2021-12-22 22:00 |

After heavily decreasing during the 4th December crash, the open interest finally seems to be making a return as it gains strong upwards trend.

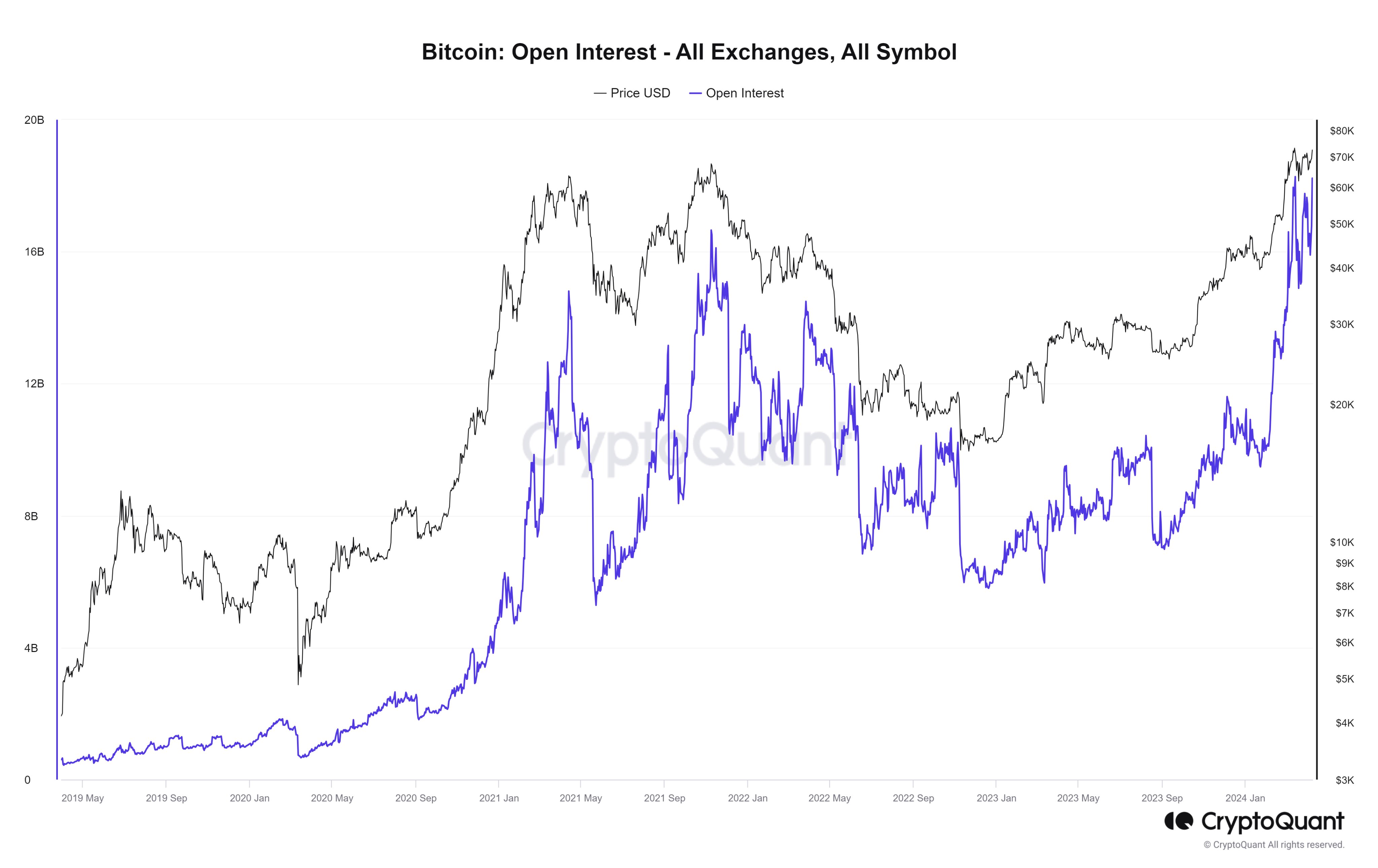

Bitcoin Open Interest Shows Strong Upwards MovementAs pointed out by a CryptoQuant post, the BTC open interest has reversed its trend, and is now showing sharp movement up.

The “open interest” is an indicator that measures the total amount of futures contracts still open at the end of any trading day on derivatives exchanges. The metric takes into account both long and short positions.

When the value of this indicator moves up, it can mean market volatility is rising. An increasing open interest may also support the current overall price trend. However, very large values of the metric can imply there is an excess of leverage in the market, which may end up leading to a correction in the price of the crypto.

On the other hand, a decreasing open interest value can result in lower market volatility. When the indicator sharply moves down, it can lead to a short or long squeeze due to the sudden price movement (the reverse can also be the case).

Related Reading | Bitcoin Whale Address Containing $11 Million Activates After 9-Year Dormancy

Now, here is a chart that shows the trend in the Bitcoin open interest over the past month:

Looks like the indicator has started moving up recently | Source: CryptoQuantAs you can see in the above graph, during the 4th Dec crash, the value of the Bitcoin open interest sharply dropped off.

The indictor showed some recovery shortly after, but soon the curve started to flatten. However, recently, the metric has shot up and shown some strong uptrend.

Related Reading | Sharply Dropping Bitcoin Reserves May Suggest Return To Bullish Trend

This trend may mean that whales are now returning to the Bitcoin derivatives market, which can be bullish for the price of the crypto.

BTC PriceAt the time of writing, Bitcoin’s price floats around $48.8k, up 3% in the last seven days. Over the past thirty days, the coin has lost 18% in value.

The below chart shows the trend in the price of BTC over the last five days.

BTC's price might have started to recover | Source: BTCUSD on TradingViewFor a while now, Bitcoin has mostly showed sideways movement as the coin has been stuck between the $45k and $50k price levels. However, today BTC seems to have shifted to some strong uptrend.

But since the price is still below $50k, it’s unclear at the moment whether this change of trend can help BTC break out of this consolidation. If the open interest is anything to go by, the signs seem to be bullish.

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.comSimilar to Notcoin - TapSwap on Solana Airdrops In 2024

Open Trading Network (OTN) на Currencies.ru

|

|