2019-6-18 16:35 |

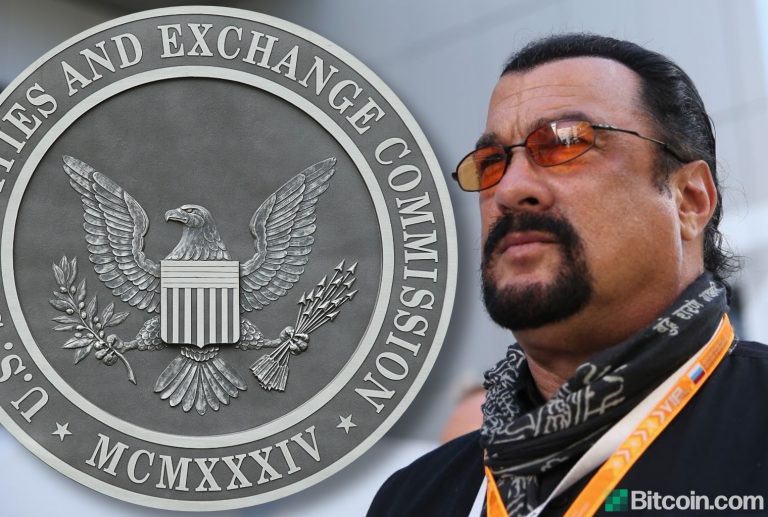

By CCN Markets: An SEC commissioner who’s a bitcoin skeptic admits the agency is experiencing internal disagreements over how to regulate crypto. However, Robert Jackson says the SEC will be more likely to approve crypto proposals, such as a bitcoin ETF, once the industry matures.

Jackson is suspicious of bitcoin, but says the agency will view cryptocurrencies more favorably when the market becomes more transparent, more liquid, and adds bigger players. Speaking at the CB Insights’ Future of Fintech conference, Jackson said: “When the markets reach that stage, I fully believe we’ll have an SEC that’s ready to move forward

The post Bitcoin ETF Will Be Approved When This Happens: SEC Commissioner appeared first on CCN Markets

. origin »Bitcoin (BTC) на Currencies.ru

|

|