2020-12-27 22:30 |

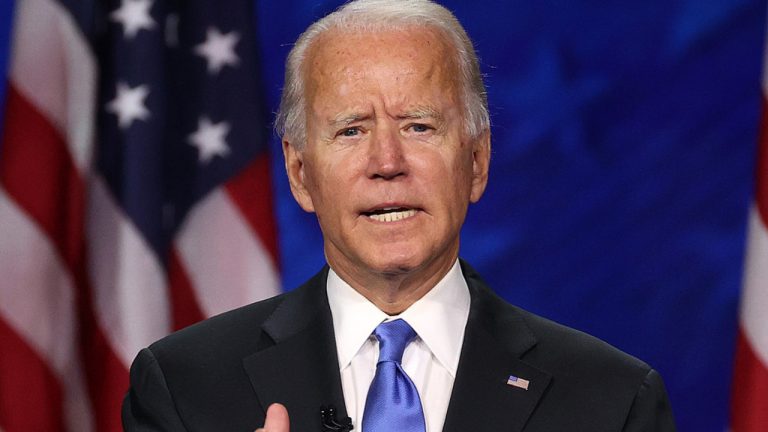

The top U.S. banking regulator is concerned that the Biden administration may roll back some cryptocurrency regulations aimed at protecting consumers. This includes allowing national banks to custody crypto assets put in place during the Trump administration.

Biden Administration Could Change US Crypto RegulationsActing Comptroller of the Currency, Brian Brooks, shared several concerns regarding cryptocurrency regulations in an interview with CNBC last week.

Brooks is the administrator of the federal banking system and chief officer of the Office of the Comptroller of the Currency (OCC). The OCC supervises almost 1,200 national banks, federal savings associations, and federal branches of foreign banks.

He was asked to comment about the recent bitcoin bull run from the regulatory viewpoint. Brooks replied:

I will tell you what I am worried about is all of this is happening in the environment where we are about to have a change of presidential administration, and there are calls on Capitol Hill to dismantle some of the regulatory protections we put in place for this stuff.

The OCC green-lighted banks under its supervision to provide cryptocurrency custody services in July. Brooks explained that his agency “is trying to make it safer for people to custody in national banks.” He added: “We’ve talked about banks supporting some of these stablecoin projects. If those protections aren’t in place, I really worry about the environments for these kinds of things. That’s what I’m most focused on. How do we preserve the safety for the people who participate in that market.”

He noted that “We are at a really critical inflection point right now is what I’d tell you. It’s kind of a fork in the road.” He proceeded to outline two paths for crypto regulation. “One path forward is that we find ways of addressing money laundering risks and we find ways of addressing terrorism financing which I think can be done. But we make this safe for the consumers and investors who participate, that’s why the banking system has such an important role to play,” he asserted, adding:

The other path which is a very real potential here is that we politicize some of these tech issues, whether it’s crypto or fintech more broadly. We politicize it by undoing all of the good work this administration has done to make it safer, to make it more real.

Brooks then referenced the letter by Congresswoman Maxine Waters urging the Biden administration to roll back some of the regulations the OCC put in place. Among the recommendations was rescinding allowing national banks and federal savings associations to provide crypto custody services. Regarding the suggestions Waters put forth in her letter, Brooks said, “If we do those things, then I’m not sure we have enough of a foundation to move forward. It’s all about consolidating regulatory gains and consumer protection that we are trying to put in place. That’s got to stick around.”

He further detailed that “The role of the government is to make sure that markets are well-regulated and well-organized so that people who are transacting know that they are transacting with good people and not bad people.” He emphasized, “Part of that means that, as in any financial markets, there has to be tracing and no anonymity.”

The acting comptroller of the currency clarified that people who hold cryptocurrencies need to know that they are not going to lose them. “That’s why it’s important to people that they be able to custody their assets in a bank, for example, the same way you might custody your stock certificates or any other assets that you own,” Brooks opined.

if (!window.GrowJs) { (function () { var s = document.createElement('script'); s.async = true; s.type = 'text/javascript'; s.src = 'https://bitcoinads.growadvertising.com/adserve/app'; var n = document.getElementsByTagName("script")[0]; n.parentNode.insertBefore(s, n); }()); } var GrowJs = GrowJs || {}; GrowJs.ads = GrowJs.ads || []; GrowJs.ads.push({ node: document.currentScript.parentElement, handler: function (node) { var banner = GrowJs.createBanner(node, 31, [300, 250], null, []); GrowJs.showBanner(banner.index); } });

“This is a real political debate right now,” Brooks noted, emphasizing:

People may not realize this but there’s leadership in Congress who’s urging the incoming Biden administration to roll back some of those protections. I think, in the name of politics, not in the name of protecting investors.

Recently, the Financial Crimes Enforcement Network (FinCEN) proposed new regulation for cryptocurrency wallets. Public comments can be submitted before Jan. 4. Meanwhile, the U.S. Securities and Exchange Commission (SEC) is taking action against a number of crypto firms for selling unregistered securities, including Ripple Labs.

Do you think the Biden administration will roll back some crypto regulations? Let us know in the comments section below.

The post Biden Administration May Roll Back Some Crypto Regulations, Top Banking Regulator Warns appeared first on Bitcoin News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|