2024-4-12 18:00 |

On-chain data shows the Bitcoin exchange inflows have remained low recently, a sign that the whales have been disinterested in selling.

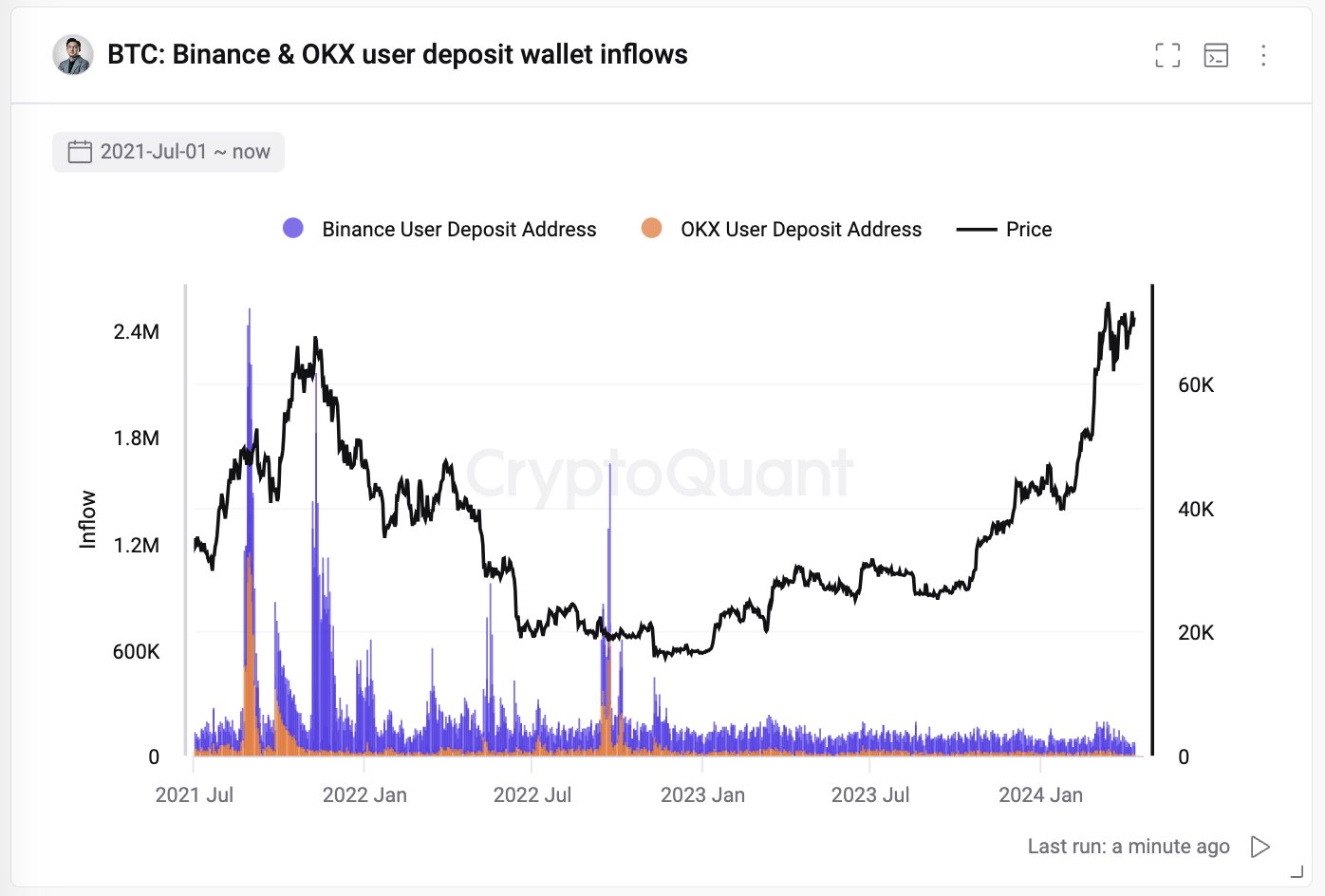

Bitcoin Inflows For Binance & OKX Have Stayed Low RecentlyAs pointed out by CryptoQuant founder and CEO Ki Young Ju in a post on X, the BTC deposits for cryptocurrency exchanges Binance and OKX have been low recently.

The on-chain indicator of interest here is the “exchange inflow,” which keeps track of the total amount of Bitcoin that’s being transferred to the wallets attached to centralized exchanges.

When the value of this metric is high, it means that the investors are depositing a large number of tokens to these platforms right now. As one of the main reasons why holders would transfer to the exchanges is for selling-purposes, this kind of trend can have bearish implications for the asset.

On the other hand, the indicator being low implies these platforms aren’t observing that many deposits currently. Depending on the trend in the opposite metric, the exchange outflow, such a value may be either bullish or neutral for the cryptocurrency’s price.

Now, here is a chart that shows the trend in the Bitcoin exchange inflow for Binance and OKX over the past few years:

Binance is the largest exchange in the world on the basis of trading volume, while OKX is generally number two behind it in the same metric. While these two platforms certainly don’t make up for the entire cryptocurrency market, the user behavior on them would still provide an estimation about the wider pattern.

As is visible in the chart, the exchange inflow for Binance and OKX has been at relatively low levels for quite a while now. When BTC observed its rally towards a new all-time high (ATH) earlier in the year, the deposits saw a slight uptrend, but recently, the inflows slumped back to low values.

This would suggest that the appetite for selling, particularly from the whales, just hasn’t been there for the cryptocurrency. Even the ATH break could only entice a few large users of the platforms to push towards selling.

The behavior is in contrast to, for example, the second half of the 2021 bull run, which can be seen in the chart. The rally back then had not only observed some exceptional inflow spikes, but the baseline inflows had also generally been higher than recent levels.

Interestingly, the two major tops of the rally had also coincided pretty well with extremely large inflows, so going by this pattern, the current rally may not be near a top yet.

Though, it remains to be seen whether this same trend would continue to hold for this cycle, given the fresh emergence of the spot exchange-traded funds (ETFs).

The ETFs have provided an alternate means to gain exposure to the asset, meaning that cryptocurrency exchanges may not carry the same relevance in the market anymore.

BTC PriceAt the time of writing, Bitcoin is floating around $70,400, up more than 5% over the last seven days.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|