2021-6-28 19:42 |

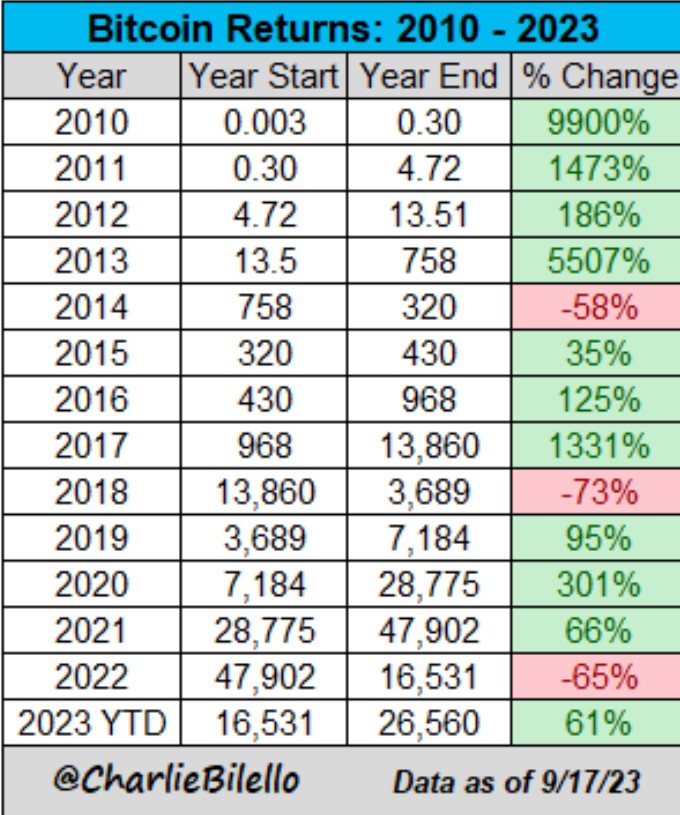

It has been more than two months since Bitcoin last met $60k price levels. During this period, the leading cryptocurrency has shown unprecedented weakness, mainly exacerbated by the cluster of China’s crackdown news. At one point last week, BTC’s price plunged to as low as $28,800, losing more than 55% compared to its peak around mid-April.

BTCUSD Chart By TradingViewPredominantly, this sort of session is considered a dip, implying that investors and bears will enter the market and fill up their bags — in the hope of an imminent surge. At least, this is the case with Bitcoin maximalist Michael Saylor, as he recently took up the opportunity and acquired $489 million worth of Bitcoin.

However, not every trader out there is of the same mind as Saylor. For instance, chief market strategist at InTheMoneyStocks.com Gareth Soloway believes Bitcoin will drop to below $20,000 before it commences its next rally. Soloway has been very precise in his predictions so far; he previously accurately predicted that Bitcoin would slide to $30,000 levels.

JPMorgan Expects to See Bitcoin at $23,000Perhaps one of the most prominent entities to anticipate that Bitcoin will further extend its losses is JPMorgan, a leading investment firm and financial services provider. As per a note from JPMorgan, unlike MicroStrategy, the majority of institutions are not buying the current BTC dip.

JPMorgan elucidated that the recent weakness in Bitcoin’s price is a result of weak flows from major institutions. In other words, the bank believes Bitcoin can’t gather enough momentum since institution riders do not find the current prices attractive — and are standing by to purchase at lower rates.

“More than a month after the May 19 crypto crash, bitcoin funds continue to bleed, even as inflows into physical gold ETFs stopped. This suggests that institutional investors, who tend to invest via regulated vehicles such as publicly listed bitcoin funds or CME bitcoin futures, still exhibit little appetite to buy the bitcoin dip,” the note from JPMorgan said.

The bank had previously described that if Bitcoin resembles the volatility and allocation of gold, it would hit $140,000. And now, using this same logic, it forecasts the fair value of the leading cryptocurrency over the medium-term to be within the $23k – $35k range.

In the note, JPMorgan interpreted China’s intensive crackdown on cryptocurrencies as promising, stating that it will add to Bitcoin’s decentralization. “The crackdown on mining operations in China should be considered as positive for bitcoin over the medium-term as it accelerates a shift away from China’s high share in bitcoin’s hash rate, reducing concentration,” the bank said.

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|