis, and add it to a block of transactions, miners are tasked to verify these blocks and, in the process, receive fees. Unlike Ethereum, Bitcoin relies on a proof-of-work consensus where miners are tasked with security and decentralization.

These miners are critical in ensuring the safety of inscribed items. Blocks must be full for the network to be more secure and miners to be even more incentivized to mine and compete for rewards. Though blamed for bloating blocks and unnecessarily increasing fees, Bitcoin Ordinals ensure blocks are full and allow miners to earn higher fees.

Falling BTC Prices, Will Inscriptions Activity Fall?On-chain data also shows that many inscribed items are primarily texts. Usually, the lighter they are, the lower the fees paid. Users who decide to inscribe big-size items have to pay more. Once there is this shift, Bitcoin blocks will become full faster, and those who scramble for their transactions to be added to the next block by miners will have to pay more in transaction fees.

Bitcoin remains under pressure when writing, and whether Ordinals activity and the minting of “NFTs” on the network will continue as it was in H1 2023 remains to be seen. In past cycles, it has been observed that dropping asset prices tend to affect on-chain activity, as seen in decentralized finance adversely (DeFi) total value locked (TVL) and in NFT scenes.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|