2021-10-12 00:26 |

Key takeaways

Barron’s newspaper thinks Bitcoin breakout from other crypto may be a “regulatory relief rally.”Gary Gensler’s recent statements and a recently proposed bill are pointed out to support the argument.Market players seem to share the sentiment that Bitcoin has become the top choice for institutional investors.According to a study by leading business and finance newspaper Barron’s, Bitcoin’s current market trend, where it seems to be surging independently of the rest of the crypto market, can be “a regulatory relief rally.”

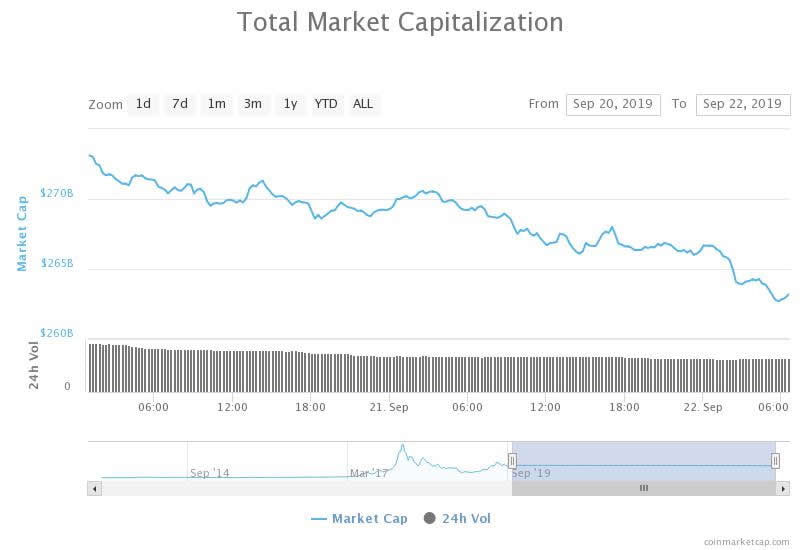

Bitcoin’s price has surged around 26.9% this month on the back of an 11.6% rally a week ago. It has gained 3.47% on the day to be currently trading at about $57,261, having surpassed a market cap of $1 trillion once again. In comparison, altcoins such as Ethereum and Cardano have not fared as well, having added 21% and 13% respectively in the last 10 days.

According to Barron’s analysis, Bitcoin seems to have broken through technical resistance levels, adding that should the gains be held, higher levels may still be reached. The article then goes on to point out that the market rally may be thanks to Gary Gensler’s recent statements while appearing before Congress.

On Tuesday, during a House Committee on Financial Services hearing, SEC chair Gary Gensler stated that his agency had no intention to ban cryptocurrencies. “That would be up to Congress,” Gensler said in response to a question from Rep. Patrick McHenry on whether the SEC would ban cryptos. Gensler however still left some worry for the industry as he reiterated that the commission still had cryptocurrencies that it considered to be securities in its sights.

To support the “regulatory relief rally” argument, the study also noted that a recent bill drafted by Congress may also be contributing to Bitcoin’s growing dominance. The bill in question, which was introduced by Rep. Patrick McHenry (R., N.C.) aims to allow new cryptocurrency startups to get a 3-year window in which they can build out without fear of regulatory action. Ultimately, the bill will provide a “safe harbor” for new projects to get decentralized.

It has been a pain point to the industry that there has been no regulatory clarity in the U.S. as the apex regulator has consistently handled the growing industry with a “regulation by enforcement approach.” However, the recent trends and statements suggest that institutional investors may finally be confident enough to enter the market massively, further pushing the market upwards.

Key market observers also share this sentiment for Bitcoin. For MicroStrategy CEO Michael Saylor, Bitcoin’s status with regulators has made it the top choice for institutional investors.

“Bitcoin is breaking out from other cryptos due to regulatory expectations, making it the clear choice for institutional investors seeking digital property as a store of value,” he said in a tweet.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|