2023-5-18 14:15 |

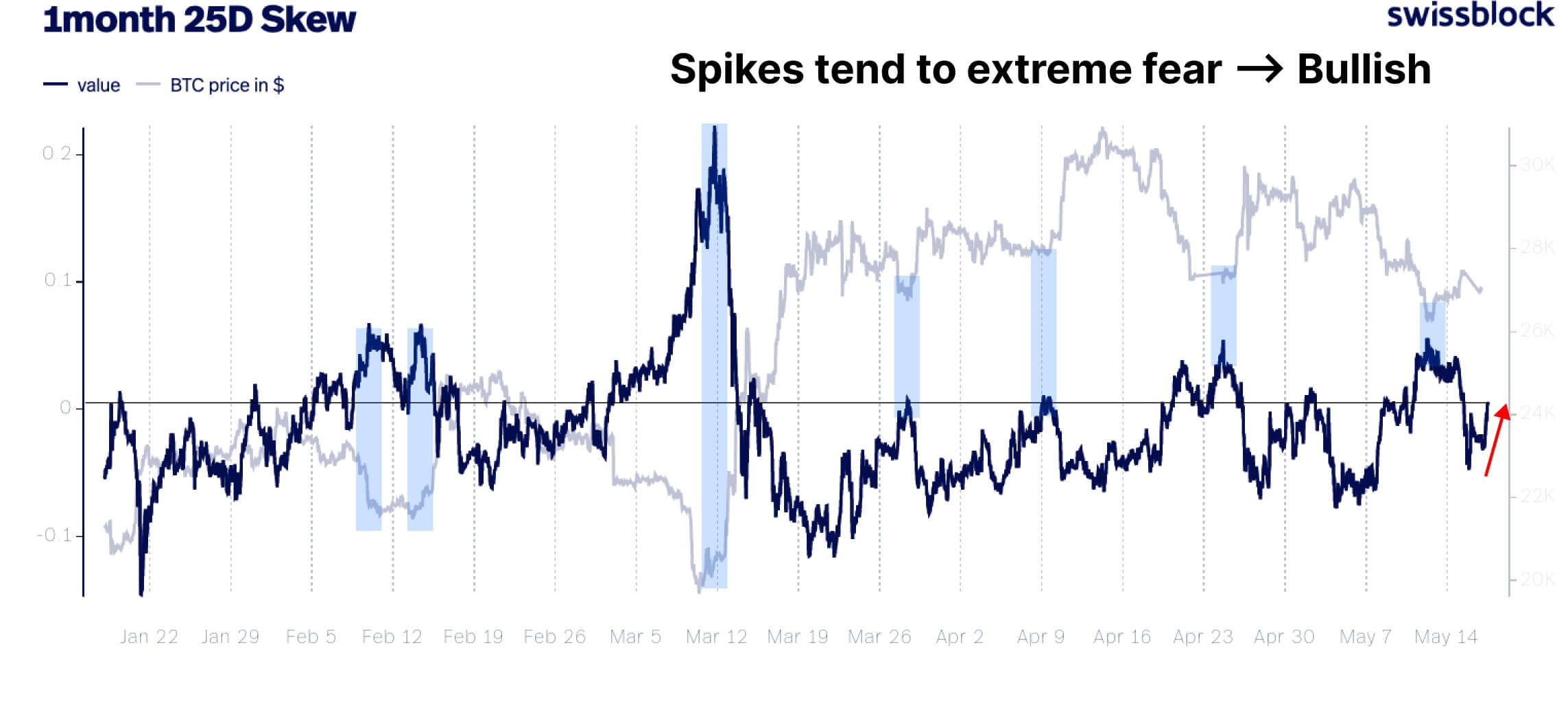

Quick Take Skew is the relative richness of put vs call options, expressed in terms of Implied Volatility (IV). For options with a specific expiry, 25 Delta Skew refers to puts with a delta of -25% and calls with a delta of 25% to demonstrate this difference in the market’s perception of implied volatility. The Bitcoin 1-month 25D Skew suggests a “Put Premium”; the demand for puts increases as investors seek coverage to the downside. However, across the entire curve, the put-to-call ratios’ overall position in the options market is skewed to the upside. This has been a bullish indicator this year. A breakdown of the curve 1 Week: -0.496% 1 Month: -0.293% 3 Months: -0.212% 6 Months: -3.156% 1Month 25D Skew: (Source: Swissblock)

The post Bitcoin 1-month 25D Skew suggests a “Put Premium” appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

PutinCoin (PUT) íà Currencies.ru

|

|