2025-9-5 10:39 |

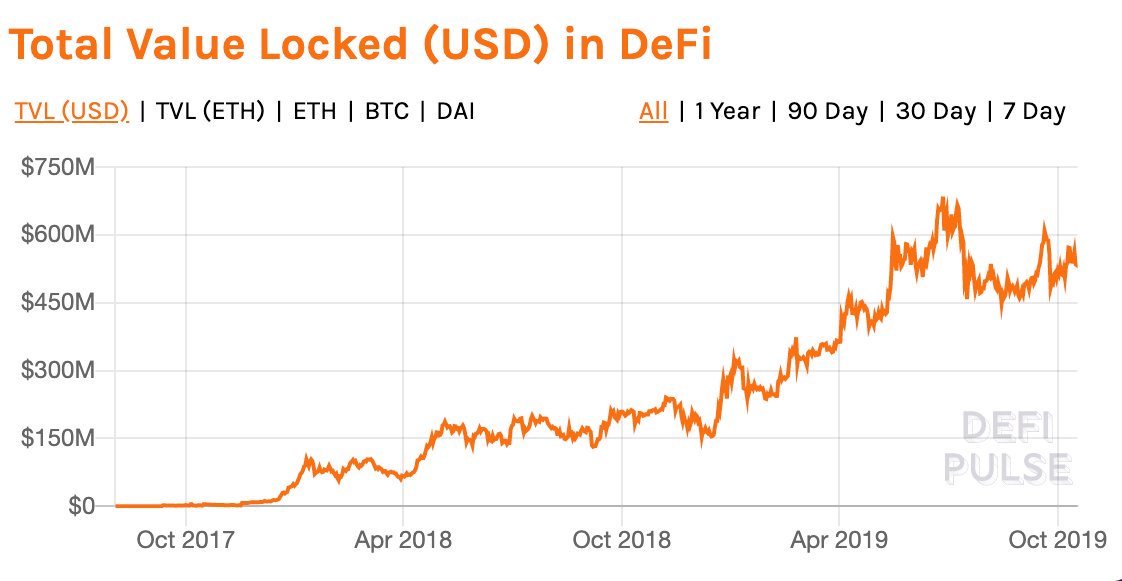

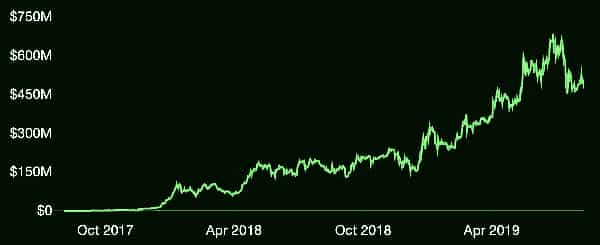

Ethereum (ETH)’s recent rise has sparked interest in the crypto market again, and investors are looking for DeFi protocols that provide more than just speculative rewards.

As ETH keeps going up, experts are looking at presale opportunities that have structured growth and meaningful product utility.

Mutuum Finance (MUTM) is one of these tokens. It costs $0.035 now and is set to grow quickly as more people use stablecoins, Layer-2 integration, and future exchange listings.

Experts say that diligent investors will see MUTM as a great contender to reach $2.50 by the second quarter of 2026 since its multi-layered development plan connects token demand with genuine use.

The overall picture of ETH’s success makes it possible for both retail and institutional investors to move money into projects with high usefulness and asymmetric upside.

Layered growth and utility drive demandMutuum Finance (MUTM) has come up with a multi-stage growth plan that will make sure that both adoption and value capture happen.

The presale phase gives people early access to the protocol, and the beta launch after the listing will let them test lending and borrowing flows right on the site.

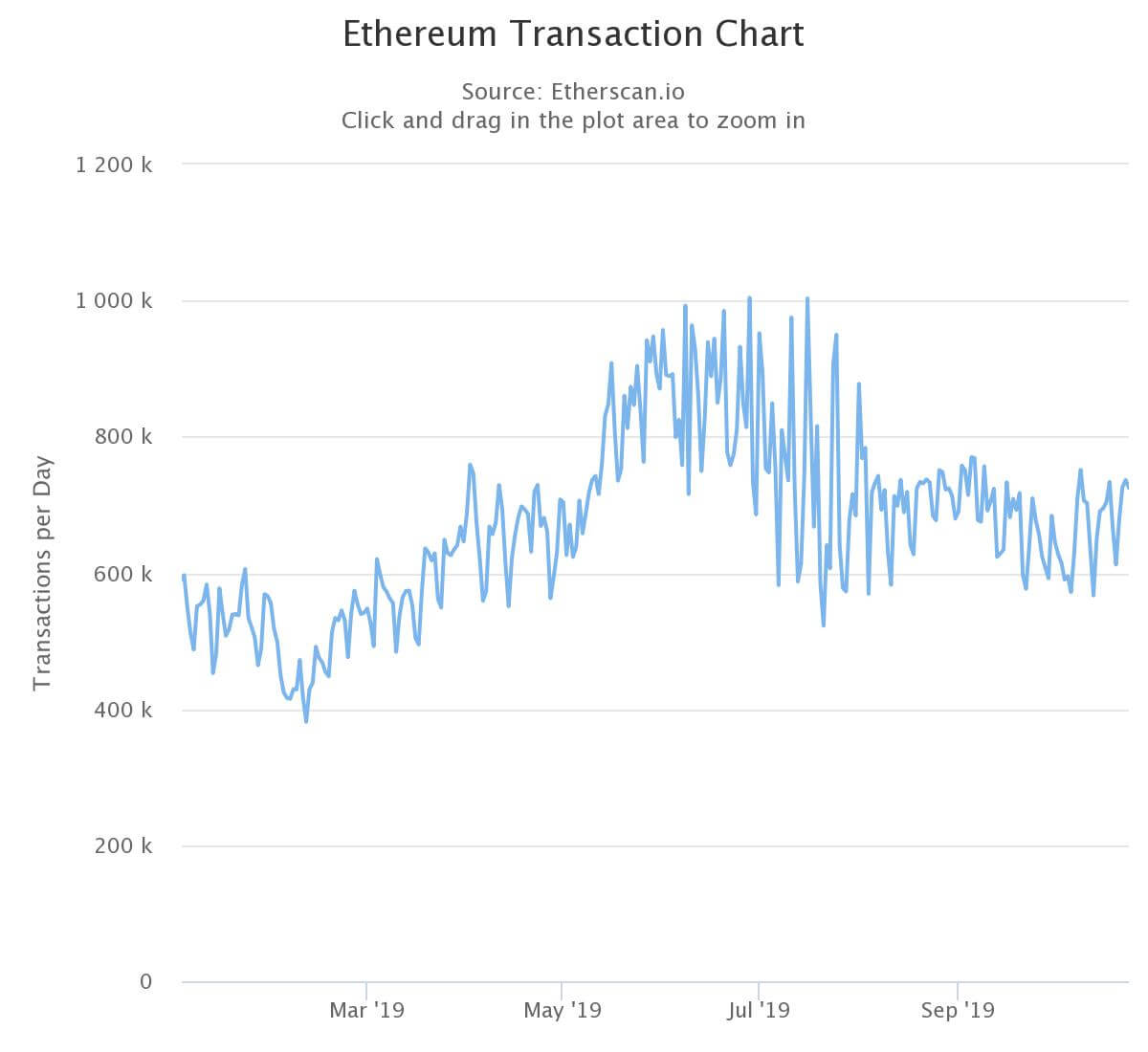

Layer-2 scaling will reduce gas friction, allowing for many transactions every day. This will create $1 stablecoins and make money in the form of MUTM tokens.

This money will go to mtToken staking incentives and open-market buybacks of MUTM. This will create a permanent relationship between using the platform and wanting the tokens.

MUTM creates a long-term paradigm where protocol activity drives value instead of only depending on market speculation by linking adoption to incentives.

As more people use the stablecoin, it will make on-chain activity more predictable, which will keep early adopters interested and pave the way for institutional investment.

The presale anchor is in the midst of this growth story: Mutuum Finance (MUTM) has now raised almost $15.32 million in Phase 6.

There are more than 16,000 holders, and 32% of the 170 million tokens set up for this phase have been sold. The current price of $0.035 is a great chance, as Phase 7 will raise the price to $0.040, which is a 15% rise.

CertiK has given MUTM a Token Scan Score of 95.00 and a Skynet Score of 78.00 after doing a manual review and static analysis. This gives investors more confidence in the project.

The community of more than 12,000 Twitter followers is increasing quickly, and the $100,000 giveaway and regular audits make others want to join in.

Analysts say that this mix of presale interest and planned expansion will make the coin more visible and popular in the coming months.

Pathway to $2.50 and investor multipliersGetting to a price of $2.50 would mean an increase of about 70X the current price of $0.035. This path is based on real processes in Mutuum Finance (MUTM).

The beta launch will quickly get actual users involved, letting early adopters stake mtTokens and earn MUTM rewards.

Adopting layer-2 will increase the number of transactions that can be processed, which will lead to higher utilization-based fees and more stablecoins in circulation, which will increase protocol income.

Expected listings on major exchanges like Coinbase, Binance, KuCoin, MEXC, and Kraken will make it easier for more people to buy and sell and help find the right price.

Also, treasury allocations from platform revenue to buybacks will produce ongoing demand pressure that is directly related to genuine activities.

If you invest $2,000 in Phase 6 early, you will get 57,000 MUTM tokens. When the price reaches $2.50, these tokens will be worth $143,000.

The tiered roadmap, Layer-2 integration, and active user adoption make this upside a real possibility, which sets MUTM apart from initiatives that are only for speculation.

This prognosis is also supported by strong price discovery and risk control. Chainlink oracle feeds, along with fallback and aggregated references, will provide correct on-chain pricing for managing collateral and liquidation.

Governance-managed borrow interest rates will keep the $1 stablecoin stable, and CertiK audit ratings will make people feel more sure about the protocol’s integrity.

These methods work together to make sure that the token’s growth is backed by quantifiable on-chain activity and risk measures that are up to par with those used by institutions.

ConclusionAs Phase 6 is closer to selling 32% of its tokens, investors have a little time to buy MUTM at the current presale price of $0.035.

The 15% price change in the next phase shows how important it is for early funders to act quickly. Mutuum Finance (MUTM) is the best DeFi play for investors looking for asymmetric returns while navigating crypto prices today and broader crypto predictions.

It has a structured roadmap, layer-2 scaling, stablecoin-driven adoption, and staking-linked buybacks, all of which make it a compelling, product-led route to meaningful upside.

People who are thinking about investing in crypto for the long term will see this chance as one that offers usefulness, security, and a way to measure growth.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

The post After ETH run, analysts see best crypto as DeFi gem targeting $2.5 by Q2 2026 appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|