2021-12-14 19:11 |

The outlook for 2022 is highly bullish for Bitcoin according to Bloomberg Intelligence. In their latest report, BI asserted that Bitcoin appears to be on a trajectory for $100,000 in the coming year even as it heads towards becoming a “global digital collateral.”

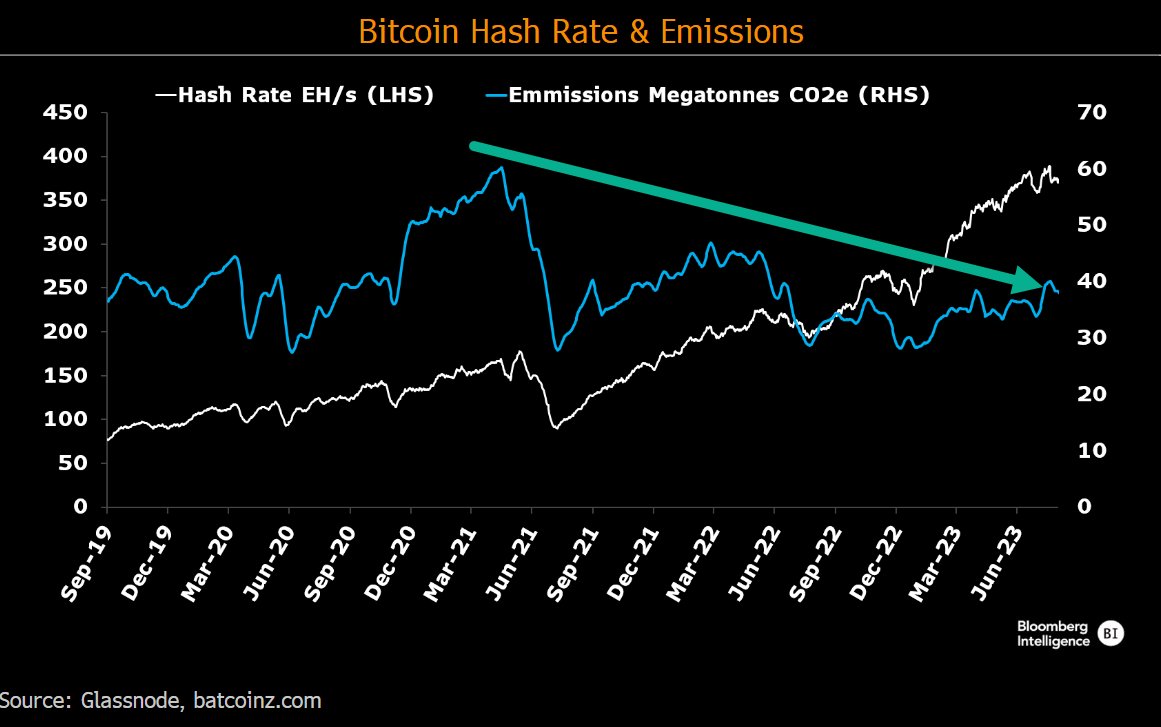

At the moment, the report judged Bitcoin to be in a consolidating bull market. This trend is expected to continue into next year even as they expect Bitcoin to reach and consolidate higher prices as it emerges from the $40,000-$70,000 range. This is because the market has largely shrugged off all the factors that played a role in its 50% downward correction earlier this year, especially the China mining ban.

BTCUSD Chart by TradingViewBeyond the price range of $70,000, Bitcoin appears to be headed to a price of $100,000 in 2022 according to the report. The report sees this happening due to the effects of demand and supply at play in the Bitcoin market.

“Bitcoin appears to be on a trajectory for $100,000. We see it as more of a question of time, notably due to the economic basics of increasing demand vs. decreasing supply,” the report noted.

Highly indicative of this is the fact that Bitcoin has been progressing towards more mainstream adoption in countries including the U.S., Canada, El Salvador, and across Europe. It expects that when increasing adoption and awareness combine with declining volatility and issuance of Bitcoin, the price will inadvertently increase.

Another factor expected to play a key in increasing the attractiveness of investing in Bitcoin is greater regulatory clarity and the tweaking of the U.S’s monetary policy. The report said next year might see the U.S. become more open to cryptocurrencies as several legislations are set to be made for the industry that is more detailed. It adds that a situation where the Federal Reserve’s move to tighten its monetary policy leads to a crash in the stock market could be highly bullish for Bitcoin.

“A primary force to reverse expectations for Federal Reserve tightening in 2022 is a drop in the stock market, which may be a bit of a win-win for Bitcoin,” the report said. “Bitcoin will face initial headwinds if the stock market drops, but to the extent that declining equity prices pressure bond yields and incentivize more central-bank liquidity, the crypto may come out a primary beneficiary.”

Similarly, the report is also bullish on Ethereum for 2022. It asserts that the $4,000 ETH price which used to be the resistance level is now its support level, “and may act as the key pivot for 2022.” However, BI expects that the price may see a 60% drawdown in the 1st half of 2022 before continuing its advance.

origin »Bitcoin (BTC) íà Currencies.ru

|

|