2023-7-18 16:00 |

The Valkyrie spot Bitcoin ETF application has now been acknowledged by the United States Securities and Exchange Commission (SEC), according to Eric Balchunas, a senior ETF analyst of Bloomberg. The acceptance of the application opens up the pathway for public scrutiny, inviting feedback before an official review takes place.

This move represents a step forward in the lengthy process of getting a Spot BTC ETF approved in the United States. With the SEC accepting the Valkyrie spot Bitcoin ETF application, an opportunity arises for investors and stakeholders to provide insights and perspectives on the proposed rule change.

Public Comment Period: A Prequel To SEC ReviewFollowing an official filing made on July 17, the SEC accepted the proposed rule change to list and trade Valkyrie’s spot Bitcoin ETF under Nasdaq. The commission has now opened a 21-day window, inviting public comments before initiating its review process.

The acceptance of Valkyrie’s ETF application was confirmed by Eric Balchunas, a senior ETF analyst at Bloomberg. He revealed on Twitter that Valkyrie is among the last applicants for a spot in Bitcoin ETF amid a wave of other applications.

JUST IN: Valkyrie’s bitcoin ETF has just been ack by the SEC, that’s the last one to file of the current crop and the only one with a ticker picked out: $BRRR https://t.co/aBWlo4ElOb

— Eric Balchunas (@EricBalchunas) July 17, 2023

Balchunas also shared that the selected ticker for Valkyrie’s Bitcoin ETF on the Nasdaq listing would be “BRRR”.

The implications of such developments are substantial as the SEC is typically stringent when it comes to approving spot ETFs for the asset, emphasizing the importance of public consensus in this nascent financial realm.

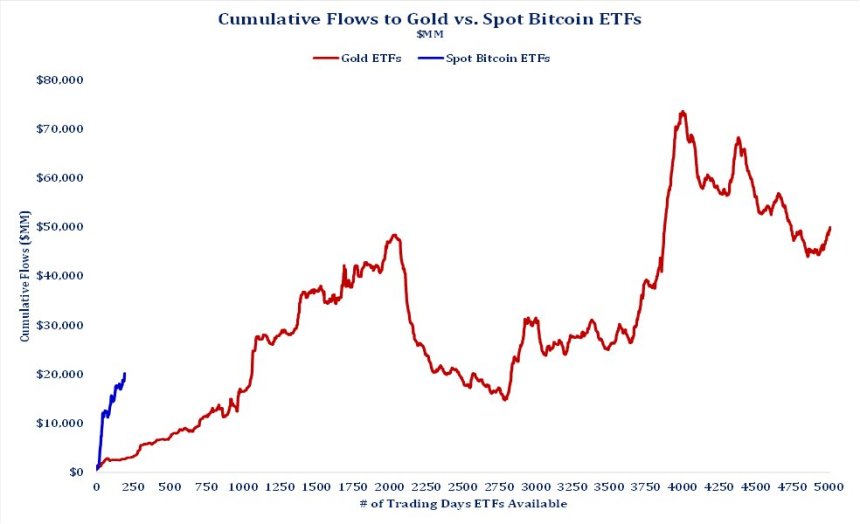

An Emergent Trend In Spot Bitcoin ETF FilingsIn addition to Valkyrie’s application, the SEC has also accepted Spot Bitcoin ETF filings from other financial giants, including BlackRock, Fidelity Investments, WisdomTree, VanEck, Invesco, and ARK 21Shares. This widespread acceptance could mean that the regulatory body is beginning to consider the launch of a Spot Bitcoin ETF, a development that could revolutionize the crypto market.

The BTC price, which has been in a turbulent phase lately, witnessed a surge following BlackRock’s spot Bitcoin ETF filing. This set off a flurry of subsequent ETF filings, pushing BTC’s price above $30,000 multiple times.

However, over the past 24 hours, BTC has slipped below $30,000 once again with a nearly 1% decline in the same period, before reclaiming the $30,000 support once more. The largest asset by market capitalization currently trades at a price of $30,087, at the time of writing.

Following a slight surge on July 13, the BTC market cap has suffered a loss of more than $30 billion ever since. The asset’s market cap has plummeted from a high of $614 billion last week to $582 billion, as of today.

Featured image from iStock, Chart from TradingView

origin »Smart Application Chain (SAC) на Currencies.ru

|

|