2021-11-7 02:00 |

Ethereum’s value has hit a recent all-time high above $4,600. However, not everyone agrees that the altcoin is fairly priced. Analysts at JPMorgan fall into this category. Although the altcoin has made great strides in utility recently, the analysts do not believe that the coin is fairly valued. They believed that the fair price of the digital asset is in fact much lower than its current value.

Ethereum has been one of the most successful digital assets in the market. This has been due to the growth of use cases such as decentralized finance and NFTs. Ethereum remains the default blockchain for investors to access these services and this has made its native token, ETH, rally over the months. Despite its use cases, JPMorgan analysts have posited that the coin is overvalued.

Ethereum Should Be $1,500JPMorgan released the first issue of a publication that focused on cryptocurrencies. The publication would show the firm’s stance on crypto and other digital assets. It opens a window into the firm and how they are viewing investments in the market. Nikolaos Panigirzoglou is at the lead of the new publication and brings his knowledge and expertise in the digital assets space to it.

Related Reading | Bitcoin ETF Inflows Slow Down As Altcoins Interest Rebound

Starting out, Panigirzoglou focused his attention on Ethereum. The second-biggest cryptocurrency by market cap got some not-so-encouraging words from the analyst. According to Panigirzoglou, ETH was wildly overvalued despite its utility in the market. This comes as a surprise to the market as ETH has proven to have more applications than its counterpart bitcoin.

ETH trading below ATH | Source: ETHUSD on TradingView.comPanigirzoglou said that ETH’s value was actually much lower than it’s worth now. He put it at 67% less valuable than the current price of the asset, which puts ETH at levels not seen since the beginning of the year. The analysts put forward that they expect the digital asset to begin a downtrend that will put it at 67% less than its current value, which is $1,500.

Panigirzoglou explained that growing competition in the space in which Ethereum operates is the reason for this. “In turn, this creates the risk that the substantial increase in the ethereum network activity over the coming years embedded in the current price of $4,100 might not materialize,” Panigirzoglou said.

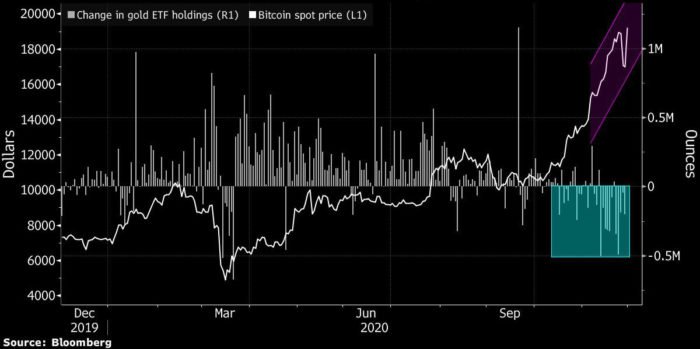

Bullish On BitcoinIn the inaugural issue of the publication, JPMorgan analysts did not have the same bearish sentiment for bitcoin as they did for Ethereum. If anything, their overall outlook for the asset was very bullish. The analysts revealed their future price targets for bitcoin, with both long and short-term targets. Both of these were optimistic for the pioneer cryptocurrency.

Related Reading | FOMO Beware: Spot Bitcoin Buying Volume Remains Low, Despite New ATH

For the short term, JPMorgan analysts put the price of bitcoin at $73,000 in 2022. With only two months left in the year, 2022 is not as far off into the future as one would think. In addition, the long-term outlook for bitcoin was also very bullish. They posited that they saw the price of the digital asset hitting as high as $146,000 in the future.

The analysts attributed their bullish outlook to the volatility of the asset. Also, Panigirzoglou did not see any competition for bitcoin as opposed to Ethereum, which sees a lot of competition from other smart contracts blockchains like Solana and Cardano.

Featured image from CryptoMode, chart from TradingView.com origin »Bitcoin price in Telegram @btc_price_every_hour

Circuits of Value (COVAL) на Currencies.ru

|

|