2020-8-24 11:55 |

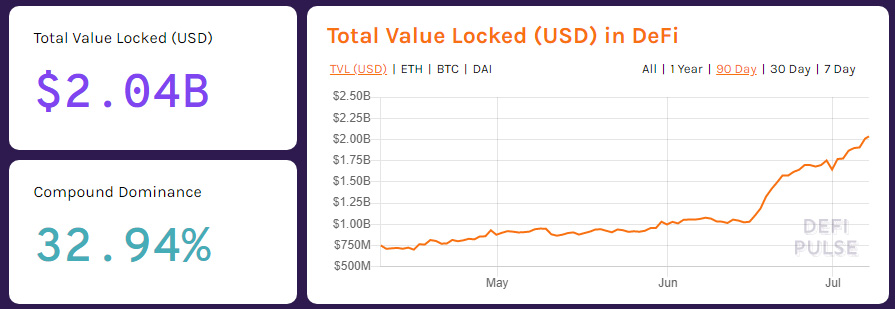

DeFi action within blockchain has been one of 2020’s most unexpected twists of fate. The start of the year brought unprecedented uncertainty, recession, and fear to markets far and wide, on a global scale. But good things come to those who wait, and Blockchain’s revival in late 2020 seems to be the silver lining all of us were praying for.

And DeFi itself feels like Blockchain’s calling – a realisation of the original mission to provide a decentralised medium of transfer, meeting with the needs of an increasingly technological and financially-savvy society. That’s why interest has boomed, and we’re seeing some truly groundbreaking returns – A quick look at top providers shows that the heralded rates of 6-7% annual returns of yesteryear are a thing of the past.

With rates creeping up over 10% for “safe” investment classes, it’s not uncommon to see over 50% returns touted for less reputable asset classes and investment pools. What’s not surprising then, is that new investors and experienced alike are being drawn into malicious and bad-actor schemes. Not to mention, most DeFi projects are all but middlemen for traditional investment schemes, acting as a guarantor.

With the DeFi wave stabilising, and information inefficiencies ironing out, the market begins to ask – “where from here?”. It’s clear that the drawbacks of DeFi are impacting the market, and educated assessments of less-apparent opportunities are showing higher potential profits on closer inspection.

COVID-19: The Overlooked Opportunity

Check the news today. Did you hear a story about COVID-19? Chances are, your answer was yes. But with the hysteria over, and more rational conversations about solutions to COVID-19 beginning, we ask – Where are the opportunities? Well, it all lies in a number:

The cost of getting a new drug to market today, is $2,500,000,000. That’s right – Not $25 million, not even $250 million. $2.5 billion. And what’s more, up to $8,000,000 per day is lost via revenue erosion, resulting from delays of getting medicines to market. The market for medical trials and the opportunities for a smart system to reduce revenue erosion are massive.

Back to that number. 3017 is the number of clinical trials currently in process or awaiting commencement to test vaccines for COVID-19. And with government contracts awaiting worldwide for a first-out-the-door solution, the race is on. And for an industry wracked by inefficiencies like time delays, lack of collaboration between providers, the industry yearns for a solution, one which could provide extremely competitive returns even when sat next to the current industry DeFi craze.

CTi: The Solution to DeFi, and Capturer of the $3.5bn Market?

Luckily one startup, ClinTex, recognised the opportunity presenting itself in the clinical trials market, and decided to use blockchain and machine learning to access the untapped potential of inefficiencies in the pharmaceutical industry.

ClinTex’s platform will reduce lead time for new drugs, improve cross-collaboration in the global medicines market for the betterment of humanity, vastly increase data collection and storage including immutability, and most importantly, reduce by an unfathomable amount the high cost of clinical trials in new drug development.

What’s more, is that ClinTex are currently offering interested parties the opportunity to own their native token CTi through their token pre-sale at a 50% discounted rate, which will allow them access to the clinical trials ecosystem. And with such a large market to be tapped, the tokens look likely to become hot property in the wake of the COVID-19 pandemic.

With all of ClinTex’s benefits, it doesn’t take a stretch of the imagination to envision how CTi could well be instrumental in bringing globally disjointed efforts together to bring forth life-saving vaccines, as well as countless other necessary medicines – Think cancer treatments, AIDS, and other “incurable” diseases. All is possible in the future of CTi.

To join the CTi presale today and get 50% off, visit https://www.clintex.io/presale

ClinTex is the sole source of this information.Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. This press release is for informational purposes only. The information does not constitute investment advice or an offer to invest.

About Bitcoin PR Buzz: Bitcoin PR Buzz has been proudly serving the crypto press release distribution needs of blockchain start-ups for over 8 years. Get your Bitcoin Press Release Distribution today.

The post In the Age of Coronavirus, the Medical Trials Market Could Offer Better Returns than DeFi appeared first on Bitcoin PR Buzz.

Bitcoin PR Buzz - Massive Exposure For Bitcoin Services, Projects, and Merchants

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) íà Currencies.ru

|

|